With summer just around the corner, consumers will be looking to host a barbecue as soon as the weather warms up – and even if it doesn’t.

Although family budgets are squeezed amidst the ongoing cost-of-living crisis, home entertaining in the sunshine could well see an uptick as expensive vacations are skipped and people elect to entertain locally on their home turf. BBQs are also a great way to enjoy cut-price cuisine when restaurants become too pricey, so it is worthwhile being aware of the revenue potential of a stay-at-home summer.

A recent report by Co-op, published on 25 May, confirmed this, with over half of UK adults (56 per cent) saying that they more likely to have a cost-effective BBQ at home this summer than spending on expensive meals out.

Sales data from the report indicates that Co-op predicts it will sell more than 22 million British sausages, 7.5 million British burgers and 6.2 million British kebabs and over the summer, with over half of UK adults (54 per cent) believing it is important to buy British products when having a barbecue.

Additionally, 15 per cent of UK adults aged 35-44 normally buy their ingredients for a barbecue 9-12 hours before firing up the coals and just over one fifth of UK adults (21 per cent) aged 35-44 normally buy their ingredients for a barbecue less than four hours before.

Co-op’s report has indeed revealed that many BBQs that take place during the summer are unplanned and impromptu, with over a third of UK adults agree they would cook a last-minute barbecue for two, while an impromptu BBQ for a group is still possible with over a quarter of UK adults agreeing they are happy cook alfresco last-minute for a small group (under five people).

Saturday is the day for spontaneous barbecues, for nearly half of UK adults, although 16-24-year-olds are more inclined to have a spontaneous mid-week barbecue. Data from the report has shown that the average number of barbecues Brits are invited to per year is three, with residents of Greater London attending the most (four), compared to those that live in Scotland, who were likely only to attend two per year.

“It’s no surprise that barbecues remain a firm favourite when it’s time to get together with friends and family in the warmer months and this summer, they are potentially going to play an even more important role, as the cost of living squeezes household budgets and going out for meals happens less,” Nicole Tallant, head of Co-op’s food team, commented.

Roll up

Looking at last year’s data, it’s clear there is enormous opportunity in the barbecue season and the rolls category really comes into its own. Rolls was the only bakery subcategory reporting volume and value growth in the year to August 2022.

The summer months saw a major increase in rolls’ importance to the total bakery category, with share peaking at 18 per cent in the four weeks to the end of July last year. Over the 12 weeks to August 2022, total sales of branded burger buns and hot dog rolls increased 40 per cent up on the year before [Nielsen, 52w/e 30.07.22].

“This incremental growth accounted for 52 per cent of overall rolls growth in this period with St Pierre and Baker Street brands delivering 92 per cent of this total growth [Nielsen].With the Met Office predicting 2023 to be the hottest on record, being prepared for another bumper barbecue season will be the key to success this summer for neighbourhood retailers,” says Rachel Wells, UK sales director at St Pierre Groupe.

The past few years have enhanced and extended the UK barbecue season, starting earlier and lasting longer, thanks to the pandemic driving al fresco dining, and last year’s glorious summer reinforcing the habit.

Wells says this shift in consumer habits is here to stay, adding that the summer ahead offers a series of bumper opportunities for retailers, as celebratory and sporting events will see people flocking to barbecues and street parties.

“On top of this, as we all know, hot weather can lead to a further increase in impulse, last-minute outdoor eating occasions, and retailers should be prepared to profit,” she says, and advises to offer a variety of complementary products, that allow shoppers to “elevate” their regular offering to something a little more special for their barbecue.

“Retailers should give popular products more than one facing; offer good, better, and best options to cater to the trend for premiumisation; and consider long-life options to help navigate unpredictable weather,” she suggests.

St Pierre Groupe’s brands that are relevant to the barbecue season are the leading brioche brand, St Pierre, and long-life bakery brand Baker Street. Bakery products like these that provide long-life, multi-pack formats are key for retailers, allowing them to navigate unpredictable shopping and dining habits.

“The coming of summer sends people out into their gardens and, as long as the weather stays dry, can carry through until the autumn. This has been reflected in St Pierre’s rolls sales going from strength to strength last summer, continuing until the last of the warm weather in late September,” reveals Josh Corrigan, customer development director, UK at St Pierre Groupe.

