Staying in is the new going out, and everyone’s loving it. The Big Night In trend is sweeping the UK, and it’s a total vibe.

Whether it’s movie marathons, football matches, or a midweek wind-down with your favorite series, or even a romantic date, people are ditching the drama of the outside world for the cozy comfort of home.

It can be anything from a night on the sofa with a partner, to a group of friends gathering together for a celebration, formal or casual – it’s about making the most of time together at home.

What makes convenience stores the true heroes of the Big Night In is their sheer accessibility. After all, who comes in handy when people need some more snacks five minutes before the movie starts or forget the popcorn for the game or need more drinks for the guests?

This trend isn’t just about stocking shelves—it’s about making your store shoppers’ first thought. It’s time to make the best of this wave by becoming one stop solution for every Big Night In needs.

Big Night Ins have long been a popular alternative to hitting the town and although they rapidly became the new ‘going out’ during lockdown, consumers are still spending considerably more time at home with affordable treats topping the shopping list.

As shoppers continue to feel the strain on household income, consumers are only going to embrace this trend more and more. What gained momentum during Covid-19 lockdown is now an integral part of British life. It’s a win-win for everyone.

Industry leaders like Susan Nash from Mondelez, Mark Roberts from Perfetti Van Melle, Tom Smith from Accolade Wines, Caitlin Brown from BrewDog, Lauren George, from Mars Wrigley and Nic Storey from Pepsico speaks collectively of how crucial and beneficial the trend if for convenience channel.

What is making it even better is consumers’ inclination towards indulging in little treats here and there.

As pointed out by Rachel Wells, Commercial Director at St Pierre Groupe, consumers have continued to invest in “treat moments” at home during the cost-of-living crisis, reserving nights out for major celebrations.

Starters for fun

We will all agree that the life of every gathering and in-house parties are snacks. Sharing packs of crisps, popcorn and nuts are absolute must-haves. They’re the crowd-pleasers that keep families happy, movie nights on point, and football fans fueled.

Savoury snacking represents a strong opportunity for convenience retailers looking to maximise their sales and cater to consumer desires to socialize at home.

As pointed out by Nic Storey, Senior Sales Director, Impulse & Field Sales at PepsiCo, the total salty snacks category in independent and symbol stores is worth £637.5million and growing at +9.0 per cent, suggesting its crucial role in the sector.

As consumers come together to connect and socialise, most will also be looking for larger pack sizes of their favourite savoury snacks that they can enjoy together. No wonder, sharing formats are now the largest segment within the salty snacks category, making up 69.4 per cent of it.

Storey from Pepsico tells Asian Trader, “Within our own portfolio, sharing packs across our core Doritos range, Sensations, and Walkers crisps have been performing strongly.”

There is an opportunity here to tap into the popularity of these brands and drive sales, in particular for those looking for a sharing format. Ensuring that a range of sharing formats is available will mean that shoppers will turn to convenience not only in the case of last-minute needs but for weekly shopping too.

Keeping the shoppers curious and interested in the range here is crucial. And a perfect mix of bestsellers and new launches is the key.

“Enjoyment is the number one driver of choice when buying crisps and snacks, so we recommend retailers offer well-loved core brands such as Quavers, Wotsits and Monster Munch,” adds Storey.

A new launch to highlight on the shelves is Walkers Smokin’ BBQ Sauce which has joined Walkers’ core line-up, helping retailers meet shopper preferences for their favourite flavours whilst encouraging them to trade up with Britain’s most loved crisp brand.

Following the successful launch of PepsiCo’s Extra Flamin’ Hot range last year, the maker also launched a limited-edition variant on the iconic Walkers crisp Walkers Extra Flamin’ Hot.

Storey believes that this latest non-HFSS innovation is set to drive additional snacking sales for retailers by introducing more shoppers to Extra Flamin’ Hot while also engaging existing buyers with a new variant featuring the iconic Walkers brand.

Walkers Extra Flamin’ Hot is available for eight weeks only, in a 150g sharing pack (RRP £1.65), 70g PMP (RRP £1.25) and 45g grab bag (RRP £1.10), and the launch will be supported by a multi-million ATL campaign, spanning TV, social media, digital, OOH and PR.

Pepsico is also doing an on-pack promotion on Walkers MAX in sizes 140g, 70g PMP and 50g. Kicked off on Jan 20 and running until March 23, the campaign offers football enthusiasts the chance to win UEFA Champions League final experience in Munich, Germany, along with UEFA Champions League merchandise.

While offering the popular crisps and nuts range is a great way to keep the shoppers hooked, retailers also need to consider premium as well as healthier, free-from range snacks.

Big Night In is a time for fun and indulgence. However, there has been notable growth in health-conscious consumers seeking healthier alternatives and plant-based options, particularly toward the beginning of the year.

