"Peas Please", an initiative led by The Food Foundation with partners Nourish Scotland, Food Sense Wales, Nourish NI and Food NI, has found that the amount of vegetables being bought by households in the UK has fallen to its lowest level in 50 years. The analysis of Defra data, conducted for the 2023 Peas Please Progress report, published today, shows that the cost-of-living crisis continues to impact on diets with the lowest income households struggling to afford healthier options.

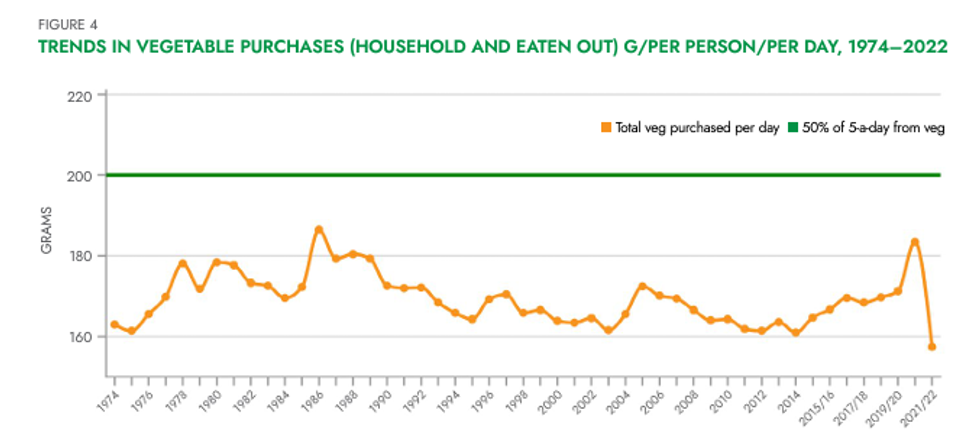

Defra’s Family Food Survey captures purchases of food by UK households from both retail and the Out of Home sector and includes vegetables in composite foods as well as those bought whole. Although vegetable purchases have been fairly stagnant for the past thirty years, purchases of vegetables dropped to their lowest level in fifty years in 2021-2022 (from 182g per person per day in 2020-21 to 154g in 2021-22), suggesting that the cost of living crisis is having a profound impact on household purchasing habits and dietary health.

Source: Adjusted National Food Survey data 1974–2000, Expenditure and Food Survey 2001-2002 to 2007 and Living Costs and Food Survey 2008 onwards, Family Food Survey 2022. Around 5,000 households in the UK are surveyed annually.

To be in line with the Eatwell Guide, the Government’s recommended guideline for a healthy diet, 20 per cent of diets should be made up of vegetables. Separately, The Food Foundation’s analysis of Kantar data provided annually to the programme reveals that not only does the volume share of vegetables purchased from retailers fall far below this, the figure is also moving in the wrong direction. The weight of the average shopping basket that is composed of vegetables has fallen from 7.2 per cent to 6.8 per cent over the past six years.

The proportion of shopping baskets containing veg over the course of the Peas Please programme (Kantar data provided to the Peas Please initiative)

Inequality in vegetable consumption continues to be a serious concern, with veg consumption following a strong income gradient even before the cost of living crisis. The Kantar basket data for the 2022-23 reporting year shows that on average, for those earning less than £10,000 a year, just 5.9 per cent of their shopping basket consisted of veg compared to 8.2 per cent for those earning over £70,000 a year.

Vegetables are the golden thread connecting diets that are both healthier and more sustainable, and there would be huge benefits for our health, the environment, and the UK’s economy if we were all able to hit the recommendations for vegetable consumption.

Transitioning UK diets towards more sustainable and healthy dietary patterns should be firmly on the political and corporate agenda as we get closer to the UN’s 2030 Sustainability Development Goals with vegetables playing an important role in supporting both human and planetary health.

The Peas Please project launched in 2017 with a clear mission to make it easier for everyone in the UK to eat more veg. Since then, 110 organisations, from restaurant chains, caterers and manufacturers to growers and retailers, have committed to veg pledges that support the public to be able to access more veg. Pledges have included everything from boosting the amount of veg contained in ready meals to serving more veg options on children’s menus. The project has led to an additional 1.1 billion additional portions of veg being sold or served.

“The Peas Please programme has shown just how much can be achieved by creating a diverse community of supporters working together to champion food system change – in this case making it easier for everyone to eat more veg," said Rebecca Tobi, Senior Business and Investor Manager, The Food Foundation. Although our report shows that those businesses who have supported the programme have achieved a huge amount – selling an additional 1.1 billion portions of veg – there is still much more that needs to be done for the UK to become a veg eating nation. With some 17 million households living with food poverty, many are likely to be cutting back on healthier foods such as fruit and vegetables given that these are a more expensive source of calories in comparison to other food groups. We urgently need to see businesses stepping up to make eating veg the easy and affordable option, and more support from the Government to ensure that everyone is able to access and afford a healthy diet”