He says independent retailers can profit from this development in the 2023 barbecue season by stocking St Pierre’s brioche buns and hot dog rolls, which are increasingly familiar to shoppers through their greater prominence in the multiple grocers’ convenience format stores.

“With the pandemic giving people the opportunity to rethink their eating habits, followed by the cost-of-living crisis focusing their minds on affordable treats, consumers are routinely trading up on bakery staples to something more premium,” he notes.

“Those hosting barbecues this summer will want to impress and offering an upgrade to standard bakery – such as St Pierre brioche – is one way to ensure they do so.”

Corrigan also points out that the trend of ‘inexpensive indulgence’, as many embrace the little pick-me-ups that we all need from time to time, would work well for bakery items like St Pierre’s brioche buns and hot dog rolls.

“Convenience stores can easily cater to these trends by providing ranges that allow their shoppers to ‘upgrade’ from traditional staples for their barbecue offering. St Pierre’s brioche range is an ideal base for enhancing burger and hot dog recipes,” he suggests.

Mark Frossell, senior national account manager at St Pierre Groupe, notes that the barbecue category stands to benefit in 2023 from the increasing popularity of more substantial barbeque foods, such as burgers and hot dogs, including vegetarian and plant-based options – driven, in part, by the rise in ‘Americana-style’ dishes on menus across the UK.

“Shoppers are also looking for quick and easy ways to create “fakeaway” favourites. Baker Street’s range of Burger Buns and Hot Dog Rolls are ideal for those looking to recreate classic burgers and hot dogs, served with a variety of toppings. Baker Street’s recipes have been specifically developed for this purpose – with burger buns ‘built for burgers’ and hot dog rolls ‘ready to handle’ the load,” he says.

The past few years have taught us how to make the most of at-home events and as the difficult economic situation continues, it’s all about ‘levelling up,’ taking hosting to new levels, a trend savvy retailers can capitalise on.

“Our key products for the barbecue season are our Baker Street Burger Buns and Hot Dog Rolls, which give retailers extended-life options that allow for variety. Both the Original Burger Buns and Classic Hot Dog Rolls can be used for a host of tasty barbecue meals, including traditional ‘American style’ burgers and loaded hot dogs,” Frossell says.

Baker Street is cleverly packed to stay fresher for longer and guarantees a minimum life of 35 days from delivery to wholesalers’ depots, helping convenience retailers ensure on-shelf availability and reducing the risk of wastage.

In the 12 weeks to Oct 22, 2022, the Baker Street brand is in seven per cent growth, following new distribution in Asda for Baker Street Burger Buns and Hot Dog Rolls [Nielsen], and Frossell says the resulting increase in consumer awareness spills over into brand awareness in independent retailers, making the Baker Street brand a must-stock for the barbecue season.

Enhancers

Summer is a very important season for the table sauces, dressings and condiments category because of BBQs and summer parties. The total “eating enhancer” category (table sauces, dressings and condiments) is outperforming the total market in the convenience channel. Ketchup and mayonnaise are the key products, accounting for over half of the category so it has year-round appeal. Areas of growth within the category also include flavoured mayonnaise, squeezy formats, salad dressings and other thick sauces such as BBQ and hot sauces.

“Summer is an important time for this category as consumers BBQ and look to add flavour to their meals. Try placing complementary products next to each other to prompt purchase – e.g. tomato ketchup by burgers and sausages, mayonnaise/salad dressings by salad bags,” suggests Lucy Richardson, Unilever UK category director.

“With 99 per cent of households buying these products, they are key top-up items in convenience stores. That’s why it is so important to have the top sellers available. If the customer can’t see it or it isn’t available, they will simply shop elsewhere.”

Taste is still the No.1 driver in the category, which has led to a huge increase in non-traditional sauces such as hot and spicy and speciality dressings.

“Key categories – Mayo, Ketchup, BBQ Sauce, Salad Dressings and Condiments – will be shopped by Brand vs Private Label initially, with brands acting as a beacon for the category. With the Cost of Living impacting the UK population, retailers need to demonstrate value by including retailer choice within the range should space allow,” Richardson says.

Simply add cheese

As one of the most shopped categories in retail, with 99 per cent shopper penetration, cheese is a popular and extremely versatile food, which can be used in a host of ways, such as toppings for burgers and hot dogs, and salads.

