The UK is known for its dark and gloomy weather, so a shining sun and warmer climate are always welcome. And Brits definitely know how to throw a good welcome. As temperatures climb and the sun makes its late but welcome appearance, summer sparks such a nationwide thirst-quenching frenzy that it takes everyone in its stride.

The soft drinks category alone is worth £3.3 billion annually to convenience retailers, presenting a gigantic opportunity. This is especially true during the summer months, when more customers are seeking on-the-go thirst quenchers from their nearby local shop.

Clearly, the sunshine and the warmth not only uplift everyone’s mood but they also unlock huge sales. And in a summer such as this one with full of celebratory and much-awaited sporting events (EURO, Olympics and Wimbledon), we expect our shoppers to be socialising even more with their favorite drink in hand.

With almost every household buying some or the other soft drinks, this segment particularly is a huge driver for c-stores both in terms of sales as well as footfall.

According to Mark Langohr, category controller – Plan for Profit, at buying group Unitas, 99 per cent of households within the UK consistently purchase soft drinks. The category is also the leading driver of footfall within symbols & independents, responsible for roughly a third.

“70 per cent of all sales are single-serve drinks, which is growing faster than multipacks. Meanwhile, sports and energy is worth more than £800m and accounts for one in two single serve drinks sold,” he said.

With 75 per cent of shoppers picking up soft drinks each week, the category also holds immense importance for local stores. By ensuring a well-stocked selection, retailers are not just meeting a demand – they’re also becoming a reliable go-to hub for customers.

Summers also resonate with barbecues which in turn means lots of drinking occasions with beer, wine and cider. With each warmer day, beers, ciders and wines go flying off the shelves as people stock to keep their personal bar full and also for those barbecues, picnics and home gatherings.

Alexander Wilson, category and commercial strategy director at HEINEKEN, explains, “Between the months of June and August, 28 per cent of year-round beer sales occur during this period, and when experiencing a particularly sunny week with warm weather, sales can reach to a point that is only second to Christmas trading periods. In 2023, this happened in June where sales peaked at £153m, whereas in 2022, we saw a week in June, July and August where sales reached £160m .”

HEINEKEN has an unrivalled beer and cider portfolio that reaches the widest range of shoppers, with “33 per cent of households in the UK buying a HEINEKEN product, with all competitors lower than 30 per cent”. Therefore, the appeal of HEINEKEN brands is unsurpassed, and retailers should stock up well in advance to ensure they are fully stocked ahead of the summer trading period.

While the usual beer, wine and spirits see a boost-up sales during warmer months, the new breed of drinks like Ready-to-drinks (RTDs) as well as low and no alcohol are also enjoying a huge demand lately.

Clark McIlroy, Managing Director, Red Star Brands which distributes Four Loko in the GB market, tells Asian Trader, “The thirst for RTDs is booming – not least since lockdown which was perhaps the original incentive for consumers to be more ‘drinks creative’ at home, but mainly because consumers are now recognising the benefits of having flavour innovation, convenience and accessibility all wrapped up in a can at their fingertips.”

Soft Drinks, Strong Sales

Summertime is soft drinks and juices time. And the best and the shortest way to be prepared is by stocking the obvious bestsellers.

Amy Burgess, Senior Trade Communications Manager at Coca-Cola Europacific Partners (CCEP), recommends retailers to stock up on sharing packs of popular soft drinks such as Coca-ColaTM. Other soft drinks to stock up on include Fanta and Dr Pepper, the number one and number two flavoured carbonates brands and Schweppes is the biggest mixer by volume in Great Britain.

Retailers should also stock RTD chilled coffee ranges as this segment is growing ahead of total soft drinks in both volume and value and is now worth more than other segments in retail, including mixers.

Burgess tells Asian Trader, “At the beginning of the year, we launched PMP versions of the Costa Coffee Latte and Caramel Latte RTD ranges, offering a unique selling point exclusive to convenience retailers to help enhance their competitive edge when it comes to the RTD chilled coffee segment.”

This summer, CCEP has launched a new on-pack promotion across its Costa Coffee RTD chilled coffee range, giving consumers the chance to win tickets to some of the UK’s biggest music festivals, including Cornwall’s own surf and music festival, Boardmasters - which Costa Coffee is partnering with for 2024.

Energy drinks is another great section seeing promising growth. This segment accounts for a third of soft drinks sales value in convenience. Interestingly, more than half of energy drinks are sold through the convenience channel.

Earlier this year, CCEP unveiled Monster Juiced Bad Apple to bring a unique apple-flavoured variant to the energy drinks category, as well as Monster Reserve Orange Dreamsicle.

Although shoppers are feeling the effects of inflation within the wider grocery market, soft drinks remain in strong growth within independents and symbols stores, especially sports and energy drinks.

A Red Bull spokesperson says, “We saw shoppers making more trips out-of-home to buy Soft Drinks last year, with trip frequency +7 per cent and as a result Soft Drinks remains in strong growth within Independents and Symbols stores, adding an additional +£213 million vs last year. Sports and energy has been a key part of this, accounting for 68 per cent of all growth and adding +£144 million to the category.

