Britain is a nation of animal lovers, with millions of pets owned in the UK. According to the annual pet population data by UK Pet Food (formerly known as the Pet Food Manufacturers’ Association), released in March, 57 per cent of UK households (16.2 million) house 38 million pets, creating a larger market than ever for petcare businesses and retailers across the country.

However, the sector is facing headwinds in the form of the cost-of-living crisis and high levels of inflation. Although the number of pets is up from 35m last year, a rise of 9 per cent, there has been a fall in the proportion of households owning a pet, from 17.4m (62%) in 2022.

Alongside a decrease of 6 per cent in the dog and cat populations, which now stand at 12m and 11m, 13 per cent (3.7m households) admit to having relinquished a pet in 2022 with this figure rising to 28 per cent among young owners (16-24years old).

Following the pandemic pet-acquisition boom, especially among millennials and Gen Z, 30 per cent of these young owners now admit that the cost-of-living crisis has made them rethink pet ownership, the report notes.

“World events have had a massive impact on lifestyles over the last few years. Throughout the pandemic, we saw an increase in people adding a pet to their family as they sought the amazing companionship a pet can bring. Today, owners are clearly impacted by the cost of living and sadly relinquishment figures are high,” Nicole Paley of UK Pet Food comments.

“Startlingly, we discovered that only 29 per cent of people considered the cost when they got a pet. Almost one fifth (18 per cnt) admitted that a pet was more expensive than they had considered. This figure rises to 23 per cent among the youngest owners (16-24) and families are also impacted with 15 per cent of those with children finding it tough.”

The vast majority of pet owners will do anything for their pet. Giving up a pet, or making changes to their pet care routine, is often a very last resort. Dr Samantha Gaines, from the RSPCA's companion animals department, says they have heard of people going without food themselves to feed their pets!

“What these statistics also show is that pets continue to be really important to people in the UK, with pet ownership on the rise, and that the companionship these animals offer is so invaluable,” she comments, while highlighting that there is help available for struggling pet owners, from pet food banks, vouchers to help with vital vet care and cost cutting tips.

Diversifying sector

According to a report by Statista, the UK pet care market was worth an estimated £6.7 billion in 2021, with the pet food sector being the largest segment of the market, generating a market value of £3.1bn, or over 46 per cent of the total market value. Premium and specialized pet food products have become increasingly popular in recent years, reflecting a growing interest in pet health and nutrition.

The pet healthcare sector, valued at £2.4bn, is another significant segment of the pet care market. Veterinary services, including routine check-ups and surgeries, account for the majority of this sector's revenue. Pet insurance is also growing.

The pet accessories sector, which includes toys, bedding, and other products designed to enhance the comfort and well-being of pets, is also a significant segment of the market, now worth £1bn. The pet grooming sector, which includes services such as bathing, grooming, and nail trimming, is also growing in popularity as pet owners increasingly prioritise the appearance and hygiene of their pets.

Despite last year’s dent in the pet population, the petcare market has an exciting future ahead as market researcher Euromonitor predicts the global petcare market to grow to £102bn by 2024, up from £67bn in 2018. In the UK alone, the grocery and convenience petcare market has reached an annual value of £2.3bn in 2023. This figure is up £281m from last year representing a 13.8 per cent YoY growth [IRI, w/e 25.02.23].

“This forecasted market growth represents a significant opportunity for retailers and convenience stores. In the past year, 7.7 per cent of pet food sales in the UK have come from convenience stores, which equates to around £201.9m of pet food sales [IRI],” comments Samantha Crossley, marketing director at Lily’s Kitchen.

Dogs like treats

As pet ownership boomed, so did treating and Armen Topalian, sales director at Mars Petcare, says that this trend is continuing into 2023.

“While treats are an additional purchase on top of the regular meals owners will be buying, there is still opportunity to drive sales even as household budgets may tighten, by offering a range that also provides additional health benefits,” Topalian comments, highlighting their Pedigree treats which are currently seeing growth of 8.5 per cent, including the Pedigree Dentastix range.

Pedigree Dentastix, which celebrated its 20th anniversary last year, not only offers owners the opportunity to treat their pets outside of mealtimes, but it is a preventative measure in looking after dogs’ oral health, he notes.