“Therefore, retailers should look to stock up on a range of branded cheese when planning their barbecue displays,” suggests Heloise Le Norcy-Trott, group marketing director for Lactalis UK & Ireland.

One BBQ accompaniment, which traditionally peaks during the spring and summer months, is mozzarella. Le Norcy-Trott says their Galbani is the No.1 Italian cheese brand, and No.1 mozzarella brand in the UK, currently accounting for more than £28m value sales, growing at 8.6 per cent YoY.

“To respond to the consumer trend for convenience in 2022, we launched Galbani Sliced Mozzarella. Perfect for the barbecue occasion, the new slices offer a simple and convenient way to add mozzarella to a variety of dishes including burgers. The new slices unlock a new segment of the chiller for Galbani, representing a key part of the brand’s over-arching vision to become the Italian cheese of choice in the UK,” she adds.

Galbani Burrata is also a perfect accompaniment to summer barbecues as consumers use Italian cheeses like mozzarella and burrata as key ingredients in alfresco dining experiences.

And, neglect not the cheddar! Cheddar cheese – including block and sliced formats – plays an important role at barbecues, meaning consumers will be looking to use the best available cheddar for an enhancement to barbecue favourites.

“The Seriously block cheddar range includes variants to cater for all tastes and includes Seriously Extra Mature, Seriously Strong Vintage Cheddar and Seriously Creamy Mature Cheddar and Mature Lighter Cheddar,” Le Norcy-Trott says.

“The brand also includes a convenient sliced offering within its range with Seriously Creamy Sliced Mature Cheddar. And not forgetting Leerdammer cheese slices and block, offering great additions to salads, and sandwiches.”

She suggests to a have a dedicated display in-store to maximise the summer eating occasion. “Stocking BBQ essentials, such as salad ingredients alongside mozzarella, will encourage up-selling and impulse purchases. It will also make the shopper’s journey around the store easier,” notes Heloise.

Meal options

Florette, the £40m salad brand, is meanwhile poised to help retailers provide shoppers with a fresh and tasty solution this summer.

“As we step into summer, lighter eating with a fresh accompaniment becomes a staple for consumers. With its long-established reputation for fresh and convenient bagged salads, Florette is well positioned to meet shopper demand for light and fresh alfresco dining options, already selling 33 million packs annually,” says Martin Purdy, commercial and marketing director at Florette UK.

He recommends providing a “mix and match” BBQ bundle in store with grill-ready options, fresh side dish accompaniments and drinks multipack, creating an appealing value proposition while driving the basket spend of shoppers who would otherwise opt to buy cheaper products (31 per cent), prepare fewer options (19 per cent) or ask guests to bring a contribution to the meal (26 per cent) [IGD, July 2022].

Florette has announced a £1m marketing campaign that will reach 8.6 million shoppers this summer. Spearheaded by sponsorship of Food Network, the campaign will connect Florette to some of the biggest chefs and food writers in the UK.

The sponsorship will be complemented by a brand-new TV advertising campaign throughout June to August, across “on demand” service platforms including ITV X, Sky and All 4.

As staying in for intimate dinners, games nights or watching sport from the sofa will be the mainstay of peoples’ social calendars moving forward, meal kits would assume added significance in the Summer.

“Old El Paso Meal Kits and components, which include its tortillas, tacos, and spice mixes, are great game-deal meal options for watching of big sporting occasions like the NFL and Six Nations at home, or even for a night in with friends to watch the latest instalment of a reality show,” comments Aditi Hilgers, head of meals at General Mills.

With the squeeze on household budgets due to the cost-of-living crisis, she notes that the need to be adventurous with in-home meal solutions has ramped up, as people cut down on eating out and saving money is front of mind. Health also remains an important consideration.

“Consumers are looking for new recipes to try that are not only exciting and nutritious, but also quick and easy to make for lunch or dinner. At Old El Paso, our tortillas contain no preservatives, no artificial colours or flavours. Many of our products are also suitable for vegans, or simply those who are opting for plant-based or reduced meat options more regularly,” Hilgers says.

Many World Food purchases are impulsive, so high visibility for Mexican, like POS activations and promotions, can drive increased sales in store, she adds. “POS like a flat pack free standing display unit is a great solution to help drive visibility whilst being mindful of the limited space available in most stores.”

