Cash usage is thriving as withdrawals ratcheted up for the third year in a row since the pandemic, data from Nationwide showed. The recent surge comes as many people opt for cash to budget at a time the cost of living remains high.

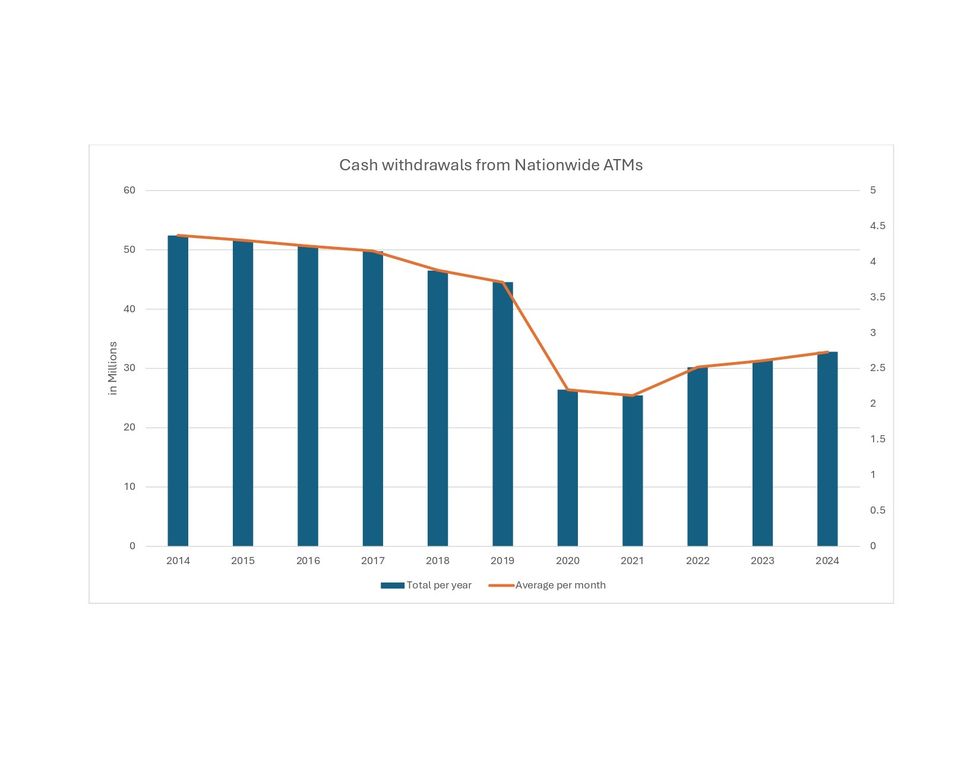

Britain’s biggest building society recorded around 32.8 million cash withdrawals from the 1260 ATMs at its 605 branches last year – a 10per cent increase on 2023. The average amount of cash taken out on each withdrawal from Nationwide ATMs was £112 last year.

“The rising cost of living continues to impact people and many are opting to budget with physical money to avoid getting into debt,” Otto Benz, director of payments at Nationwide Building Society, said.

“Nationwide has the largest branch network in the UK, which allows us to support customers who want access to cash, whether that be from our ATMs or over the counter.”

The busiest time of the year for cash withdrawals was the week before Christmas (w/c 16 December) where £97.9m (up 1.8 per cent on last year) was withdrawn – this is the highest amount dispensed in a week since pre-Covid.

The week leading up to Black Friday (w/c 25 November) saw £85.3m withdrawn – a 12 per cent year on year increase and the second highest weekly dispense since pre-Covid.

Prior to 2022, the number of cash withdrawals at Nationwide had been steadily declining from its 2014 peak. This fall was most pronounced when the pandemic struck, when withdrawals dropped by more than 40 per cent in a year (26.4m in 2020 v 44.5m in 2019).

Nationwide cited bank branch closures as a reason for the rise in ATM usage, which has seen vital free services being removed from high streets up and down the country. This has led to a 16 per cent increase in withdrawals from non-Nationwide customers and a four per cent increase from Nationwide customers looking to access cash, as unlike the major banks, it hasn’t closed significant numbers of branches in recent years.

Nationwide has reaffirmed its commitment to communities by continuing to offer face-to-face service, with its Branch Promise meaning everywhere it has a branch; it will remain until at least 2028.

“The major banks have closed branches in towns and cities across the country taking away many of the free ATMs that people rely on, which is why the biggest rise in withdrawals comes from non-Nationwide customers,” Benz said.

“The resurgence of cash shows why we need to continue having a physical presence on the high street, enabling customers to access their money on their terms, whether digitally or in branch.”

The biggest increase in cash withdrawals were recorded in Chiswick, West London (up 140%), Shotton, Flintshire (up 115%) and Fakenham, Norfolk (up 96%). However, many areas where Nationwide is now the last branch in town have also seen sizable increases, including Henley-on-Thames, Oxfordshire (95%), Cupar, Fife (66%) and Bromborough, Merseyside (61%). See notes to editor for top ten biggest increases2.

The rise in multi-use ATMs mean that cash withdrawals are only part of the picture. Nearly half (43%) of all transactions are for other services – from printing mini-statements and paying bills and changing PINs to paying in cash and cheques.

When it comes to depositing cash, over the last five years (2020-2024) Nationwide has seen a 21 per cent increase in the number of times its ATMs are used to deposit cash into accounts with the average amount deposited rising to £278 – 0.5% per cent increase on five years ago. However, the amount of cash being deposited is down 4 per cent compared to the peak seen in 2022.