The unstoppable rise of crafted apple cider is setting the benchmark for success in the UK’s £1.1 billion off-trade cider market, according to the latest Westons Cider Report.

The leading cider producer advises that convenience retailers who prioritise premium products and strategic ranging will be best placed to drive sales in 2025.

This trend aligns with the broader Lager, Beer, and Cider category insights featured in Asian Trader’s March 7th issue, which highlighted the importance of premium offerings in driving sales growth.

Despite crafted cider thriving across the broader market, its share in convenience still lags slightly behind (20% vs. 24%). This gap presents an exciting opportunity for convenience retailers to tap into the premium crafted cider trend and unlock significant revenue.

Westons Cider’s milestone report reveals that, while total cider sales have edged up by just 0.1 per cent YOY, crafted cider is experiencing remarkable growth with a significant 14.6 per cent surge in convenience alone.

As consumers increasingly seek authenticity, quality, and heritage, premium crafted ciders are becoming essential for retailers eager to drive long-term success.

A decade of transformation in cider

Westons Cider predicted the rise of crafted cider in 2018 and, seven years on, the numbers prove just how transformative this shift has been. Back then, crafted cider made up just 9 per cent of apple cider sales — today, it accounts for nearly a quarter of the total cider market, adding an impressive £26.3 million to the category in the past year alone.

While the overall cider category has edged forward (+0.1%), crafted cider has surged ahead, growing at ten times (11.1%) the rate of the total market. This unwavering momentum cements crafted cider’s place as the fastest-growing segment in the industry.

This shift reflects a fundamental change in consumer preferences. A decade ago, cider was a broader, more fragmented category, featuring more brands and greater variety. Today, the focus has shifted — fewer brands, stronger premium offerings, and an emphasis on quality over quantity.

Crafted cider: A major untapped opportunity in convenience

Despite commanding a premium price of £4.32 per litre in convenience, compared to £2.76 for the total category, crafted cider remains underrepresented in this channel, with distribution at 95.4 per cent compared to 98.4 per cent across the total market. Bridging this gap could unlock an impressive £3.7m in value sales.

Even with limited shelf space, crafted cider continues to show a solid 5.8 per cent YOY growth, highlighting a strong and growing consumer appetite for high-quality options.

“Shoppers are looking for premium cider options in convenience, and retailers who give crafted cider the prominence it deserves will reap the rewards,” said Tim Williams, insight and innovation manager at Westons Cider.

“With crafted cider delivering strong margins and demonstrating double-digit growth, giving it prime position in chillers and on shelves will drive greater profits. The demand is already there – retailers just need to back the right brands.”

Key growth opportunities for 2025

The opportunity to recruit younger drinkers is ripe for the taking. While cider remains a household staple, penetration has slipped to 40.9 per cent, down from 43.9 per cent in 2022, showing that the category must evolve to stay relevant.

However, younger shoppers, particularly those under 45, are actively trading up to premium drinks, making crafted cider an aspirational yet accessible choice. Crafted cider is already gaining traction with affluent consumers, with ABC1 shoppers now accounting for 65.8 per cent of spend — up from 61 per cent last year.

Notably, crafted cider has the highest proportion of younger shoppers, with under-45s making up a larger share of spend compared to any other cider segment. This clear shift towards quality and authenticity presents a huge opportunity for convenience retailers to refresh their cider range and attract a new wave of consumers.