Summer snacking

Crisps, Snacks and Nuts (CSN) is a fast growing, priority category with huge scale. Worth £4 billion and growing at 10.7 per cent YoY, CSN shoppers are spending an extra £100 in the category, up 14 per cent YoY.

“Over the summer season, shoppers look to enjoy tasty snacks with friends and family, whether they’re barbecuing, planning a picnic or gathering to watch major sporting events at home. Summer snacking represents a critical opportunity for retailers to drive footfall and sales,” comments Matt Collins, trading director at KP Snacks.

Snacks will also be important this summer as recessionary conditions prevail and consumers turn to snacks as an affordable treat.

To maximise sales this summer, Collins asks retailers to stock a strong core range of CSN products with a sprinkling of NPD to tempt shoppers. Valued at £1.5bn and growing strongly at +10.1 per cent, the sharing segment is key to summer occasions as friends and family gather to enjoy the warmer weather and seasonal events.

“At KP Snacks, we’re catering to the rising consumer demand for sharing with a diverse portfolio of sharing format snacks, from crisps to nuts to popcorn and pretzels. We offer snacks for all occasions and tastes, perfect for adding extra fun and excitement to at-home occasions this summer,” he says.

PMPs have also seen significant growth in the last few years, and the KP Snacks portfolio of large PMPs is currently worth £97.3m RSV, and is growing at 45.9 per cent, Collins informs, adding that they are continuously expanding the PMP portfolio to add value to retailers with both variety and promotion.

“Last year, KP Snacks launched Nik Naks Scampi ‘N’ Lemon as a large format PMP, generating interest with the return of a shopper favourite which had been absent across singles formats since 2008 and multipacks since 2019. The Nik Naks brand is worth £39.1m and growing strongly at 60 per cent,” he says.

Earlier this year, the business launched McCoy’s Epic Eats, a brand new product range with two flavours, Nacho Cheese and Spicy Salsa. Available in a 45g Grab Bag format and £1.25 PMP, McCoy’s Epic Eats brings unique and tempting flavours to the category and has been designed to drive brand penetration.

Bringing a kick to the healthier Snacking segment, KP Snacks also recently launched popchips Hot & Spicy. popchips is a beacon brand in healthier snacking and the new launch taps into the growing trend of spicy flavours to tempt shoppers and boost sales for retailers.

Drinks pairings

The soft drinks category is worth more than £2.9bn in convenience and is the third most valuable category to independent retailers. Sparkling soft drinks are a popular refreshing accompaniment to help bring summer occasions to life.

“As the warmer weather arrives this summer, we expect people to gather together with friends and family at home for barbecues, sports fixtures and nights in,” comments Amy Burgess, senior trade communications manager at Coca-Cola Europacific Partners (CCEP).

“Retailers should focus on leading brands like Coca-Cola, led by Coca-Coca Zero Sugar, the fastest-growing major cola brand in retail in value and volume. It also includes Fanta and Dr Pepper, the number one and number two flavoured carbonates brands respectively, both in double-digit value and volume growth; and Schweppes, the number one mixers brand in convenience, more than twice the size of its nearest competitor by value and volume.”

She asks retailers to ensure displays where the shoppers can pick up everything they want in one go.

“It’s particularly important with barbecues, which can often be impromptu when the sun comes out, so creating barbecue-themed displays with burgers, sausages and chilled drinks can make it easier for customers to quickly stock up for these gatherings,” she says.

Food and beer pairings are also a great way for retailers to maximise sales. 63 per cent of at-home beer consumption takes place with food, compared to just 58 per cent for total alcohol, presenting an £85m sales opportunity for the off-trade during the BBQ season. Burgers are consumed during almost 20 per cent of summer outdoor occasions, and best enjoyed alongside an ice-cold beer.

Affordable booze

Alcohol tends to see an uplift in sales over the spring and summer period. Consumers continue to value convenience and many also focus on their drink experience at home. Calli O’Brien, head of marketing at Aston Manor Cider, says this would mean shoppers “buying chilled cider straight from the fridge in local and independent retailers to enjoy during BBQ season.”

“Cider is the impulse drink of choice so retailers can respond to this by offering a 100 per cent chilled range, stocking a wide range of options in cans and bottles,” she suggests.