“With four out of five dogs suffering from gum disease, it’s important for owners to focus on oral health. As a trusted brand, Pedigree Dentastix is the ideal range to keep treating relevant for cost conscious shoppers. Retailers should ensure they are adding these products to theirranges and should consider expanding their categories to offer a complete solution beyond main meal,” Topalian adds.

Crossley adds that the treats category for dogs and cats is growing year-on-year and is something convenience retailers should consider stocking when filling their shelves.

“Recent data shows that value sales of both dog treats and cat treats are up six per cent and 15.3 per cent respectively [IRI, 26w/e 28.01.23] – yet year-on-year data for Lily’s Kitchen demonstrates our performance in this sector is even stronger – with our dog treats up 8.5 per cent and our cat treats up 15.9 per cent,” she says.

“We have a wide range of treat options for both dogs and cats, including baked treats, chews and training treats, all designed to entertain your pet’s taste buds. We’ve always believed that our four-legged friends deserve to eat proper food – full of nourishing, natural ingredients – and that’s no different when it comes to treats.

Natural in demand

Many consumers are increasingly concerned about the quality of the food they feed their pets, and there is growing interest in natural and organic pet food products. These products are often made with high-quality ingredients and free from artificial additives. Significantly, some pet owners may continue to prioritise their pets’ health and well-being, even in times of economic hardship, and may be willing to spend more on pet food products that they believe are better for their pets.

“At Lily’s Kitchen, we know that consumers are looking for quality, natural pet food for their pets. Today, pet food is about more than sustenance and just simply feeding your pet. It’s about giving them something good that offers proper nutrition with added health benefits,” Crossley comments.

“The natural pet food category has been growing more than three times faster than the total petcare category [IRI] for the last four years. It’s vital that convenience stores tap into this shopper motivation and stock natural brands in their stores.”

She says Lily’s Kitchen work closely with vets and nutritionists to create nutritionally complete and balanced recipes for each stage of a pet’s life.The recipes are made with proper, natural ingredients, including fresh and freshly prepared proper meat.

“As the leading brand in premium natural pet food, we’re on a mission to make sure every single cat and dog eats proper food,” Crossley says.

“Every pet needs a complete and balanced daily diet, full of goodness and wholesome ingredients to keep them in tip-top condition. Our proper food for pets has been created to support our four-legged friends throughout their lives, with amazing nutrition for each stage of their development.”

Butcher’s Nourishing Food For Dogs has recently announced the launch of a brand-new product, specifically developed to help support dogs’ heart health. The Healthy Heart recipes contain the right amount of naturally active ingredients to support the heart muscle function, the brand claims.

The recipes contain algae oil, a naturally rich plant-based source of the omega 3 fatty acid DHA to help support a healthy heart and Taurine & L-Carnitine which are essential to support the heart muscle function.

Vitamins C & E are antioxidants that help strengthen natural immune defences while vegetables such as spinach and butternut squash are a great source of omega 3 fatty acids, antioxidants & fibre, all of which are contained within the recipes.

The launch has been supported by instore and online activations, digital, social and PR activity.

“Owners have become more engaged with their dog’s health and wellbeing over recent years. Our New Healthy Heart recipes are an everyday, affordable meal solution that utilises naturally active ingredients to support a healthy heart and help dogs thrive,” Natasha Bryant, senior brand manager at Butcher’s Nourishing Food For Dogs, says.

“Our Natural Health Support range is specifically developed and carefully formulated to meet nutritional requirements. Each recipe in the range is 100% complete and balanced and contain exactly the right amount of naturally active ingredients to support dogs’ health needs.”

And, last month’s Crufts dog show has seen Burgess Pet Care unveiling its Sensitive dog food range, with over 2000 bags sold at the event.

“Crufts 2023 was a fantastic show for us. We were delighted with the level of interest and engagement we had with dog owners, who were keen to learn more about our Sensitive dog food range which is made without ingredients that typically cause stomach complications in dogs,” Charlotte Varley, communications manager at Burgess Pet Care, said.

“We sold out of the trial bags of Sensitive dog food we had taken to the show, selling 2,000 bags by day two, and over 1,000 customers entered the competition we ran on our stand.

“Since returning from Crufts we have some fantastic customer feedback from dog owners who have subsequently changed their pets’ food to Burgess Sensitive and are already noticing positive changes,” she added.