Retailers should focus on offering artisanal snacks, products from locally sourced suppliers and dynamic flavours to create a special and memorable experience for customers.

And a great name to consider here is Fairfields Farm.

Tash Jones, Commercial Director at Fairfields Farm, shares her insight, “As consumers look to add premiumisation to their Big Night In occasions, there is a strong role for products that meet this demand, for example Fairfields Farm’s hand cooked crisps, which offer high margin and cost-effective range differentiation for retailers.

Jones also agrees that sharing formats are particularly popular for Big Night In occasions as customers often seek better value for money.

Fairfields Farm’s 150g sharing packs consistently perform exceptionally well during these occasions, aligning perfectly with consumer preferences – as demonstrated by substantial YoY sharing growth for the format.

Jones adds, “In May 2024, we introduced our latest flavour, Prawn Cocktail, in response to growing consumer demand for nostalgic tastes. Looking ahead to 2025, we have some exciting developments in store here at Fairfields Farm, including the launch of two brand-new flavours.”

Meals and deals

Convenience is always an important factor in successful BNIs, especially when hosts want to give guests something fun and different but do not want to spend hours prepping and cooking.

That’s where brands such as Rustlers come into their own. Tasty, convenient and cooked in less time than it takes to boil a kettle, Rustlers is the ideal Big Night In product, enabling consumers to enjoy a convenient chilled ready meal without interrupting the night’s events.

According to Ross Davison, Head of Convenience at Kepak (Foods Division), Rustlers continues to grow and is now worth £118m, outperforming the micro-snacking category with growth of over 2 per cent.

In 2025, we expect Asian ingredients and flavours to really take off within the mainstream culinary landscape, and this will inevitably have a knock-on effect on BNI food choices.

With 95 per cent of UK households buying into the World Foods category (Kantar, 2024), there is clearly a massive BNI opportunity here.

This is where brands such as Master Cook range of authentic meal kits and accompaniments really come in handy.

Matthew Moyes, Marketing Controller at leading speciality food importer and distributor Empire Bespoke Foods (EBF), informs, “Specifically developed for world food enthusiasts who want to recreate their favourite dishes quickly and easily, the range celebrates global cuisines including Indian, Japanese, Korean, Malay, Thai and Vietnamese and delivers authentic flavours and taste experiences quickly and easily.”

"Our new range of premium Cornichons – whole crunchy mini pickled cucumbers from the UK’s leading gherkin brand Mrs Elswood – are perfect for pimping up a cheeseboard and delivering a tasty accompaniment to a wide range of savoury foods.”

Moreover, Mrs Elswood, the UK’s favourite gherkin brand, has just unveiled a new duo of snack pickles in handy pouches ideal for the Big Night In.

The innovative new Mrs Elswood Pickle Bites are now available in convenient 50g packs in fiery Peri Peri and original Classic flavours. Gluten-free, vegan and kosher, MrsElswood Pickle Bites also offer an 18-month shelf life.

“Delivering all the much-loved punch and crunch of a MrsElswood Gherkin but now in a handy pouch for extra convenience and portability, we are confident that MrsElswood Pickle Bites will be a hit with consumers seeking a new vegetable-based snacking experience,” comments Moyes.

“We know that consumers are increasingly seeking healthier snacking alternatives – and a pickled vegetable fits the bill perfectly.”

Considering that the top two usage occasions are sandwiches and burgers, selling gherkins on a secondary location near the bread (sandwich loaves, burger buns) or even burgers can help the shopper plan their whole meal and can help increase basket spend.

Another key thing that people stock ahead of a gathering is bread and bakery products.

Premium brands like St Pierre offer an easy and affordable way to elevate these occasions.

Shoppers are increasingly looking for products that deliver some indulgence as well. Retailers can easily cater for this by providing ranges that allow customers to “upgrade” from traditional staples.

Brioche is a keyway to enable customers to do this, and St Pierre’s brioche range is an ideal base for enhancing a host of popular at-home recipes.

Wells shares with Asian Trader, “Our best-selling products, St Pierre Brioche and Seeded Brioche Buns, offer consumers a simple way to elevate the everyday at-home occasions, including for the Big Night In.

“They are all pre-sliced for convenience and benefit from an extended shelf life, to help reduce in and out of home wastage."

St Pierre is a brand going from strength to strength and is now the fastest growing bakery brand in the top 15, the fastest growing brand in rolls, the fastest growing brand in breakfast and the fastest growing brand in lunch and evening meals.

Retailers need to offer products that attract shoppers and keep them bringing back. Freshness is paramount, and Baker Street’s products are cleverly packed to stay fresher for longer, helping retailers ensure on-shelf availability with less risk.

Interestingly, consumers are also looking for quick and easy ways to create ‘fakeaway’ favourites.