“If a store has limited chiller space, then it’s worth retailers at least ensuring there are a good selection of flavoured ciders available chilled alongside top selling ciders. When a shopper buys cider on impulse, having it chilled and ready to drink are often more important than price, however promotions still play an important role in communicating value for money that will help to win longer term customer loyalty.”

As the cost-of-living crisis has caused many to pay more attention to what they are spending their hard-earned money on, O’Brien says it is important that retailers offer a range of formats and ready to drink options to make the most of the summer opportunities.

“Aston Manor’s ethos is all around affordability. We are here for shoppers, helping them to save with our affordable cider, allowing them to focus their spend on what really matters,” she says. “Our range provides shoppers with an affordable solution, without trading down on quality, so they can be assured they are not compromising when needing to spend a little less cash on cider.”

Larger multi-packs are also important and ensure retailers can help consumers keep their supply stocked up to enjoy with friends and family during BBQ season. “When it comes to must-stocks, product packs such as the pint cans in our Crumpton Oaks’ four-pack, are a popular option to enable consumers to keep their supply stocked up,” she says.

A third of shoppers only ever buy cider in cans so it is important retailers stock both bottles and cans to provide choice for consumers. Frosty Jack’s and Crumpton Oaks Cider come in both pack formats and O’Brien recommends retailers dual stock plastic bottled products alongside cans, to help attract more customers into stores.

Alexander Wilson, category & commercial strategy director at Heineken, notes that innovation is a key driver of growth in the beer and cider category, highlighting the recently unveiled brand new look of its leading cider brand Strongbow.

“The stripped back design features the famous archer front and centre with vibrant pops of colour, to help attract a fresh generation to the much loved and trusted brand,” he says.

“In March, we also launched Strongbow Tropical Cider, to further encourage new drinkers into the cider category. A tropical blend of mango and pineapple, this new flavour provides a refreshing and fruity twist on the nation’s favourite cider.”