“In addition to more trips, we’ve seen an increase in shoppers buying Energy Drinks through Independents and Symbols. Last year, 3 million shoppers purchased an energy drink in the channel (+25 per cent vs last year), making it a key category to focus on in 2024.”

Thanks to ongoing innovation within the category, particularly around flavours, a large part of this growth has come from an influx of new shoppers.

“Sports and energy has been the fastest growing category of the last 12 months, adding an additional +£411m to soft drinks and contributing 47 per cent of all category value growth. In Symbols and Independent stores, sports and energy is already leading soft drink category, accounting for 40 per cent of all value sales and growing share (+3pts vs last year).

“We’re also seeing this trend play out within the wider market, and in the last year there were weeks where sports and energy over-took Colas as the leading category in value share within the total market. Within this, Energy has been a key player, now accounting for 19% of all Soft Drink and growth is showing no signs of slowing, so we expect this trend to continue throughout the summer,” the Red Bull spokesperson tells Asian Trader.

Innovation has been vital to the success of Energy Drinks growth this year, with particular engagement around new flavours, which has helped broaden the category’s appeal to new groups of shoppers, where taste was previously a barrier.

Speaking about sports and energy drinks, Lucozade is another name to bank upon as it is known as a brand that consumers love. Lucozade has helped to lead the energy drinks segment as a trusted brand consumers know and love, thanks to the continued focus on innovation, packaging and flavours.

Matt Gouldsmith, Channel Director, Wholesale, Suntory Beverage & Food GB&I, tells Asian Trader, “Shoppers are already purchasing more Lucozade drinks per trip, with an uplift of 3.3 per cent, which means retailers should ensure they’re stocked up.

“Sales of Lucozade Sport were again strong in 2023, with the brand climbing in value by 21.2 per cent, continuing the strong performance displayed in the previous year, helped by the launch of Lucozade Sport Zero Sugar in March.

“Lucozade Energy also grew in value last year following the introduction of a new look and taste for the brand’s Original and Orange flavours.”

The new enhanced flavours helped the brand drive 8 per cent value and 1.1 per cent volume YOY growth and was the result of 18 months of extensive research and development, and input from 6,500 consumers. The changes also prompted 25 per cent more shoppers to purchase the brand and over half of these (52 per cent) were light or lapsed shoppers, which suggests the drinks’ fresh new pack design and bolder flavour profiles are renewing shopper interest in the brand and driving trial, Gouldsmith adds.

Brits are increasingly seeking on-the-go, quality energy options at everyday value price. Boost Original Energy is another safe name here that enjoys a consistent fan following thus ensures steady sales. The flavour ranges such as Boost Red Berry is also rising in popularity.

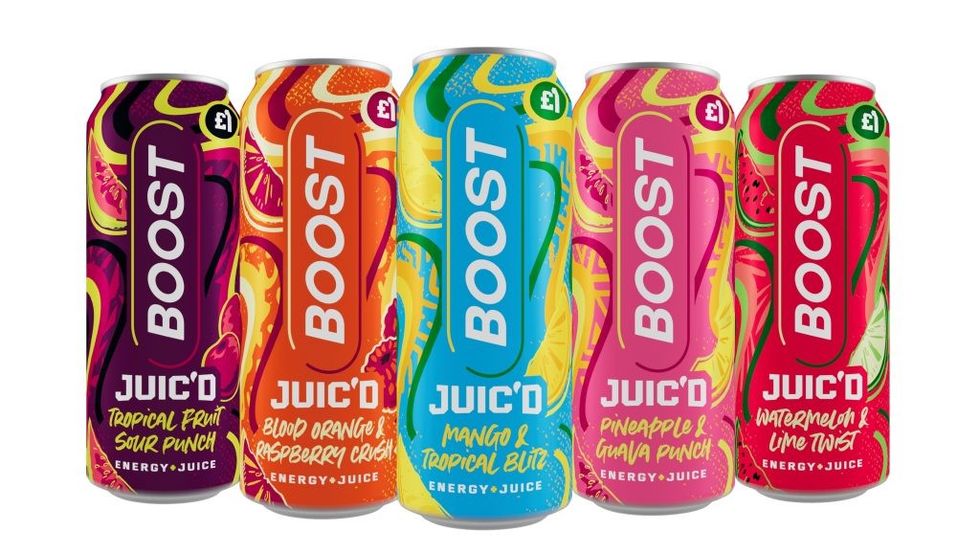

Boost is also present in the largest selling can segment within the energy category with the introduction of its new 500mlJuic'd range.

Adrian Hipkiss, Commercial Director at Boost Drinks, tells Asian Trader, “2023 saw Juic’d as the biggest selling new 500ml Energy drink range, showing there is a particular desire for flavoured variants in the category.

“The impactful, affordable price point of Boost’s Juic’d range, combined with its unique flavour profiles, offer retailers huge profit potential, as 74 per cent of consumers see the range as being something new and different to the category.”

Boost Sport enjoys a strong positioning within the sports drinks category.

Boost Sport is currently among the leading sports drink brands in volume. As consumers are increasingly turning to products that deliver on quality without compromising on price, it’s important for retailers to take into consideration the two main drivers influencing consumer purchase of sports drinks- taste and value.