Josh Corrigan, Customer Development Director, UK, at St Pierre Groupe, informs, “Retailers can cater to the demand (fakeaway) by stocking Baker Street’s range of Burger Buns and Hot Dog Rolls, which are ideal for consumers looking to recreate classic burgers and hot dogs, served with a variety of toppings.”

Baker Street’s recipes have been specifically developed for this purpose – with burger buns “built for burgers” and hot dog rolls “ready to handle” the load.

“They also cater for the whole family and multiple meal occasions – a very attractive proposition for those wanting to make their food go further.”

Baker Street’s burger buns and hot dog rolls’ association with “Americana-style” dishes also offer the retailers exciting opportunities for pairings with American beers, wines and spirits, as well as soft drinks.

For sweet tooth

Big Night In usually equates to family time and shoppers look for something for everything. A party-at-home cannot be complete with some desserts, chocolates and candies.

In the current cost-of-living climate, confectionery offers an inexpensive way for customers to treat themselves without breaking the bank. It’s a small luxury that can significantly enhance their night.

Format is key so offering both chocolate and candy bags is a must. In candy there is a key trend for sours, and Sour Patch Kids is growing by over 50 per cent so retailers should make sure their range includes a strong range of sours.

Susan Nash, Trade Communications Manager at Mondelēz International, says, “Shoppers like sharing moments, and the evening occasion is the key time of day for sharing, with tablets and bags being the most convenient and popular format among the consumer.

“At this time of day, consumers want to treat themselves and indulge. So in order to build a successful and efficient Big Night In range within confectionery, stores must offer the best-selling lines

Shoppers like variety as well so it’s important to have a range of flavours and different types of sweets from hard to soft to appeal to all shoppers.

Value is important too in this aisle, where 70 per cent of sales are in PMPs. So in order to build a successful and efficient Big Night In range within confectionery, retailers must focus their space on the best-selling lines across these key formats and pack types.

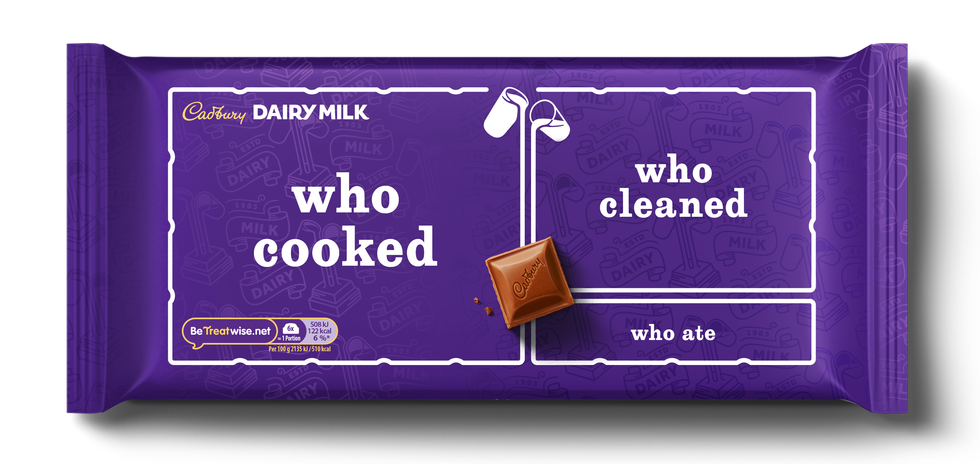

One of the latest offerings by Mondelez is Cadbury Dairy Milk’s Made to Share range. The range includes twelve limited edition on-pack designs for its Cadbury Dairy Milk 180g and 95g PMP bars which are all centred on appreciation for each other.

With front-of-pack designs posing questions such as ‘Who Pays the Subscription?’, ‘Who Drove?’ and ‘Who Cooked?’ to determine who gets the biggest share of chocolate, the playful new riffs on the iconic Cadbury Dairy Milk bars add a collectable novelty to the sharing occasion.

Perfect for the Big Night In occasion in the run-up to Easter, Mondelēz International is also unveiling the Easter Favourites Pouch, its first-ever confectionery pouch made from paper. The new pouch contains Mini Cadbury Dairy Milk Eggs, treat-size bags of Cadbury Mini Eggs and Cadbury Creme Eggs.

For sweet-lovers, EBF too offers the on-trend fruit candies from US confectionery giant Mike & Ike, perfect for sharing.

Alongside Mondelez and EBF is Perfetti Van Melle which promises to offer retailers various delicious and popular options for Big Night In.

Armed with 30 mini lollipops in fan-favourite flavours like cola, strawberry, orange, apple and cherry, Chupa Chups Mini Lollipop Bag targets sharing occasions with launching in time to add some sweetness and variety to upcoming summer parties and holidays.