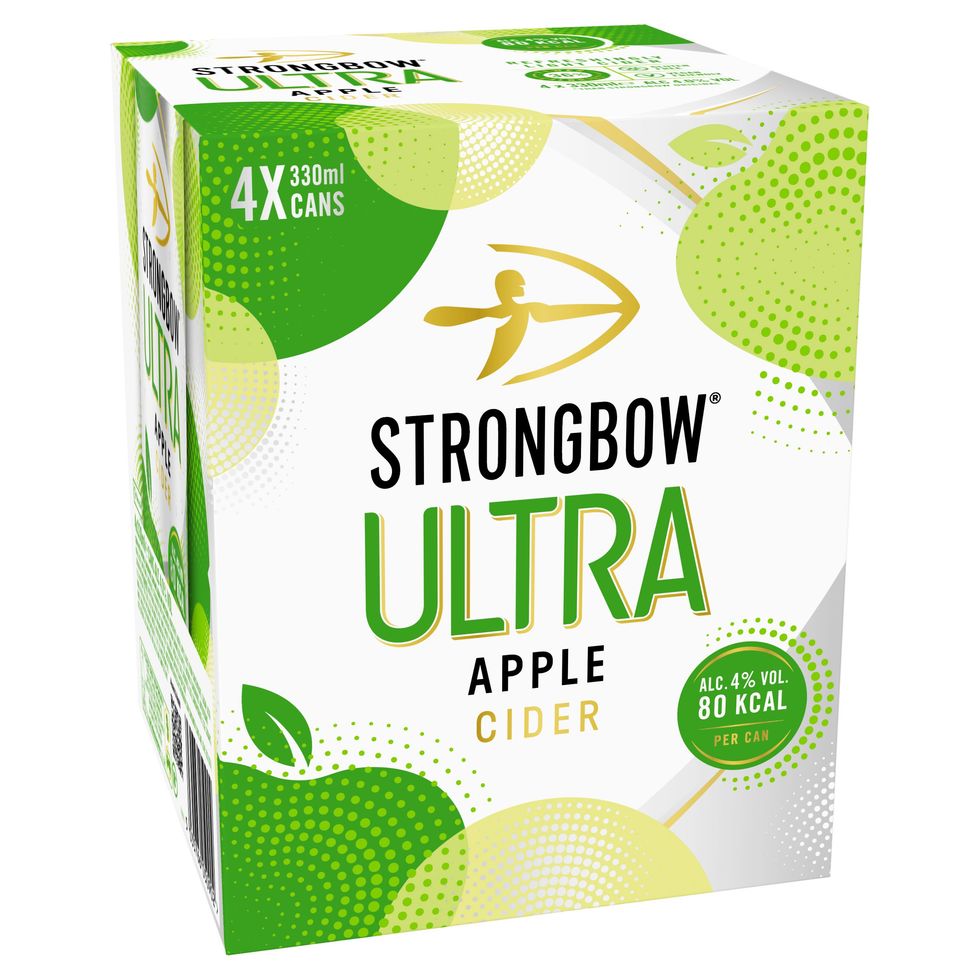

Wilson also highlights the growing demand for lighter-tasting, lower-calorie drinks within the cider category, which presents a huge opportunity for retailers to grow cider shopper penetration from its current 45.4 per cent level and flavoured cider from 30.9 per cent.

“We’re targeting these consumers with our latest launch, Strongbow ULTRA Apple, A crisp twist on a much loved-favourite, and with 36 per cent fewer calories than Strongbow Original - at 80 calories per 330ml can (four per cent ABV) - the new addition to the Strongbow ULTRA portfolio is perfect for shoppers looking for a lighter cider alternative to enjoy during the big night in occasion, with natural apple flavours and no compromise on great taste,” he says.

Bucking the trend

The beer and cider category continues to experience growth in the off-trade, currently worth £5.95bn. Beer has long played a key role in the BBQ occasion, with the total value of beer during the summer months last year (May to September 2022) touching £2.5bn.

“Summertime marks the start of warmer outdoor occasions and social gatherings – the perfect moments to enjoy a crisp, cold beer with friends and family. This presents a great opportunity for retailers to stock up on popular items and capitalise on the demand for summer beers and lagers,” comments Sunny Mirpuri, director for wholesale and convenience at Budweiser Brewing Group.

Budweiser Brewing Group saw the World Beer category grow +2.3ppt of share of Total Beer and NABLAB +0.5ppt of share World Beer over indexing +2ppt of share between May to September last year. Mirpuri says this indicates the importance of retailers stocking the right range of beers to capitalise this year.

Moreover, since July 2021, BBQ occasions have grown by a significant 26 per cent over two years, likely driven by the boom in at-home occasions which came as a result of the pandemic restrictions.

“This year, we believe BBQ occasions will be more prominent than ever as the warm weather approaches and the Women’s World Cup holidays entice consumers to gather with friends and families,” Mirpuri says.

Beer has continued to buck a wider retail alcohol category decline trend over the past six months with shares up 0.2 per cent in the last quarter alone [Nielsen].

“Contribution from both premium and No and Low beers has bolstered the value growth as consumers seek better quality in-home drinking experiences from well-known and trusted brands during the cost-of-living crisis and move from wine and spirits into beer,” comments Wilson, of Heineken UK.

Off-trade beer sales over the last six months have also shown the category withstood a wider retail alcohol sales dip following the pandemic as consumers continued to re-enter the on-trade. “Within this, Heineken UK's portfolio of brands remains a key player in the UK beer market and is driving growth across the category with its extensive portfolio, offering a range of beverages for all occasions,” Wilson adds.

Premium offerings

In the off-trade, the premium and super-premium category now equates to 61.7 per cent of total beer value [Kantar/BBG Alcovision] and Budweiser Brewing Group has forecasted that 70 per cent of total beer consumption will be in the premium or super-premium category by 2025.

“Whilst shoppers are attempting to make savings across large expenditures, such as household bills and eating out, smaller ‘treat’ purchases such as alcohol are one area that consumers are happy to trade up. Retailers will have to rely more heavily on brands and products that consumers already know and love and need to be prepared for this demand,” Mirpuri notes.

He recommends Corona as a must-stock premium option for summer occasions such as BBQs. Corona continues to show strong performance, with sales growing by 55 per cent since 2019. Meanwhile, Stella Artois has its own place on the picnic bench this summer too. It is designed to be consumed with food, making it a great option at BBQs. “Stella Artois is now enjoyed by shoppers more often with food than as a standalone drink which is why retailers must ensure to stock it this summer,” Mirpuri adds.

Heineken’s Wilson also notes that premium offerings are growing despite the cost-of-living crisis, pointing to the 10.6 per cent growth in the last quarter for premium lager category.