Dr Suzanne Moyes, deputy managing director and in-house vet at Burgess Pet Care, added: “For dogs with sensitive stomachs that have special dietary needs, Burgess’ Sensitive dog food range features easily digestible proteins, prebiotics and antioxidants to provide your dog with all the nutrients they need, without the upset tummy and runny poos.”

Premiumisation and humanisation

The generational shift in pet ownership over the past few years has seen the increasing premiumisation and humanisation of the pet care sector. Feeding time is about creating bonding moments with your pet, treating them, meeting specific needs relating to life stage and breed, and much more.

“At Lily’s Kitchen, we believe that feeding time is part of the family dinner ritual. We’ve also noticed that pet parents are often looking for pet products which feel familiar on a human level, such as protein bars, comforting family favourites and plant-based foods,” Crossley says.

“For this reason, it’s important for retailers to offer a wide breadth of pet care products, beyond the core SKUs for the brands they stock. For instance, Lily’s Kitchen creates pet food which celebrates the big occasions and everyday meals with wholesome recipes, such as Cottage Pie – made with proper meat and vegetables.”

Expanding on the significant rise in interest around plant-based diets for dogs, Crossley notes that people are becoming increasingly aware of their impact on the world around them, and that also extends to pet parenting decisions.

“Specifically, there’s a drive to reduce meat consumption, owing to an increased understanding around its environmental impact. In the UK, 9.3 million people eat a meat-free diet and five million of those have a pet. When it comes to the attitudes of the UK’s dog parents, 34 per cent believe it’s good for their pet to regularly have plant-based meals, and 43 per cent believe it’s healthy to limit the amount of red meat eaten by their pet,” she says, citing Mintel’s2020 report on pet food.

Crossley urges retailers to take advantage of this consumer trend by ensuring that they stock a range of plant-based meals and snacks alongside meat and fish based recipes.

“Lily’s Kitchen developed our Plant Power wet recipes for dogs so that pet parents who want to feed a little less meat now and again can be confident their dog is enjoying a nutritionally complete, balanced meal, made with top notch ingredients and full of flavour,” she says.

Topalian adds that consumers in the category are particularly concerned with the sustainability credentials of the products.

“When we talk about sustainable choices for consumers, we see this as a long-term trend that is far broader than just the product itself or the packaging itarrives in. One in three consumers have claimed to have stopped buying certain brands or products because they had ethical or sustainability related concerns about them [Deloitte, 2021],” he comments.

“It’s vital that businesses behave more sustainably in order to offer shoppers brands and products that reflect their own values.”

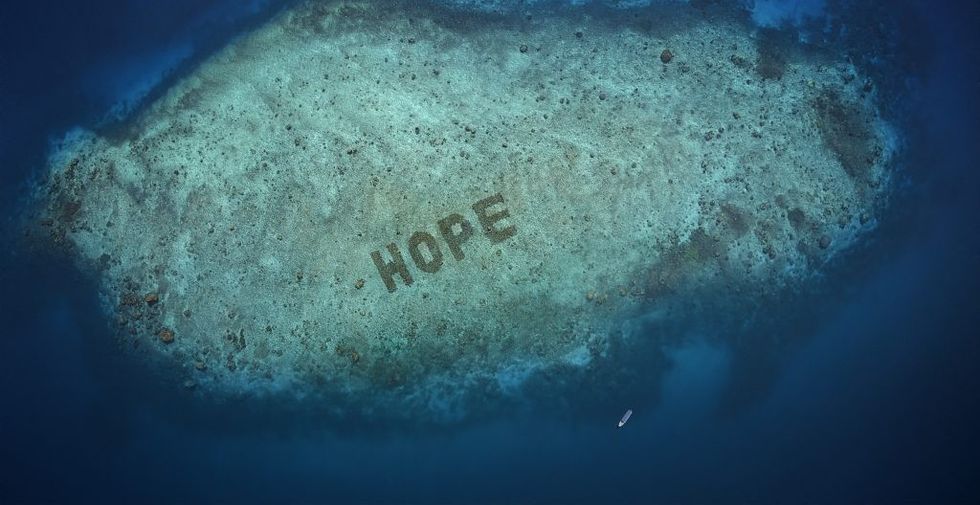

Sheba Hope Reef Programme is one of the latest purpose-driven initiatives of Mars Petcare. “More than a marketing campaign, we have been perfecting coral reef restoration within Indonesia for over a decade,” Topalian says. “Our new Sheba Hope Reef programme takes what we have learnt to the global stage by activating new restoration programmes in critical regions around the world.”