As pointed out by Mark Roberts, Marketing & Trade Marketing Director at Perfetti Van Melle, the range uses only natural colourings, infused with Vitamin C, featuring a recyclable paper stick and individually wrapped to promote hygiene and portion control.

Another must-stock item is Fruit-tella, the delectable chews that contain real fruit juice and are made with all-natural colourings and flavours. This makes them the perfect portable snack for families looking to enjoy a big night in treat without an added sugar-hit.

Thanks to the enduring popularity of Mentos Fanta amongst consumers, the hit treat is back in a pouch bag format, alongside Mentos’ most-loved flavour fruit roll, Fruit Mix, worth £5.1m.

Sharing bags are the most popular pack format in confectionery, accounting for 71.4 per cent of sweet value sales, states Roberts.

Mentos is targeting the growing trend for sharing occasions with Mentos Fanta Pouch Bag and Mentos Fruit Mix Pouch Bag, the latter of which features the fresh addition of a Green Apple and Blackcurrant flavour sweet.

The sour trend has grown in popularity, particularly amongst Gen Z. Chupa Chups Belts range taps into growing demand for sour and fruity sweets, the range comprises of tantalizing sour mixed belts, sour apple belts, sour strawberry belts. Packed in convenient 90g bags, the vibrant and playful packaging is designed to stand out on shelves, add colour to the confectionery aisles and to entice new shoppers to the category.

Roberts told Asian Trader, “With the overall laces, belts and wands category now valued at £91m and experiencing a remarkable growth rate of +19 per cent, Chupa Chups is poised to capture an even larger share of this expanding market and advises buyers to stock up now.”

Perfetti Van Melle’s biggest launch of 2024 was Mentos Discovery, a fruit roll that features 14 different flavours such as lychee, watermelon and passion fruit. These flavours are rarely seen in confectionery and therefore stand out as different and intriguing.

Research conducted by Mintel in 2022 demonstrated that 63 per cent of sweet consumers want a wider range of flavours, and sales figures prove that. 57 per cent of Mentos Rolls sales come from mixed fruit, making 2024 the ideal timing for Mentos Discovery to hit the market.

Roberts explained how the team scrutinised trends, consulted research and analysed sales performance to make informed decisions for 2024.

The proof is in the pudding as Mentos Discovery has had incredible results in 2024 despite the single roll only being launched in May. It is now a £1.1m sub-brand with the single roll accounting for £820,000 worth of sales.

Another must share bag brand to stock in stores this season is Bonds of London, which is loved by customers thanks to their clearly marked prices.

The bags are marked as £1.25 with flavours including Great British favourites like Fruit Pastilles, Jelly Beans, Chocolate Peanuts, Midget Gems, Fruit Jellies and Chocolate Honeycomb.

The newest PMP product from Bonds are their Kids Sweet Bags which retail at 50p each.

Kathryn Hague, Head of Marketing at Hancocks, explains, “Younger customers love these tasty ‘pick n mix’ sweets with pocket money prices. Independents can encourage sales by merchandising products for the whole family for big night in, and stocking a range of options for every age group to enjoy.”

Candy Realms Fizzy Mix Candy Cup is another great standout product that captures the attention of shoppers.

Hancocks also has Candy Realms Sweetest Mix Candy Cup RRP £2.50 where customers can indulge in fruit flavour sour coated jellies and vanilla flavour mallows.

Kids novelty products are another must stock ahead of the Big Night In. The Crazy Candy Factory Gummy Noodles RRP £1.00 are the perfect choice.

Hague adds, “At Hancocks, we have an unrivalled range of pick and mix favourites with our Kingsway range, offering the nation’s favourite confectionery, including a wide variety of halal, vegan and vegetarian options.”

All Kingsway confectionery is available in either 2.5 kg or 3kg bags with an RRP of £1.49 per 100g.

Top sellers from the range also include the Assorted Fizzy Mix, which offers customers the chance to enjoy a variety of the most popular fruity and bubblegum flavoured fizzy sweets.

Kingsway Raspberry Bon Bons, Giant Strawberries, Strawberry Bon Bons, Fizzy Bubblegum Bottles and Watermelon Slices are also best sellers from the range.

Novelty products are also a great way to encourage impulse sales, so stocking up can help independent retailers. Warheads popping candy at RRP of 99p per pieceis also a must stock.

Another line to consider stocking to drive impulse buys is the popular American brand PEZ. Their iconic PEZ dispensers come in a range of much-loved children's characters and have an RRP of £2.

Lauren George, External Communications Manager, Mars Wrigley, strongly believes that the Big Night In trend, fueled by the desire for convenience and comfort, presents a significant opportunity for the retail sector.

As cost of living continues to be at the front of many consumers’ minds, price-marked packs (PMPs) are notably increasing in popularity.