“It’s essential that retailers stock a sports drink offering that takes the ‘taste’ and ‘value’ drivers into account to effectively maximise sales from impulse shoppers. This also offers retailers a chance to connect with their core audiences, thereby enhancing sales rates to their maximum potential” says Hipkiss.

Making the most of the ever-growing opportunity that Sports Drink category provides, Boost launched a limited-edition Raspberry & Mango variant into their isotonic sport drink range in April 2023. The range was later permanently incorporated the Raspberry & Mango flavor into its core range following the NPD exceeding the forecasted figures by an impressive 170 per cent.

Demand is also on the rise for drinks that incorporate natural ingredients, provenance and nutritional benefits. Rio is a perfect option here.

Hipkiss tells Asian Trader, “Rio offers exciting growth opportunities for retailers; and with a range of products such as Rio Tropical and Rio Tropical Light, there’s a selection of products on offer to suit varying consumer needs, including those looking to make more conscious choices regarding the sugar content of products consumed without compromising on flavour.”

Boost's Iced Coffee is another must-stock item as it comes at an attractive retail price point.

Hipkiss tells Asian Trader, “In recognising this increasing demand for iced coffee, Boost instigated an innovative in-depot fixture within one of Scotland’s largest depot, and Unitas member United Wholesale, which saw leading chilled coffee brands displayed prominently together , driving retailers to iced coffee products and promoting further category growth at +12 per cent. Boost strives to replicate this successful activity with other trusted partners, fuelled by its founding principle ‘The Honest Broker’, which encourages mutual growth through open communication and collaboration.”

Iced beverages continue to be a popular option for consumers as an afternoon pick-me-up or a convenient beverage that travels well when on-the-go. The growing demand for iced coffee now means one in three hot coffee drinkers prefer an iced coffee on a warm day, with RTDs delivering a great, affordable treat that UK shoppers are increasingly looking for. As such, this provides retailers with a great opportunity to draw customers in, especially over the summer months, and in turn maximise sales.

Another interesting and fan-favourite brand when it comes to RTD ice coffee is Starbucks. Its three ranges- Caffe Latte, Caramel Macchiato and Skinny Latte- have boosted Starbucks chilled coffee to emerge as the fastest growing brand in these formats, increasing “138 per cent year on year”.

Large-format Starbucks Multiserve chilled coffee range was recently expanded to include Starbucks Multiserve Skinny Latte chilled coffee, tapping the consumer trend for less sugar in favourite products which in turn inspired the launch of the Starbucks Doubleshot Espresso No Added Sugar Multipack.

Adam Hacking, head of beverages at Arla, tells Asian Trader, “Typically, Starbucks chilled coffee commands a higher selling price than most soft drinks lines meaning that many independent retailers report particularly strong levels of cash rate of sale. This can of course be enhanced through ensuring prominent shelf placement, with POS placement to capitalise on Starbucks’ huge brand recognition.

“For Starbucks chilled coffee, we respond to consumer consumption habits and harness trends to feed our innovation and attract shopper interest. The last few years of exponential growth in at-home convenience driven by the pandemic is a perfect example of this. In fact, such is its significance, at-home convenience is no longer a trend but a new, permanent, consumption habit and has been the driving force behind Starbucks’ product innovation.

These continual innovations and range increases have led to Starbucks chilled coffee in becoming the fastest growing brand in the multiserve format, increasing 138 per cent year on year.

“In terms of flavours, across the ready-to-drink chilled coffee category, we have seen sweet flavours continue to grow in popularity, with Chocolate and Caramel being the fastest-growing flavours in the past 52 weeks. Caramel has grown by 30 per cent and Chocolate (and Mocha) products have grown nearly 70 per cent,” Hacking adds.

Apart from chilled classics, retailers should also keep Starbucks’ Frappuccino range and Plant Based Chilled Classics.

Hacking says, “Chilled coffee is the largest value segment of dairy drinks and should therefore be offered a prominent position on shelf, with dedicated space offered to recognisable brands that offer high rate of sale.”

Tipsy Cool Bubbles

Summers are the time to relax and summer and beer go hand in hand.

In fact, beer is having a good year in convenience, up in both value and volume. Contributing to that growth, craft beer is up +25.6 per cent in value, continuing to drive premiumisation into the category.

Black Heart Stout has contributed to a reinvigoration of the stout category, which is now worth £149m and growing 18.3 per cent in value. In just over a year, Black Heart has achieved a 5.4 per cent share of total stout to a value of £8.7m, introducing incremental shoppers to the category by helping to appeal to a younger more affluent consumer.

As an initial offering, we recommend starting with BrewDog’s top two products- Punk IPA and Hazy Jane New England IPA. As the number one craft beer brand in Scottish convenience, Punk IPA can also act as a signpost for the category. If introducing craft beer for the first time, BrewDog 330mleight-can mixed packs is an important recruitment tool.

When choosing which beers to stock, Guinness is another iconic stout brand to include in the list.

Lauren Priestley, Head of Category Development Off Trade at Diageo GB, tells Asian Trader, “Retailers that prioritise their Guinness stock will be able to tap into a popular and trusted brand but also a brand that offers a range of formats to suit a range of customers.”

