The convergence of cheap capital, fast internet and national lockdown supercharged what had been until then a mostly supermarket-centred grocery delivery market (Ocado the major mover). Very quickly a hundred different delivery flowers bloomed – many of which are wilting now that costs have gone up and people have gone back to work.

During Covid, the streets might have been largely empty of cars, but they buzzed with thousands of mopeds with big square branded pillion boxes, as delivery freelancers working for Gorillas, Deliveroo, Getir and many others, zoomed around delivering bread, milk or chewing gum, curries, MacDonalds meals and loo roll (if you could get hold of it).

Convenience stores and their customers were welcome to use these services – either apps or platforms such as Just Eat – but there was a whopping fee to pay to the company, and on top of that a charge for the delivery itself. Unsurprisingly, the delivery outfits worked best with higher value orders – such as restaurant takeaway meals – but at the same time, lockdown retailers began to see the advantages of bringing back delivery for their businesses.

Halo effect

First, it was probably the need to build and deepen community relations, especially to the benefit of the old and infirm who could not leave their homes during the pandemic. But the way it was done was often ad hoc, with individual retailers and stores arranging their own delivery methods and schedules, and doing it themselves or using their own staff.

Soon, it became clear not only that the service was adding to trust and reputation regarding the convenience channel, but also that there was a “halo effect”: customers who had never set foot in a particular store would happily order from it groceries to be delivered, extending the consumer catchment area often by several hundred per cent – say, from a one mile- to a three-mile radius.

Indeed, leading c-store platform Snappy Shopper reported that roughly 80 percent of their customers using the app were acquired through the platform and would never have visited their physical store. Alongside this, customers are more likely to spend more money when using the app, as retailers report a £26 average basket spend, compared to only £10 in-store – an increase of a remarkable +160 per cent.

Now, the moped-led multiple services, which were over-saturating the grocery delivery market as it mushroomed under lockdown – are in a death struggle, with many being bought up by bigger competitors, or simply closing down operations in various territories.

Some survivors are specialising in delivering meals from so-called dark kitchens, providing tangential competition for the food-to-go services of c-stores; but others (Getir, Weezy) are starting to operate grocery delivery operations, similar to the Ocado depot model, but on a smaller more local scale from their own dark warehouses, representing a much more threatening challenge to local retail stores.

Lumina says that food to go and promotions are key to delivered meal occasions for convenience. Delivered meal occasions remained stable in the 52-week period ending on 11 December 2022 compared to the previous year as shoppers continue to trade down from out of home occasions to manage spend. The report shows that the choice of food to go, fresh produce, and promotions are all more important for delivered meal occasions compared to in-store. Offering promotions on a range of ready meals is one way to win.

Clearly the delivery category is in a period of intense change and development, with battle lines drawn between the retailers of the grocery sector and the pure-play delivery companies who do not operate retail premises. The supermarkets continue to operate delivery as a loss-leader, but there is evidence that the rewards to a business from delivery are inversely proportional to size: for grocery delivery, “small is beautiful”, because it can add revenue to c-stores, whereas it eats into revenue for larger chains forced to operate a massive delivery organisation.

Apps such as Beelivery (which travels from c-stores to consumers) is one example of a service that could prove profitable for retailers. “Forget waiting weeks for a delivery slot from your favourite supermarket,” it tells shoppers. “Beelivery are able to drop off all your essentials within 45-90 minutes thanks to its team of local riders. Options differ depending on where you’relocated as the drivers pick up from local shops, but the range is impressive. Fruit, veg, dairy, meat and pantry are all covered as well as less essential items like fizzy drinks and sweet treats as well as a few toiletries. It’s a real one stop shop.”