George explains, “PMPs offer reassurance to consumers that they are paying a fair price for a quality product. PMPs also prove to be important to retailers as they can build a sense of trust and confidence amongst consumers.”

“The impulse purchase trend has resonance for Mars Wrigley, and we want to continue to partner with our customers to deliver against them. Our category-first approach defines new routes for shoppers in the omnichannel world. Displays and in-store media are critical for us to drive awareness and conversation at the point of purchase.”

Data demonstrates that consumers are looking to purchase within the bite size sub-category.

“Appealing to the screen time consumption occasion, while also opening new opportunities in baking and decorating, M&M’S Minis are set to unlock shopper penetration by recruiting younger consumers into this sub-category, where Mars Wrigley already leads with a 42 percent market share,” says George.

M&M’S Minis are available in multiple pack formats- 70g Price Marked Pack, 115g Core Pouch, 176g More-To-Share Pouch and 800g Party Pack. This innovation fills the gap for a permissible treat that is fun to eat and capitalises on the Gen Z target market’s love of new and exciting tastes, offering a moment of escape.

Another line to stock is Mars Wrigley’s SKITTLES Giants Gooey that was launched last year. Filled with a gooey, citrus core, this innovation taps into the trend for fun and unexpected tastes while capitalising on the growth in fruit-inspired confectionary which has seen the category increase at a CAGR of 4.3 per cent.

While candies attract the young shoppers and the ones with children, it is premium chocolates that usually catch the attention of everyone.

In Independents in the last 12 weeks, unit sales for premium chocolate have shown an 8.9 per cent increase, with Divine Chocolate unit sales increasing by more than double this figure, showing an uplift in sales of nearly 25 per cent.

Commenting on the figures, Lydia Stubbins, Group Marketing Director, Divine Chocolate Ltd, said, “We believe this shows that little luxuries, like delicious chocolate are still something consumers are willing to spend money on, despite the cost-of-living crisis.

“It also shows that despite price increases within the category because of the rising price of cocoa, consumers are not put off.

Of course, this data covers the Christmas period when premium chocolate is a go-to for consumers but even looking at Premium Chocolate more widely over the last 12 months, the category shows an increase of 15.5 per cent when it comes to revenue. This shows that there is a clear opportunity for Independents to grow basket size by stocking a range of premium chocolate, Stubbins said.

There’s been a rise in nostalgic and traditional flavour profiles across chilled desserts, beverages and sweets, with consumers increasingly searching for edible escapism.

As such, Divine identified a gap in the block chocolate market for a range of bars that bring these flavours to life in an indulgent, fun and premium way with their range of Dessert Bars.

Stubbins pointed out that 54 per cent of shoppers view Divine’s Dessert Bars as an alternative to their usual premium dessert (e.g. a cheesecake, trifle or shop bought pudding) which offers

independents a great opportunity to steal sales from the premium dessert category (one typically dominated by grocery multiples).

In addition, 45 per cent of consumers surveyed said they’d buy Dessert Bars on top of their normal premium dessert and/or chocolate bar, so there is a clear opportunity to drive incremental growth, beyond just the Big Night In occasion, Stubbins adds.

At £4.49 RRP and a strong 58 per cent purchase intent, Dessert Bars are a fantastic, highly incremental way to grow basket size with shoppers who are looking for something a little bit special, that doesn’t break the bank.

For Good Times

Big Night in brings big opportunity in the alcohol aisle as both the hosts and the guests are seeking more options to stock as well as gift.

As a well-established category, still wine remains an anchor in the stores, driving footfall, repeat traffic and overall customer loyalty. With £6.3 billion in sales in the past year, still wine has continued to perform strongly because of a combination of established consumer favourites and exciting innovation across several areas, from new formats to product formulation.

Wine sales generally stay strong year-round, but for maximum customer loyalty, stocking core signpost brands will boost shopper trust who in turn will keep returning to your store when they need a bottle for tonight.

Crucially, the majority of sales in convenience come from the core mid-range price point between £6 - £8, therefore it should be at the heart of every retailer’s range in-store.

Now in its second decade as the UK’s number one wine brand, Hardys is worth £316m, delivering £46m more in value to the category than its number two competitor.

Within convenience, Hardys remains the strongest core brand accounting for £149.3m in sales last year.

Tom Smith, Marketing Director - Europe, at Accolade Wines, tells Asian Trader, “We are seeing white wine continue to lead the category, accounting for four out of the top five varietals.

“This is also reflected in Hardys performance as we see, Hardys Sauvignon Blanc, Hardys Crest Chardonnay and Hardys Stamp Chardonnay/Semillon all showing growth, which shows that shoppers are still looking for accessible, familiar varietals from a brand they trust that, most importantly, deliver on taste.”

With sales of £103m, another brand in dynamic growth across convenience is Jam Shed from Accolade Wines.