As at-home hosting gains prominence, white spirits such as vodka and gin are key players in creating both signature cocktails and classic mixed serves.

Priestley states, “Ensuring a good range of popular brands are available on shelf, such as Gordon’s, provides shoppers with reassurance that they’re able to rely on the retailer for their favourite products and for high-quality drinks.”

Iconic vodka brands such as Smirnoff, are also a must-stock. The portfolio includes Smirnoff Raspberry Crush, Smirnoff Mango & Passionfruit Twist, Smirnoff Berry Burst, as well as its latest expression, Smirnoff Spicy Tamarind. Stocking a good selection of flavoured spirits enables customers to experiment with different flavour profiles to create high-quality serves that are easy to make at home.

Super-premium brands like Cîroc have a wide portfolio of popular flavours, with eyecatching, vibrant bottles that help the range stand out on the shelf. Cîroc’s new limited-edition flavour innovation, Cîroc Limonata, is the perfect product for summer.

Prisetley recommends retailers to get active on social media to promote their drinks range.

“Diageo has recently transformed their Diageo One platform to now include a wider range of assets for retailers to use to help promote their drinks ranges and venues all-year-round. Those who sign up will be able to order POS material, get exclusive access to expert guidance on marketing, as well as download social media assets to use on their own pages to promote their range,” Prisetley tells Asian Trader.

Not to be overlooked here is Pimm’s, an iconic symbol of the British summer for decades, and an integral part of British sporting summer since the 1950’s. It is available in both the iconic Pimm’s No.1 Cup 70cl bottle as well as its Pimm’s No.1 250ml RTD premix format mixed with lemonade.

Summer time is cider time too. In fact, in terms of cider-drinking occasions, some of the biggest days for cider are linked to sporting occasions. With the Euros and Olympics both taking place this summer, we anticipate a significant uplift in their sales.

Sally McKinnon, Head of Marketing at Westons Cider, explains, “Last summer showed us that cider undoubtedly steals share when the temperature rises, so it’s essential retailers stock up on bestsellers this time of year.

“While total cider continues to grow, the crafted sector is outpacing the market. And, having added £34m to the category in the previous 12 months, this is where retailers should focus their range.”

Premiumisation continues to be a key trend for cider drinkers as shoppers seek out brands that echo quality, and it’s the crafted apple brands that are delivering on this through heritage and provenance.

With the sun expected to shine brightly for next couple of months, wine is also expected to flow.

Managing Director of SW Wines Europe, Dan Harwood, forecasts that Pinot Noir and Merlot will boom over summer of 2024.

“Rosé is the drink we all know and associate with that summer drinking moment, but people shouldn’t neglect their reds. To keep things exciting, brands should focus on their ‘fruit-forward wines’ when it comes to promotion over the summertime.

“We know the flavours of a red pair really well with meats such as lamb and beef - and that shouldn’t be limited to Autumn/Winter. A chilled bottle of your favourite red varietal, such as the Eisberg Signature Merlot or Cabernet Sauvignon, is the perfect addition to that BBQ moment,” Harwood tells Asian Trader.

Moderation is a trend that’s growing not just in the alcohol industry, but across all sectors.

Harwood adds, “As more consumers move towards drinking less - they look at wine as a ‘treat purchase’ and are happier to spend more on a bottle of wine they’ll really enjoy.

“If you pride yourself on having an extensive range of wine available, you should have more than one alcohol-free option on shelf. Affordable options, like our newly relaunched Signature range, are perfect for convenience. To get more people to try alcohol-free, it needs to be easily accessible.”

With an RRP of £4.00 at most convenience stores, people are willing to pick up a bottle of Eisberg Signature to try something new. Then, once they get converted, they usually opt for more sophisticated choices like Eisberg Selection.

The obvious challenge through 2024 will be the on-going rising cost of living. As a result of broader economic turbulence, shoppers are watching every penny.

Tom Smith, Marketing Director - Europe, at Accolade Wines, agrees here, saying that Accolade,is committed to offer a portfolio of market-leading, quality brands as well as affordability.

If there was ever a time for retailers to give more space and turn their attention to boxed wine, it’s now – they offer great quality credentials but also more value for money to shoppers, whilst helping to reduce glass costs and environmental considerations.

Smith adds, “At Accolade Wines, we are focused on transforming consumer perceptions around the quality of boxed wines and introducing new shoppers to the category. Most recently, we introduced Jam Shed, Hardys and Mud House in bag-in-box formats, which offers consumers great value for money, and taps into sharing occasions.”

Stores can keep their alcohol range fresh and intriguing by some new names like Cipriani Bellini which is a blend of Italian Prosecco and fresh white peach puree. Only 5.5 per cent ABV, it is best served chilled and can be sipped elegantly anytime of the day. Plus there is an alcohol-free alternative too- Cipriani Virgin Bellini.

Over the last couple of years, the UK has seen some challenging times. Consumer confidence now has stabilised, but still remains fragile.

Calli O’Brien, Head of Marketing at Aston Manor Cider, agrees here saying that Aston Manor’s ethos is all around affordability.

“Our range provides shoppers with an affordable, great-tasting solution, so they can be assured they are not compromising when needing to spend a little less cash on cider.