The programme aims to restore 185,000 sqm of coral reef by 2029, and by assigning a global brand like Sheba to the activity, Topalian says they can get the word out to millions of households around the world.

Dry or wet?

As top-up shop for essentials is one of the key missions for convenience consumers, Crossley, of Lily’s Kitchen, notes that offering a range of core pet food options in their local stores in both wet and dry formats is important.

“It can be a challenge to transition to a new pet food, and cats, in particular, can be quite fussy about their meal preferences. For this reason, we would recommend stocking our customer’s favourite SKUs, such as the Countryside Casserole dry recipe for dogs and the Tasty Cuts in Gravy meals for cats,” she says.

Dry pet food is the most popular type of pet food in the UK, but Topalian says they have seen a rise in wet pet food.

“Dog wet has had a purchase value increase of 21.8 per cent while cat wet has grown 13.4 per cent [Nielsen, 12w/e 08.10.22]. With an increased number of people spending more time at home due to flexible working, many have switched to wet food becausefewer people now need to leave a bowl of dry food out at the beginning of the day before leaving for the office,” he notes.

“Wet food is also generally perceived to be a more enjoyable meal for our dogs, offering high levels of animal proteins and a variety of tastes and textures.”

While the emergence of more premium brands has driven the growth of cans, Topalian informs that pouches remain by far the largest format within petcare and are seeing positive signs of growth, up 12.5 per cent in the past year.

“We expect pouch to remain the greatest growth driver in the future as pet owners continue to spend on their pets and look to select more cost-effective options,” he adds.

Citing Mars Petcare panel data, Topalian says the impact of the cost of living crisis is relatively minor in the category, which could work to the advantage of convenience stores.

“Fewer shoppers are looking to save money in pet care than almost any other category with pet owners spending 15 per cent more and buying from more categories than non-pet owners. It is, therefore, important for retailers to take advantage of this by ensuring that they carry a strong selection of petcare products including both wet and dry pet food to maximise the sales potential and offer a range of trusted, well-known brands such as Whiskas, Pedigree, Sheba and Dreamies in a variety of formats,” he suggests.

All feeding occasions

Crossley says stocking a sufficient breadth of range covering all feeding occasions is essential to making the most of the sales opportunities.

“Ranges should include main meals – both wet and dry options, so consumers are able to feed pets in their preferred format – treats and functional products, such as the Lily’s Kitchen Woofbrush,” she says.

“We would also recommend that independent stores utilise shopper and consumer insights when making range decisions and that they ensure there’s visibility and clarity in store so it’s as easy as possible to shop. This in turn will help pet parents make the right decisions for their pet.”

Crossley also points to an opportunity for convenience stores to service pet parents who are out and about with their pets for longer than planned or who may have forgotten essential items at home.

“Lily’s Kitchen recently launched On the Go bars, for example, for dogs to enjoy no matter where they are. They provide complete nutrition in one handy mealtime bar. Available in two mouth-watering flavours – beef and chicken – they fit easily into a pocket. For this reason, On the Go bars are a great product for independents to stock and promote in their stores,” she recommends.

Pet-friendly store

Personalised customer service is the forte of local stores and independent retailers can use this in the pet care category to stay ahead of the supermarkets. By getting to know their customers and their pets’ needs, they can offer tailored recommendations and advice that can build trust and loyalty.

“With the sharp rise in the number of pet owners in the UK, it is important that independent convenience stores are pet friendly, as this should help to set their shops apart from larger retailers,” Crossley suggests.

“For instance, consumers who are on a long Sunday walk with their dog may need to stop for refreshments or a top-up shop while out, and often won’t feel comfortable leaving their pet outside. Making your shop pet-friendly opens a whole new sales opportunity to drive revenue and create returning footfall.”

She points out a number of ways to make your shop pet-friendly, such as placing a dog water bowl outside or locating a jar of dog treats by the door to let pet parents know that your shop is a welcoming place for pets.