The Jam Shed portfolio now includes Shiraz, Malbec, Chardonnay, Rosé, Red Blend, Tempranillo and Jam Shed Fruits- Rhubarb & Strawberry Smash and Black Forest Mess.

Smith reveals that Jam Shed’s growth has been driven by recruiting new consumers to the brand and converting them to loyal “Shed Heads” who truly engage with the rich, jammy, and smooth taste of the Jam Shed portfolio.

It’s a must-have brand for all UK retailers to take full advantage of this new generation of more adventurous, less traditional wine drinkers, he adds.

Red wine remains a staple addition, so bestsellers like Merlot, Shiraz, and Cabernet Sauvignon should always be part of retailers’ red wine offering.

Smith adds, “We are also seeing impressive growth of red blend varietals, with wines such as Barossa Ink Shiraz really resonating with consumers due to its contemporary aesthetics and opulent style.”

For white wine, Sauvignon Blanc, Pinot Grigio and Chardonnay came out top for value sales, with Sauvignon Blanc and white blends driving a lot of growth last Christmas.

Retailers should ensure a selection of these varietals is stocked. Mud House French Sauvignon offers shoppers a more premium option, while Wise Wolf Chardonnay is the perfect white wine to dress up the dinner table, with its unique eye-catching bottle made from made using “100 per cent post-consumer recycled glass cullets”.

This February, Echo Falls, the UK’s number one flavoured wine brand, launched a fresh, fruity flavour – Watermelon and Kiwi Fruit Fusion. With a 9 per cent ABV, the new launch will appeal to a young consumer demographic as it taps into a demand for RTD cocktails and sweet ciders in a bid to lure existing consumers of these popular products towards fruit wines.

Smith shares, “Although key trends are expected to continue, within the current climate, the cost-of-living pressures will influence shoppers’ purchasing decisions and how much consumers are willing to indulge.

“We’ve seen a decline in impulse purchasing and expect some shoppers to switch down to cheaper products or to reduce frequency and basket size. The £6-9 range remains important for impulse buying due to the lack of range for wines priced at £6 and lower, forcing consumers to trade up.

“While wines priced at £9 aren’t performing as strongly as the £6-9 range, many shoppers will still be looking to trade up for certain occasions.”

Trading up to more premium options like Hardys Crest is common among shoppers. The wine still lands within the £6-9 range but is a higher-quality option, whilst for others it may be an extra bottle of their everyday favourite.

Hot off the heels of the launch of Mud House Sauvignon Blanc in Mini Box format, Accolade Wines is delighted to continue diversifying and expanding its mini boxed wine portfolio with the addition of fan-favourite wine Jam Shed Shiraz.

Known for its rich, bold and jammy flavour profile, the Jam Shed Shiraz Mini Box is widely available across grocery and retail channels. A key benefit of boxed wine is that its freshness and quality is preserved for up to six weeks after opening, so consumers can savour the wine at their own pace or share with friends over multiple occasions.

Catching the trend, Kingsland Drinks also recently expanded its Campaneo range with the addition of new, convenient 2.25L Bag in Box (BiB) format.

As informed by Jo Taylorson, head of marketing and product management, Kingsland Drinks, the conditions for this still-emerging format are ripe for success, with producers, brand owners and retailers investing in quality of liquid, innovative packaging and campaigns that educate the shopper on the format’s virtues.

“This has been supported by the wider industry, press and influencers who are waxing lyrical about bag in box wines. Slowly but surely the format is shaking off its reputation as a ‘cheap’ alternative,” adds Taylorson.

In the RTDs, the growth has been slow yet steady as the category matures.

While we are seeing less innovation from brands, there have been smarter and more effective launches as the category matures and has a clearer view of the consumer. Consumers are also making more considered choices within the category rather than chasing the new best thing on shelves.

Store managers should ensure there’s a dedicated section for chilled down RTD’s that cover classic spirit and mixer combinations all the way through to bar-quality cocktails to really pique interest from Big Night In shoppers looking to treat themselves.

Good times often come with chilled beer.

To cater for a bigger group with different tastes, retailers must keep larger multi-pack formats like BrewDog’s Mixed pack are ideal for this occasion.

Along with Premium Lager, Craft Beer features significantly in many at home occasions, including night In (alone or as a couple), regular/everyday drink and planned social gatherings.

Caitlin Brown, Category Executive, BrewDog PLC, shares with Asian Trader, “We’ve also seen good distribution growth for Craft Beer in Total Impulse (+0.6), with key supply wins for Hazy Jane, Lost Lager and BrewDog’s Mixed multipack. With wider availability for these products, linked to the big night in mission, the sales opportunity is even stronger.”

Of the top occasions for Craft Beer, BrewDog is the most consumed, with 29 per cent of Craft Beer drinkers choosing Punk IPA when trying to relax.