"From loved favourites such as Crumpton Oaks Apple Cider, through to branching out from wine into perry with our ‘new look’ Chardolini, consumers are welcoming the opportunity to try something new at home, especially in summer.”

Rise of RTDs

RTDs are in huge demand. Shoppers are being extra experimental in here and the makers also seem ready to serve every wish and fantasy. Clearly, RTD continues to present great opportunities for retailers.

Priestle tells Asian Trader, “Diageo has launched a raft of new RTD innovations, including recently launched Cîroc Passion and Cîroc Summer Citrus RTDs, as well as The Cocktail Collection, a trio of bottled premium cocktails.

Serves available within The Cocktail Collection include Johnnie Walker Old Fashioned cocktail , Tanqueray Negroni cocktail , and Cîroc Cosmopolitan cocktail.

Alcoholic ready-to-drinks (ARTDs) offer a convenient solution for those seeking a hassle-free drink that they can easily enjoy at a festival or summer event, while guaranteeing a perfect serve every time.

Jack Daniel’s and Coca-Cola RTD is a fan favourite, generating nearly £34m worth of sales since it launched in March 2023.

Burgess from CCEP tells Asian Trader, “We have recently updated the packaging design for Jack Daniel’s and Coca-Cola Zero Sugar, to clearly set it apart from the Jack Daniel’s and Coca-Cola Original Taste variant and tap into the opportunity for zero sugar options.

“We have also added to our ARTD portfolio Absolut Vodka & SPRITE which blends the smoothness of premium vodka, Absolut, with the loved lemon-lime soft drink, SPRITE, offering a refreshing serve, perfect for enjoying during this summer's biggest events and festival.”

CCEP has also recently launched the brand’s “Planned for the Unplanned” summer campaign, a digitally-led marketing campaign including PR, social media and influencer activity, to build momentum behind the ARTD variant following its launch earlier this year.

This follows on from its “Endless Summer” on-pack promotion which gave shoppers the chance to win pairs of UEFA EURO 2024 and 2024 Summer Olympic Games tickets.

When it comes to RTD, having a variety of products is the key. Stocking new flavours of brands like White Claw can empower convenience retailers to get one step ahead with innovation before it is widely available in the multiples

Matt Rounding, Sales Director for White Claw, explains the reason behind the rising popularity of the brand, “Young drinkers’ needs have evolved, and traditional alcohol categories are meeting them less and less. They are looking for more flavourful options, they want drinks made with natural ingredients and they want choices that allow them to factor in ‘better for you’ factors in their decision making such as calories and sugar content.”

White Claw has limited-edition summer flavour with watermelon, pineapple and passionfruit in a new pack format. The brand is also coming up with Lemada, a fizzy Vodka lemon available in 250ml cans and two flavours.

“Group RTD products by what they deliver against. Refreshing flavourful products can be grouped together. Classic Premix products like a Gin and Tonic or Whiskey Coke go together and then classic cocktails like passionfruit martinis and margaritas can be grouped together,” Rounding tells Asian Trader.

Newbies to keep

Stocking new launches is the key to keeping the shoppers curious and engaged, thus making them to go beyond their shopping lists.

To keep your clients engaged, Starbucks has launched Protein Drink with Coffee in its RTD range. Launched on June 13, Starbucks’ debut protein drink is a part of its ready-to-drink range (RSP £2.75).

“Offering the delicious flavour you’d expect from the UK’s number one RTD chilled coffee brand, with the added benefit of being a convenient, high-protein beverage, the innovation can be enjoyed on-the-go to support active lifestyles.

“Crafted from a smooth blend of Starbucks Arabica Coffee, with 20g protein per bottle (330ml), creamy low-fat milk, and no added sugar (contains naturally occurring sugars), Starbucks® Protein Drink with Coffee is available in three iconic coffee variations: Caffe Latte, Chocolate Mocha flavour, and smooth Caramel Hazelnut flavour. The high-protein range adds strength to the protein category which has seen exponential growth, increasing in value from £46m in 2021 to £147m in 2024,” says Hacking from Arla.

The high protein content supports daily protein intake, without compromising on taste.

“Starbucks’ consumers are some of protein’s biggest fans – in fact, they buy it 6.1 times per year more frequently than average protein buyersix. Now they can enjoy it with the same great taste as Starbucks’ chilled coffee,” adds Hacking.

By appealing to existing protein drinkers as a trade-up opportunity and by tapping into the penetration opportunity for new shoppers, Starbucks Protein Drink with Coffee is expected to drive growth in the milk-based beverage category.

It is available in three iconic coffee variations- Caffe Latte, Chocolate Mocha flavour, and smooth Caramel Hazelnut flavour.

Another noteworthy new launch here is Starbucks Frappuccino Caramel No Added Sugar.

The line extension taps into consumer demand for greater choice to increase frequency, attract more consumers and enhance Starbucks’ point of difference.

“Reduced sugar innovations have driven 13 per cent year-on-year growth in global food and drink NPDs. The new Starbucks Frappuccino Caramel No Added Sugar will build on this to quench the thirst for lighter enjoyment and fill the Frappuccino gap in the Starbucks range of skinny and no added sugar SKUs,” says Hacking.