“Additionally, as a store owner, we would encourage you to trust that the pet parent will control their dog and will usually carry it if needed. Lily’s Kitchen would also recommend leaving a roll of dog waste bags close to your shop entrance, something that walkers are often caught without on their strolls! This will give a clear signal to all dog lovers who pass by that your store is the place to go for all their pet care needs,” she says.

Independent retailers can specialise in pet care and become experts in the category. They can offer a wide range of products that cater to different pet needs, including specialised diets, supplements, and grooming products. This expertise can help them differentiate themselves from supermarkets and build a reputation for quality and reliability.

“We also know that many shoppers value expertise from their independent store owners,” Crossley says.

“Lily’s Kitchen can work with retailers to share broader pet care tips and advice, in addition to sharing insights on our own high-quality recipes. For example, we can guide retailers on how to provide advice around transitioning pets onto a new food, what to look for on a label, or the benefits of wet and dry food formats. Having this knowledge available in-store can help to build a relationship with customers and set independent stores apart from multiples.”

Standout display

The purchase of everyday petfood products tends to be highly planned with nine out of ten shoppers planning their purchase, Topalian, of Mars Petcare, notes.

“This means that maintaining availability and ensuring bulk formats are in stores for shoppers looking to stock up is crucial,” he adds. “As well as driving sales through wet and dry petfood, retailers are also perfectly placed to capitalise on the increasing demand for treating. Therefore, it is important for retailers to utilise this opportunity by increasing space for these products.

“Positioning within stores will also be key to driving excitement amongst shoppers. Retailers should place new launches at the front of stores or at the end of aisles to increase visibility and raise awareness of their petcare range.”

Crossley, however, thinks that independent retailers can drive sales in the category by indulging a consumer’s impulse mission.

“It’s important to disrupt shoppers, and POS materials are a great way of doing this, as is featuring pet products at till points. With petcare being a high value category, pet treats are a great product to feature at a till point, as well as gondola ends and on clip strips too,” she suggests.

“Over the years, Lily’s Kitchen has helped train and educate retailers on our high-quality recipes and the wholesome ingredients used to make them, to help them explain and sell our products to shoppers. We also work closely with our retailers to help them choose a range of products that best suits their needs, in addition to planogram support, bespoke displays, POS material and samples.”

She also advises independent stores to group petcare products together on their shelves based on their category, positioning all the treats together on one shelf, for instance, while stocking the wet and dry recipes separately. Moreover, stores can prioritise stocking the bestselling flavours from left to right and add the life stage SKUs after the core range, again from left to right.

“This helps pet parents to easily identify exactly what it is they are looking for. Alongside this, Lily’s Kitchen has always supported retail trade with promotional activity that encourages shoppers to try our products.”

She reveals that the brand will be launching a Limited Edition SKU to celebrate a cause close to its heart.

“Towards the end of summer, our scrumptious festive recipes and treats for both cats and dogs will be hitting the shelves and a new range of products for dogs will also be launching later this year which will reinforce our position as a leader in quality, taste and nutrition,” she adds.

A resilient category

We know that convenience shoppers spend approximately £150m a year on pet food in convenience and last year we saw an increased share of their spend through this channel. Spend per trip is up 21 per cent for cat food and 27 per cent for dog food with increased spend mainly being driven by pet population growth and inflation [Nielsen, Nov 2022].

“This provides retailers with the perfect opportunity to encourage shoppers to increase their basket size by offering theright products, in the right formats, at the right price,” Topalian says. “The petcare category remains resilientas shoppers look to cut spend elsewhere and over the next two years, the petcare category is forecast to grow by £1bn.”

Crossley observes that ranging decisions driven by shopper and consumer insights will be key in attracting shoppers.

“We know that consumers are increasingly spending more money on high-quality food for their pets. Natural and healthy pet food products have grown in popularity within the petcare category. In fact, 65 per cent of millennials have a stronger preference for natural products than their older peers and, recognising a third of new pet parents are in this group or Gen Z, emphasising natural and healthy products has become a popular requirement for most pet food brands,” she points out.

“For this reason, stocking natural and premium petcare options with eye-catching branding will boost sales and basket spend for retailers.”

The pet care market is a dynamic and growing industry that is expected to continue to expand in the coming years. The increasing popularity of pets as companions and family members, combined with a growing focus on pet health and well-being, is likely to drive continued growth and innovation in this sector.