“This trend has been consistent over the past two to three years and the key brand that is driving this growth is Birra Moretti which has grown an incredible 42 per cent since 2016 and is now the leading premium brand in both the on and the off trade,” Wilson says.

“We expect premium lager and Birra Moretti growth to continue in 2023 and have already seen this in January and February of 2023. In terms of what it means for the category, expect more advertising, activation and innovation from brands in premium.”

No and low alternatives

Another category that is seeing huge growth is the no and low category, as more and more beer drinkers look to moderate their alcohol consumption without eliminating it entirely.

Now worth £125m across the off-trade, the category is dominated by beer with a value share of 1.8 per cent of the total beer category. One in ten beer drinkers now regularly opt for an alcohol-free alternative, a figure which has grown by 16 per cent YoY [Kantar Alcovision].

“As friends and families get together for BBQs, retailers need to offer for a wide range of drinking preferences for summer socializing,” Budweiser Brewing Group’ Mirpuri says.

“Corona Cero, Budweiser Zero and Stella Artois Alcohol-Free, have seen double-digit growth since launching, making them a great choice for customers looking to provide their shoppers with alcohol-free alternatives of their favourite beers.”

Wilson says penetration has been the primary driving force of no and low alcohol growth over the last five years, but there is scope to grow further.

“The no and low category grew 5.6 per cent on a full year basis (MAT) and this year’s Dry January saw no and low lager sales rise 39.5 per cent over the last five years. While January was previously the high watermark for no and low, participation in this category now effectively mirrors total beer and cider throughout the year and is bought year-round,” he informs.

There have been many new entrants to the category in the past year and this is providing a greater range of choice for consumers as the no-and-low segment continues to grow awareness. At the same time, we’ve also seen sales consolidating across established beer brands, partly due to large advertising campaigns on the likes of Heineken 0.0 and other major brewers.

Wilson says Heineken 0.0 continues to lead the no-and-low category with a 27.3 per cent share of non-alcoholic beer, growing by 3.1 per cent YoY.

“While lager holds the lion share of non-alcohol in beer and cider, well-known ale and craft brands are also on the rise within this category helping to normalise the segment for more shoppers,” he adds.

Meanwhile, Birra Moretti Zero, the alcohol-free option from the leading premium beer brand, provides a premium choice for shoppers in the no-and-low category and for cider drinkers, Heienken UK’s Old Mout Berries & Cherries Alcohol Free Cider and Old Mout Pineapple and Raspberry Alcohol Free Cider are great alcohol-free options. Made using natural flavours, Old Mout Alcohol Free Ciders are suitable for vegans and gluten-free consumers – just like their alcoholic counterparts.

Wilson highlights the growth of smaller packs due to the cost-of-living crisis, and expects this trend to continue over the coming months

“Since shoppers started reverting to these habits of making smaller, but more frequent shops, retailers should be looking to supply customers with choice and offering a range of beer and cider multipack sizes to help cater to a variety of consumer occasions,” he suggests.

He also recommends that single cans and bottles are placed in chillers and positioned primarily alongside products such as slimline G&T cans or with single beer and cider options.

“Multipacks should be stocked in the beer and cider aisle between mainstream flavoured and premium flavoured and should be easily accessible and signposted clearly in-store to drive sales and satisfy customer needs,” he adds.

RTDs and cocktails at home

Tim Dunlop, brand director at Hammonds, which distributes BuzzBallz Cocktails in the UK, says cocktails at home is a trend that they see continuing.

“Consumers want products that are ready-to-drink, portable and convenient while still meeting their flavour and taste expectations. BuzzBallz Cocktails ticks all these boxes, offers something unique and innovative to consumers, and brings fun to drinking occasions,” he says.

“They are a different, no-mess solution with a strong visual appeal and unique round shape that is perfect for posting on social media. The colours and the round format really drive interest and impulse purchase.”

Plus, BuzzBallz are one of the few bar-strength cocktail options in the RTD and premixed cocktail market, and retailers can sell them chilled in the container, making them highly versatile for consumers looking for contemporary cocktails they can prepare with speed and ease during a BBQ or summer party.

“There are huge opportunities for stores to drive sales in the run up to the summer season. To maximise sales, retailers should stock a range of contemporary, eye-catching premixed drinks options, highlighting ABVs, and price points, to demonstrate the breadth of options available,” Dunlop says.