Frappuccino saw 11 per cent organic UK growth in 2023, making it the number one most important platform across in-store locations. Caramel meanwhile enjoys the highest rate of sale in multiple grocers, with the flavour variation taking 40 per cent of Frappuccino sales.

Moving on, Lucozade too has recently launched three new drinks - Lucozade Sport Blue Force, Lucozade Energy Blue Burst and Lucozade Alert Blue Rush.

The launch of Blucozade is the first time that all three Lucozade sub-brands have appeared side by side in a single launch, with new drinks across function, flavour and format. This cross-category innovation creates an exciting line up of new drinks across the Lucozade brand, adding a splash of colour to retailers’ chillers and creating real excitement for shoppers.

Innovation has always been vital in the drink's aisle, particularly in energy drinks, with engagement around new flavours.

“Lucozade Energy has moved its 380ml single SKUs to 500ml bottles only, including Lucozade Energy Orange and Original, the Lucozade Energy Apple, Cherry and Caribbean Crush flavours and Lucozade Zero Pink Lemonade. The move also sees the introduction of a price-marked variant, RRP £1.501, available for the first time in 500ml format, offering a bigger bottle1 and better value for Lucozade Energy drinkers,” Gouldsmith tells Asian Trader.

The move to 500ml single bottles from 380ml PMP and existing 380ml standard pack flavours across the range enhances the options for shoppers wanting to choose the right drink for their different consumption occasions by offering them their favourite drink, in a larger on-the-go format. Lucozade Energy 380ml bottles will still be available in multipacks, while 250ml and 330ml cans offer a great entry option for those looking for an on-the-go drink, and 900ml bottles deliver a great “drink later” option. Standard non-PMP single 380ml packs of Orange and Original flavours will still be available across Northern Ireland.

Red Bull is a driving force behind flavours in the market and NPD has been largely incremental, with 45 per cent of shoppers that bought into the flavoured Editions range being new to the brand. Editions have recruited shoppers fast, with 2.8 million buying the brand, growing seven-fold in just two years.

The Red Bull spokesperson says, “This was reinforced last year, by the launch of our most successful NPD yet- The Summer Edition with the taste of Juneberry, which sold 9.4 million 250ml cans, and has now been made permanent in the range as The Blue Edition along with The Red Bull Ruby Edition, which was introduced in September as The Red Bull Winter Edition with the taste of Spiced Pear.

For Red Bull, NPD has been largely incremental with 50 per cent of shoppers that bought into the Edition range being new to the Red Bull brand and 75 per cent of Red Bull Editions value was incremental to total Sports and Energy, so having them alongside their core range is likely to attract incremental shoppers.

Red Bull continues to drive flavour innovation and growth with the launch of its brand-new Summer Edition Curuba Elderflower. Available nationwide, the new Red Bull Summer Edition aims to tap into the ever-growing demand for flavoured energy.

With 85 per cent of shoppers agreeing that they “want to try new and unusual flavours in Energy Drinks”, the new Red Bull Summer Edition Curuba Elderflower offers the perfect taste blend of exotic curuba, rounded off with floral notes of elderflower to excite shoppers and drive trial.

The spokesperson adds, “Boasting a flavour profile that is described as exotic, refreshing, and floral with hints of melon, pineapple and elderflower, the new Red Bull Summer Edition performed well in consumer testing with more than two-thirds of Energy Drink buyers say they would likely purchase a Curuba & Elderflower flavoured Energy Drink.”

The launch of the new Red Bull Summer Edition Curuba Elderflower will be supported with a range of tailored POS to raise awareness in-store across all key touch points.

Another interesting NPD here is Red Bull Pink Edition Sugarfreerange. Sugarfree continues to be a key part of the functional energy category and Red Bull is well placed to deliver this demand, states the spokesperson.

“To ensure it continues to meet this demand across the full range, the brand is now leveraging the Sugarfree need across the flavoured part of its portfolio, with Red Bull Pink Edition delivering the first fully Sugarfree Edition.

“Red Bull Pink Edition Sugarfree is offered in 250ml (£1.55), 355ml (£1.95) and 4 x 250ml (£5) can pack formats and follows the launch of Red Bull Summer Edition Curuba Elderflower, which is already proving popular with shoppers,” the spokesperson says.

Red Bull Sugarfree promises to bring an older and more affluent shopper to the category which is different in profile to the average Energy Drink shopper, so is key to catering to different shopper groups. Having full sugar and Sugarfree options on shelf is important as increasingly shoppers are buying across both.

New in Alcohol

Recognising the growing requirement for lower ABV beer, BrewDog Cold Beer has been recently launched to cater to low ABV beer demand.

BrewDog is further shaking up the beer aisle with a new session IPA.

Lauren Carrol, Chief Marketing Officer at BrewDog PLC, comments, “We are placing significant investment into the launch and anticipate Wingman will become our biggest launch of the year. Our shoppers love to experiment and try new styles, and with its great tasting liquid, quirky new packs and stand-out marketing activity we are sure Wingman will quickly become a fan favourite.”

Wine section too is buzzing with new launches this summer.