From a Craft Beer perspective IPA is the most popular and best-performing style of beer all year round in convenience. The heartland of craft is Punk IPA, which acts as a signpost for the category.

Brown adds, “As an initial craft offering, we recommend starting with our top two products, Punk IPA and Hazy Jane New England IPA 4-can multipacks, which also continues to see a lot of love from shoppers.

“We also recommend rotating your range twice a year to reflect weather conditions and seasonality. As leading SKUs, Punk IPA and Hazy Jane New England IPA should be featured all year round but there is an opportunity to flex the range and include the likes of Wingman session-IPA and Black Heart on a seasonal basis.”

The BrewDog 330ml 8-can mixed packs is also an important recruitment tool.

Something else to drink?

As consumers turn to comforting, affordable indulgences during the colder months, hot chocolate is also very much a key component of the Big Night In (BNI) trend.

The Mars Chocolate Drinks & Treats (MCD&T) hot chocolate range achieved an impressive 33.9 per cent increase in units sold during BNI in Q4 2024.

The range’s standout performer, Galaxy Instant, has delivered exceptional results in the convenience channel all year round, with unit sales surging by 85.4 per cent and surpassing 1,000,000 units sold.

Kerry Cavanaugh, general manager at Mars Chocolate Drinks & Treats, comments, “Big Night In continues to be a key part of hot chocolate consumption for those seeking to recreate the coffee house experience at home.

“Our hot chocolate range not only plays a pivotal role during peak BNI periods but also delivers exceptional results year-round in the convenience channel, driven by our portfolio hero, Galaxy Instant.”

With more shoppers looking to moderate their alcohol-consumption, session-able products have been a huge focus for BrewDog over the last 12 months, including the launch of session-IPA, Wingman and low ABV lager, Cold Beer.

Brown says, “Since its nation-wide launch at the start of the year, Wingman has tapped into the growing session-IPA occasion and is now the fastest growing craft beer brand. It is also helping the wider portfolio by acting as a recruiter into craft beer, with 61 per cent of shoppers going on to buy craft beer for the first time, following the first purchase of Wingman.”

“Following an initial launch with the Tesco group, Cold Beer has been available nationwide since September and represents another success story for us and has delivered over £1.4m sales since launch,” she adds.

With more consumers focusing on moderation or even abstention, a whopping 43 per cent are reducing the alcohol content of the drinks they consume, and this does not show signs of slowing. This has led to a generational shift, with almost 40 per cent of 18-25s not drinking alcohol at all vs 22 per cent in 2019.

With the continued demand, we expect the low and no category to grow further and play a stronger role in shopper’s repertoire.

Well-known, established brands such as BrewDog, which holds two of the top 10 sellers within alcohol-free beer and continues to evolve and improve its alcohol-free range, as well as product quality, will be key to this success.

No and low alcohol category is buzzing at the moment with lots of additions coming up, encouraged by the shoppers’ response.

Another name to remember here is Kingsland Drinks that started packing non-alcoholic wines and spirits in 2019 and is now responsible for developing and launching some of the market’s leading brands.

The company currently blends and bottles non-alcoholic gin, rum, whisky, tequila, and still and sparkling wines, using world class technology and controls to ensure the highest possible quality assurance standards.

Taylorson from Kingsland Drinks explains, “Lower and no abv wines and spirits are earning their place on fixtures and consumers are responding by integrating them into their shopping.

“They are becoming a must have item to have stocked at home and ready to go for those evenings in where consumers want to ‘unwind’ with a drink that offers complexity, but don’t necessarily want to consume alcohol or for consumers who are following the “zebra striping” trend, alternating alcoholic and non-alcoholic drinks to avoid overindulging and to moderate their consumption of alcohol.”

Store managers should look to Andrew Peace for a high quality, slightly lower abv option on the wine aisle. The Australian wine brand has worked tirelessly to craft wines at 11 per cent abv which give consumers a great tasting wine while maintaining a great value price point.

Another major trend currently seen is the rise in demand for adult soft drinks.

With consumers constantly on the lookout for something different, the iconic French ‘La Mortuacienne’ artisanal lemonades from EBF, together with Virgil’s handcrafted American sodas in classic Black Cherry, Cream Soda, Root Beer and ‘Flying Cauldron’ Butterscotch Beer flavours, not only quench thirsts but deliver premium quality, sophisticated no-alcohol options.

Pump up the sales

Overall, shopper confidence is improving at a total level as inflation rates recover. A little creativity along with promotions and mindful merchandising can create a significant difference in the numbers.

Nash from Mondelez reveals to Asian Trader, “Our latest insight indicates both penetration and frequency of convenience shopping has increased, reflected in the shopper shift to smaller more frequent shops, with shoppers prioritising their immediate needs, be that for immediate consumption or for that evening.”