Very appy

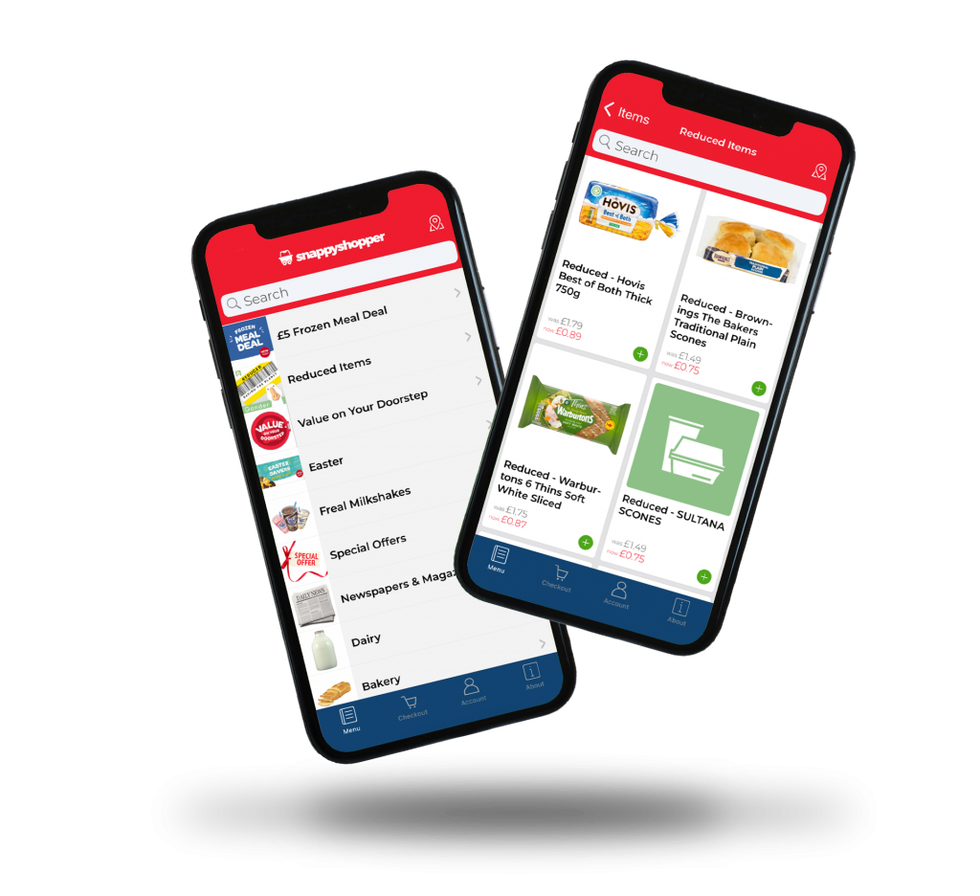

The big contender, though, must remain Snappy Shopper – an app but also a platform – which started in Scotland and accelerated during lockdown, and which is now spreading throughout the UK – unlike many niche or bespoke delivery apps (Farmdrop, Hey Delivery) that need to be in London or a few other large conurbations to make any kind of economic sense.

"Home delivery is an essential part of the future success of convenience stores, enabling them to widen their community network and future-proof their business against the competition," explains Snappy’s Dael Links.

“Retailers have reached a crossroads; they need to diversify their delivery options and invest in the right technology to meet the ongoing needs of their consumers, or they will struggle to compete. As working from home has become the norm for more people, their appetite for convenient and fast deliveries that fit their at-home lifestyle has increased.”

The Snappy Shopper app cuts out the fees from the delivery firms by leaving the last-mile method up to the creativity of the retailer. What it does is match convenience of purchase with price and locality, giving c-stores delivery “four-wheel drive” effects.

“Consumers value convenience more than anything, they still want easy at home delivery despite the current cost-of-living crisis," says Dael. “However, customers are looking for value when they shop, so it is important that prices are competitive. Snappy Shopper never inflate the shelf price, so online prices are the same as in-store, meaning customers can order with no extra costs. Snappy Shopper is the only marketplace with on-the-shelf price that isn’t commission-heavy on retailers.”

The platform is developing all the while, and porting those developments over to the Snappy app. For example, it recently became the first delivery app to allow “reduced to clear” functionality, which will encourage customers to order who previously would only have the option to visit in-store to find marked-down bargains. Partners have complete control over their product list and pricing on the app, with the ability to manage orders and connect with delivery drivers with ease.

The Snappy app enables retailers to drive sales and engage with new customers, whilst also continuing to encourage communities to shop with their local retailers. Vitally, our According to our retailer network, around 80% of their customers who use the Snappy Shopper app were acquired through the platform and would never have visited their physical store. Alongside this, customers are more likely to spend more money when using the app as retailers report a £26 average basket spend, compared to only £10 in-store - that’s a significant increase of +160%.

One Stop, meanwhile, has integrated with Deliverect’s software, which they believe is a real “game changer" as it allows One Stop to integrate all three of their delivery platform partners (Uber Eats, Just Eat and Deliveroo) on one centralised system.

This has provided One Stop with many efficiencies and increased online accuracy across many metrics, enabling them to more than double their online SKU count to around 3000. Deliverect has now rolled out to more than 600 of their company