Accolade Wines recently debuted a new Pinot Grigio Blush – Cupiolo. Set to disrupt the old-world wine category, Accolade Wines has also launched a brand-new, premium European wine brand Remastered. The range comprises two Italian wines – Sangiovese and a Sicilian Fiano – “remastered” to attract new shoppers to the category, Smith from Accolade Wines tells Asian Trader.

Wine disruptor Jam Shed has also brought two all-new variants to the wine market, combining its unique jammy taste profile with innovative fruity flavours that shoppers are sure to love.

Jam Shed Fruits comes in two exciting new flavours- Rhubarb & Strawberry Smash, and Black Forest Mess.The two new falvours are targeted primarily at younger shoppers, who are looking for a more complex and sophisticated fruit wine.

Additionally, Echo Falls, the UK’s number one flavoured wine brand, launched a fresh, fruity flavour – Watermelon and Kiwi Fruit Fusion.

Smith explains, “With a 9 per cent ABV, the new launch will appeal to a young consumer demographic as it taps into a demand for RTD cocktails and sweet ciders in a bid to lure existing consumers of these popular products towards fruit wines.”

Another new launch that is creating buzz is BeLight from Casillero del Diablo.

Claire Raine, Brands Controller at Concha y Toro UK, tells Asian Trader, “BeLight Sauvignon Blanc and BeLight Rosé are both just 8.5 per cent alcohol and only 65 calories per 125ml glass.

“We are confident that consumer loyalty to Casillero del Diablo will help shoppers to be confident in trying these delicious new wines.”

Elsewhere, Four Loko, a vodka-based higher ABV drink with no caffeine, has recently launched Dark Berry Burst to add into its vibrant range that includes White, Strawberry Lemonade, Tropical, Blue, Fruit Punch, Gold, Sour Blue Razz and Sour Apple (all 8.5% ABV).

Four Loko will also be ramping up the pre-party experience to more than 100,000 festival-goers this summer as part of its sponsorship of three major UK music festivals - Parklife, TRNSMT and Leeds, owing to £1.5m investment in trade and consumer activation by the company.

Moving on, Aston Manor Cider has introduced a new range of Frosty Jack’s pack formats which come in at several different recommended retail price points to help provide shoppers with better value.

Non priced marked options are also available. The price marked packs provide reassurance that shoppers are not being overcharged, further strengthening Frosty Jack’s reputation as the market leader in high strength cider.

Summery Trends

Apart from stocking the bestsellers and NPDs, it is important for retailers to keep abreast of seasonal trends and the general mood.

Like, they should note that consumers are increasingly making healthier and mindful choices.

Therefore, to maximise the soft drinks opportunity, it’s important for retailers to stock a range of options that can appeal to those shoppers who are seeking out healthier drinks. Juice Burst continues to go from strength to strength here, significantly outperforming the market.

Purity Soft Drinks has recently launched Juice Burst’s biggest marketing campaign yet “Punchy To The Core”. The campaign is set to reach over 30 million UK adults and will be seen 174 million times through social and digital activity, nationwide sampling, and disruptive OOH advertising including thousands of bus t-sides and phone kiosk adverts across 21 major UK cities.

Sarah Baldwin, CEO at Purity Soft Drinks, urges retailers to be ready to cater to thirsty shoppers.

“As the weather gets warmer, more shoppers will be looking for soft drinks while on-the-go. Retailers should have their range ready to go in temperature monitored chillers close to the entrance to tap into impulse on-the-go sales.”

“While classic soft drink flavours like orange and apple remain as popular as ever, consumers are increasingly looking to experiment with modern flavour twists, and we see certain flavours boom in popularity throughout the warmer months,” adds Baldwin.

“Our latest flavour, Juice Burst Peach Ice Tea, is another popular choice throughout summer and follows the tea-flavoured juice market growing ahead of the total soft drinks category year on year.”

In the convenience channel, summer is the biggest trading period for beer and cider, with flavoured ciders in particular over-indexing among consumers.

Wilson from HEINEKEN tells Asian Trader, “In impulse, we see a spike in purchasing during the summer, with 70 per cent of sales being of single and small packs, and so convenience retailers ought to focus on these as priority. During football events specifically, we see a rise in mid-pack sales of both cider and beer. To take advantage, retailers can plan ahead of time to ensure they have the right format in store for the right occasion.”

During the summer seasons, there is a big opportunity for retailers to encourage customers to trade up to premium brands, including Birra Moretti and its new Sale di Mare variant. To further encourage trade up, retailers should take advantage of eye-catching, themed PoS materials to increase the chance of impulse purchases.

This also includes clearly displaying the price of items, and advertising any promotions in and around the store, and if possible, through social media.

Speaking about what is trending, Wilson states, “We have seen strong growth in citrus-flavoured cider, especially of orange and lemon flavours, and earlier this year, HEINEKEN UK launched new Strongbow Zest to play into these trends. We are also seeing strong growth in mainstream apple ciders, such as Inch’s, at 14.8 per cent, while in beer, world lager is displaying the biggest growth at 15 per cent.”

Empowering indies this summer

With a slew of sporting events lined up, 2024 summer presents a perfect opportunity for indie retailers to create theatre and cross-category displays in store to engage shoppers.

This summer, Unitas, the UK’s leading independent wholesaler group, is equipping convenience retailers with summer soft drinks category advice from its “Plan for Profit” guide.