BuzzBallz has launched an eye-catching range of 12 packs with convenient shelf-ready packaging featuring a tear-off section for ease of in-store presentation, bringing a pop of colour to drinks fixtures, aisles and chillers.

Pre-mixed cocktails are expected to increase share of the RTD market, a fast-growing category crying out for more innovation and excitement and Dunlop says BuzzBallz Cocktails is the coming together of indisputable fun and quality.

“We’ve created a real buzz in the USA and we know the UK has every potential to follow in its footsteps, with the right brand proposition and quality credentials. Summer 2023 will be key as there will be so many opportunities to tap into once the good weather kicks in,” he says.

When it comes to cocktails, often people will be looking to create these serves during celebratory moments. Lauren Priestley, head of category development off trade at Diageo, says retailers would benefit from planning ahead and thinking about key calendar dates such as bank holidays and sporting events, ensuring their spirits range offers customers high-quality options.

“With this in mind, we suggest stocking super-premium vodkas, such as Cîroc that not only inspire customers to create cocktails at home that matches the moment they are celebrating, but it also increases overall basket spend,” she says.

“We also recommend maintaining a selection of flavoured vodka. Research has shown that flavoured vodka is performing incredibly well, and is now worth £343m in value. These lend themselves perfectly to the ongoing cocktails at home trend as they can form the base of easy to create serves, that do not require bartending expertise to enjoy a high-quality drink,” she adds.

Smirnoff has been leading the charge in flavoured vodka, having launched a raft of new innovations including Smirnoff Raspberry Crush, Smirnoff Mango & Passionfruit Twist, Smirnoff Berry Burst and the latest innovation, Smirnoff Cherry.

Smirnoff has also spearheaded the vodka category by adding Smirnoff Mango & Passionfruit Twist premix RTD to its growing flavour portfolio. The 250ml format was rolled out across the off trade last September, and is available to purchase as a single slimline can or price-marked-pack.

“The premix can echo the bold flavours as well as the vibrant packaging Smirnoff Mango & Passionfruit Twist is known for. With on-shelf appeal, the latest launch provides people with a new, convenient way to enjoy the liquid,” Priestley says.

The premix RTD category provides an opportunity for brands to take the serves that are most popular in the OOH channel, and package them into convenient formats so the delicious drinks can be enjoyed during a more varied range of occasions.

Leading gin brand Gordon’s has also added a new RTD to its growing portfolio - Gordon’s Premium Pink Gin and Lemonade (five per cent ABV). Available in a 250ml format, the innovation provides retailers with an opportunity to capitalise on the success of Gordon’s Premium Pink Gin and its popular serves, providing a delicious option for shoppers who prefer a sweeter taste profile.

“In fact, Diageo’s RTD brands currently make up 59 per cent share of the total sub-category’s sales - showcasing how it’s the leading, recognisable brands that present the biggest opportunity for retailers, as shoppers are seeking out the drinks they know and love from such brands as Smirnoff, Gordon’s, and Captain Morgan,” Priestley adds.

With 31 per cent of UK alcohol drinkers choosing gin, it is a category not to be overlooked. The spirit lends itself to a range of serves, from the classic Gin & Tonic, which can be simply created at home, to more creative cocktails.

“Retailers should therefore continue to tap into the category’s strengths by leaning into brands that provide popular and innovative variants, further widening the number of occasions in which consumers would choose gin,” Priestley says, adding that retailers would benefit from stocking a core range of gin from well-known brands with varying price points to appeal to a wide range of shoppers.

“Offering varying price points also means you’re catering to more consumers – whether they’re simply searching for their favourite brand to stock up on, seeking something a little different from their usual choice, or looking to trade up for a special occasion,” she says. “Tanqueray, for example, is the number two premium gin brand and fits perfectly alongside Gordon’s as an easy upselling opportunity.”

The barbecue opportunity is very big business for independent retailers, thanks, in part, to the growing “shop local” trend. People have discovered a new appreciation for at home events with friends and family following the last few years, resulting in an extended barbecue season. The coming of summer sends people out into their gardens and, as long as the weather stays dry, can carry through until autumn.

Retailers are advised to stock up on burgers, sausages, sauces and drinks to be ready for those last-minute purchases which happen when the sun comes out.