Cost of living pressures have also seen a move by consumers to “eat in” more, again providing opportunities in convenience retailing for “meal for tonight” and “big night in offers” as consumers see staying in with friend and family as a cost-effective alternative to going out.

Nash adds, “We also see a continued focus on value, with price-marked pack sales increasing in convenience at a total level. Price marked packs help deliver a value message in store, tapping into consumers’ need for ‘affordable’ treats, so they’re an important part of a convenience retailer’s range.

“However, there is still a demand for premium products, and we see consumers not wanting to hold back on seasonal treats, in particular. It’s also important to note that consumers are focused on value not price.”

Traditionally, Big Nights In were restricted to sharing seasonal events and major sporting occasions, but with the trend to stay in remaining as strong as ever, consumers are constantly on the lookout for new taste adventures to spice up their BNI experiences.

This can mean some significant opportunities for retailers to capitalise on impulse food and drink purchases; creating dedicated displays and promotions on linked purchases will also help drive sales.

Not surprisingly, the right price is another crucial factor as this allows consumers to experiment without spending too much, although premiumisation is also a rising trend so don’t overlook demand for higher quality products too.

Effective merchandising is key to success and ultimately this comes down to understanding your customers, and why they are shopping with you. If customers are entering the store with a view to stocking up for the Big Night In occasion, for example, this should influence where chilled drinks, meal kits and confectionery are positioned and how they are displayed.

Davison from Kepak urges retailers to use the broad consumer appeal of Rustlers as an integral part of the Big Night In selection, offering complementary drinks, snacks and desserts as part of a basket-boosting meal deal.

Products often bought with Rustlers include complementary big night in food such as fries and drinks, underlining the role Rustlers has to play in the Big Night In offering.

“The rising popularity of Fakeaways, where consumers recreate their favourite takeaway meals at home, is boosting the Big Night In occasion, with 74 per cent of consumers saying they are ‘convenient’and 70 per cent saying they are ‘good value’,” he adds.

Indeed, such occasions are an excellent opportunity to co-merchandise products, boosting sales while providing customers with a convenient one-stop shopping experience.

Pairing items like Fairfields Farm’s crisps with beverages or dips, or offering options such as olives and peppers, perfect for ‘picky bits’, enhances the appeal.

Event-themed merchandising, such as grouping products around cosy evenings in, major sports events, Valentine’s Day or Christmas, also drives higher sales.

Clearly labelling and positioning these items in high-footfall areas of the store further maximises their visibility and impact.

Jones from Fairfields Farm shares with Asian Trader, “I always recommend stocking a wide variety of products to appeal to a wider audience.

“While indulgent snacks are essential, it’s equally important to include options that cater to allergy sufferers and dietary restrictions. Our Fairfields Farm range is 100 per cent vegan and gluten-free, ensuring everyone can enjoy the flavours they love.”

Let’s Hang out

Ice cream tubs for that perfect rom-com night, microwaveable meals for hassle-free dinners, and even board games or party supplies for group gatherings-convenience retailers who think outside the box and offer a variety of these items will win the hearts (and wallets) of their customers.

Stock up on crowd-pleasers like crisps, popcorn, and sharing-size chocolates, but don’t forget the lesser-known heroes- dip tubs, cocktail mixers, and fancy ice cubes. Arrange them in easy-to-grab bundles for a "Night In Survival Kit" vibe.

Everyone knows snacks are the life of the party, but why stop there? Add some supporting characters to the mix—like ready meals, pizzas, and quirky dessert options—to tempt customers who might be too tired to cook.

Don’t shy away from premium options either; nothing says "treat yourself" like gourmet popcorn or a cheeky bottle of prosecco. Use bold signage and cheeky puns like "Netflix & Nibble" or "Score Big on Snacks" to grab attention.

The devil is in the details—or in this case, the napkins, paper plates, and even the odd pack of playing cards. Big Night In shoppers aren’t just after food; they’re hunting for a hassle-free evening. Capitalise on this by stocking convenient extras like microwaveable popcorn bags, reusable straws, or even themed party supplies.

And for those wanting to impress their guests? Offer quick recipe ideas or cocktail suggestions near relevant products. Pairing suggestions like “Nachos + Guac = Perfection” or “Mix this tonic with that gin” can inspire upselling while making your store feel like the ultimate party guru.

And don’t underestimate the power of social media. Use your social media channels to promote your Big Night In range with vibrant photos and clever captions. Highlight limited-time offers or “staff picks” for the ultimate Friday night lineup. Also, encourage shoppers to snap their Big Night In hauls and tag your store.

By tapping into customer needs with smart merchandising, irresistible offers, and a dash of creativity, retailers can not only see good sales but also more footfall. So stock up, think like a party host, and watch your sales turn into a celebration of their own. Have fun!