Available to download and in print at Unitas member depots, the 16-page guide includes market and shopper trends, ranging advice and planograms.

The guidelines are specifically designed for independent retailers.

The guide also includes ranging recommendations and an overview of the top-10 bestselling products within “Drink Now” and “Take Home” categories, like Red Bull 250ml, Monster Original 500ml, Coca-Cola 500ml, Coca-Cola 330ml, Oasis Summer Fruit 500ml, Dr Pepper 500ml, Lucozade Orange 500ml, Lipton Peach Ice Tea 500ml, Volvic Water 1Ltr and Lucozade Sport Orange 500ml in the former category.

The guide’s “Take Home” category included names like Coca-Cola Original 1.75Ltr, Pepsi Max Cherry 2Ltr, Lucozade Orange 900ml, Highland Spring 1.5Ltr, Volvic Water 1.5Ltr, Schweppes Lemonade 2Ltr, Dr Pepper 2Ltr, Red Bull 4x250ml, Vimto Squash 725ml and Schweppes Slimline Tonic 1Ltr.

Further researches show merchandising food and drink together can double shopper engagement and increase sales by up to 32 per cent, so stocking sharing packs of soft drinks alongside meals and snacks is a great idea.

Baldwin from Purity Soft Drinks also banks on cross-merchandising, advicing retailers to recommend Juice Burst to meal deal and food-to-go customers.

“Almost one-third of soft drink customers in convenience are seeking food to-go, and research shows that merchandising food and drink together can double shopper engagement and increase sales by up to 32 per cent.”

Energy drinks continue to be in demand so that category needs special attention.

Providing a range of sizes to cater to different occasions is the key. Like, we know that 68 per cent of shoppers will only buy one can size of Red Bull Energy Drink and most shoppers already know which can size they want to buy before entering a shop.

Larger can sizes (355ml and 473ml) have been seeing impressive growth across the range, with an additional +16 million cans sold in the last year, the Red Bull spokesperson tells Asian Trader.

Red Bull Sugarfree taps into the growing consumer health trend and sells more units than any other unflavoured Sugarfree functional energy variant.

Now more than ever, price-marked packs play an essential role following the rise of living costs and price conscious customers as they offer retailers a fantastic opportunity to communicate clear and effective value-driven price points with their consumers, while delivering excellent margins.

PMPs enhance the overall customer experience by providing transparency, clarity and reassurance regarding product pricing. Customers appreciate knowing the exact price upfront, which reduces confusion and frustration during the purchasing process.

Speaking about importance of stocking PMPs in c-stores, Hipkiss from Boost says, “Boost is dedicated to fostering transparent and collaborative relationships with wholesalers and retailers, making honest and open communication a cornerstone of its approach. We continuously track changes in the retail landscape and consumer trends to offer guidance across all areas. It's evident that PMPs are an effective strategy for driving repeat purchases and cultivating a loyal customer base.”

Proper displays and fixtures are also crucial to catch the attention of busy shoppers.

With people planning BBQs, picnics and festivals throughout the summer, it’s crucial for retailers to get their fixtures in the alcohol section right to capitalise on seasonal demand and increased footfall ahead of events.

McKinnon from Westons Cider recommends convenience store owners to prioritise fridge facings, while utilising ambient space and stacking for larger packs.

“Cold, single bottles are a summer favourite, so increasing facings of popular ciders like our Henry Westons Vintage 500ml can drive both value and volume sales.

“Single, glass bottles that are adequately chilled and ready to drink are essential to any cider fixture. Simply put, shoppers don’t want to buy lukewarm cider, so if retailers haven’t got the temperature right, they will miss out on sales.

“That said, with floor and fridge space at a premium, there is certainly a role for larger pack formats, such as our Stowford Press 10 Pack – up a staggering +1,256.2 per cent YOY in convenience – especially great ahead of bank holidays and match days when cider sales spike.”

To further drive sales for retailers, Westons Cider is currently running the biggest on-pack promotion in its history across the Henry Westons range.

The on-pack competition is supported by an extensive out-of-home campaign including retailer screens, multiple in-store activations and bespoke branded shippers, estimated to reach more than 11.5 million consumers throughout the coming months.

Just chill

Summers are always fun but this summer is extra special as there are a host of sporting and festival events to look forward to from UEFA EURO 2024, Paris 2024 Olympic Games to Glastonbury.

As the mercury rises, so does the thirst for icy cold refreshment, so does the sales of on-the-go consumption, so does the chances of impulse sales and so does the chances of people trying out new launches.

A good wide dedicated section of summer drinks can be your secret weapon for skyrocketing sales. Stock up on tantalizing iced teas, bestselling as well as new ranges of soft drinks, energy drink, get creative and be innovative to draw in sweltering customers seeking a cool escape. Limited-time offers and irresistible combos make your store the ultimate summer destination.

Eye-catching displays and sizzling promotions during this time can turn casual shoppers into loyal fans.

This summer, the beverage aisle is expected to be the most sought-after spot in the store, with customers eagerly reaching for anything cold to beat the heat. Summer drinks don't just cool you down; they drive sales up, making every sip a boost for business. Stock well and have a happy summer.