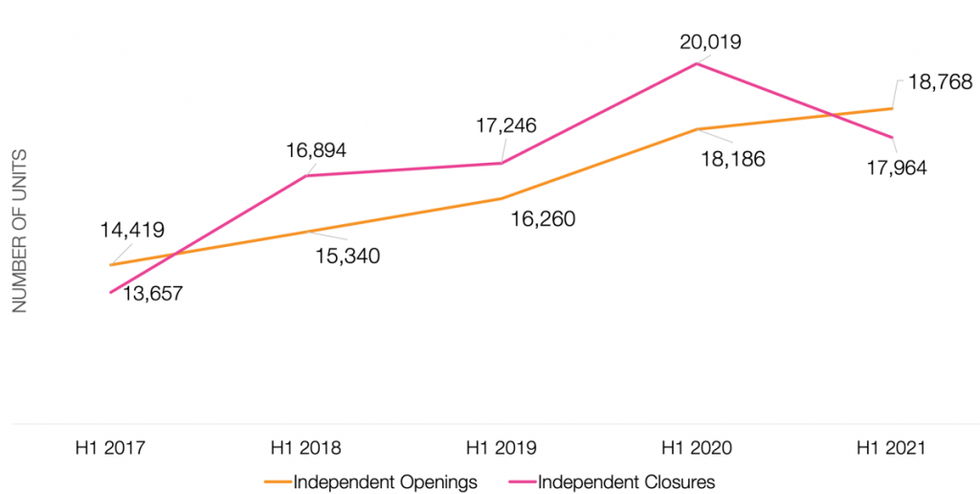

The independent store market has returned to growth in the first six months of 2021 for the first time since H1 2017, as entrepreneurs took advantage of the availability of retail units and increased consumer support for local businesses.

According to the latest figures from the Local Data Company (LDC), there were more openings of independent stores than closures with a net change of +804. Store openings stood at 18,768 and closures at 17,964.

Growth was driven mainly by food retailers, with convenience stores being the top growing category with 323 more net stores. Barbers ((+317) came in second and the top five comprised fast food takeaways (+311), grocers (+208) and takeaway food shops (+184).

The data the independent market stands in stark contrast to the significant loss in units seen across the chain retail landscape, which saw a net loss of 5,251 in the first six months of 2021.

The closure of multiples provided independent retailers access to an increased volume of vacant units, often with attractive deals from landlords including rent-free periods and capital expenditure contributions to encourage take-up of empty units, the report noted.

The data also shows that government support such as furlough, the moratorium on tenant evictions and business rates relief, which has been extended until March 2022 (66% relief from 1 July 2021), is having the desired effect.

“We can attribute this improved performance to a few things; the success of government support schemes which will remain in place until March 2022; the growing appetite for categories such as take away food and convenience stores, boosted by several lockdowns, and a consumer which is increasingly concerned with the provenance of products, sustainability and supporting local businesses,” commented Lucy Stainton, Commercial Director at the Local Data Company.

“Independent operators are also benefitting from the volume of available units, many of which come with attractive deals from a new market of shopping centre landlords who are now looking to the independent sector to fill the significant number of stores being vacated by chains.”