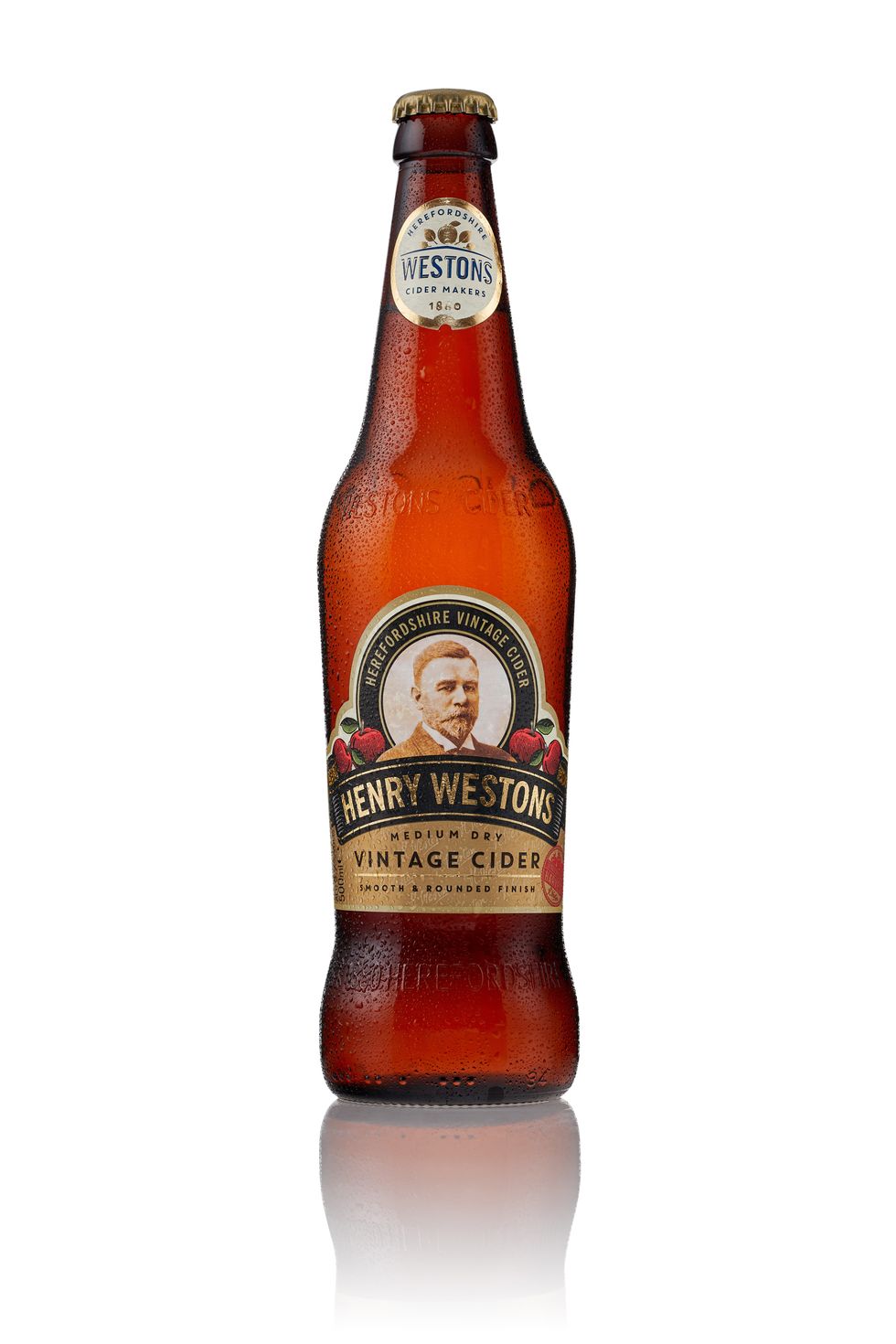

Apple cider remains the core of the category. Accounting for nearly two-thirds (63.7%) of market value, apple cider continues to dominate. While pear cider’s overall share remains small at 4 per cent, premium crafted pear ciders are seeing renewed interest. Henry Westons Vintage Pear has added £550,000 in sales over the last year, alongside growth in other premium pear offerings. This suggests a clear opportunity for retailers to premiumise the pear cider segment, tapping into the same consumer demand that has propelled crafted apple ciders to success.

With limited chiller space in convenience, ensuring crafted apple cider has adequate facings is crucial to maximising sales. Stocking the right mix of single-serve formats for impulse purchases and larger multipacks for planned consumption will help capitalise on both shopper missions.

Shoppers are trading up across the drinks aisle, and cider is no exception. The crafted cider segment’s growth of over 10 per cent highlights the increasing willingness of consumers to pay more for quality, taste, and heritage. Convenience retailers who prioritise premium SKUs stand to gain the most from this trend.

Convenience category spotlights:

- Crafted cider’s Southern stronghold: Crafted cider is particularly strong in the South, accounting for 73 per cent of volume in the five most southern TV regions. Convenience retailers in these areas should allocate more shelf space to premium crafted options to maximise sales.

- British weather may be unpredictable, but cider sales don’t have to be: While summer remains cider’s peak season, unpredictable British weather has led to inconsistent sales patterns in recent years. June 2024 was unseasonably cool, leading to a 20.5 per cent drop in cider volume sales YOY, while August saw more rainfall than previous years, pushing volume down 12.5 per cent versus 2022. However, sales rebounded slightly compared to August 2023, which had particularly poor weather. Given this volatility, retailers should double down on major selling moments — like bank holidays and sporting events — where demand remains strong regardless of weather conditions.

- No & low is pouring into the mainstream: The segment has grown 8.4 per cent YOY, highlighting increasing moderation trends. Stocking low/no alcohol apple and fruit ciders ensures a complete range to meet evolving consumer needs.

- Independent retailers are outperforming the market: While total convenience cider value is up 2.1 per cent YOY, independent retailers are growing even faster, at 4.4 per cent YOY. This shows a particularly strong opportunity for crafted cider, which still holds only 17 per cent share in independents versus 20 per cent across total convenience. There is clear potential for independent retailers to expand their crafted cider offering and close this gap.

“As Westons celebrates 145 years of cider-making, it’s remarkable to reflect on how much the category has evolved,” Darryl Hinksman, head of business development at Westons Cider, said.

“What’s also clear is that authenticity and provenance matter more than ever. The past decade has seen major brewers attempt to capitalise on cider’s popularity with brand extensions, yet these failed to resonate with consumers in the long term. This reinforces a key lesson — shoppers are looking for genuine cider brands with real heritage, not just big names entering the category.

“Looking ahead to the next decade, we expect this refinement to continue, with cider becoming even more premium-driven. Shoppers are actively seeking authentic, high-quality options, and convenience retailers who align their ranges with these consumer trends and prioritise best-selling premium ciders, like Henry Westons and Stowford Press, will be the ones to unlock growth and maximise their cider sales.”

Henry Westons Vintage 500ml is the number one SKU in the convenience channel, more than twice the size of the second-placed product and in strong growth (+8.2%). Thatchers Gold 500mlx4 was ranked eighth last year and has risen to second. Inch’s is new to the top ten this year in eighth place.

Pack sizes are smaller in this channel with singles and four packs dominating the top ten. Larger packs have a role, however, as Strongbow Dark Fruit 10 pack is the third highest ranked pack.

The full report – including impartial stocking advice for retailers – is also available for digital download here.

All data Westons Cider Report 2025, Circana 52 w/e 28 December 2024 and Kantar, 24 December 2024.