A convenience store in Telford is rewriting its own definition. It’s a community hub where elderly locals gather to chat, youngsters come for guidance and support while financially struggling parents bring their kids to meet Santa. Not only that, it’s also the go-to place for leading suppliers when they want to create ripples in the market.

Premier Jules Convenience in Hadley, Telford does it all, apart from serving daily supplies with a side of warm banter. The store has been standing in the community since 1982. Under the vision of award-winning retailers, Julie Kaur Duhra and her husband Joey Duhra, the store has always been rising like a phoenix, thus managing to stay well ahead with the changing times.

During a detailed conversation with Asian Trader, Julie revealed all about the journey of Premier Jules Convenience, its strength and uniqueness along with her own evolution as a business and community person.

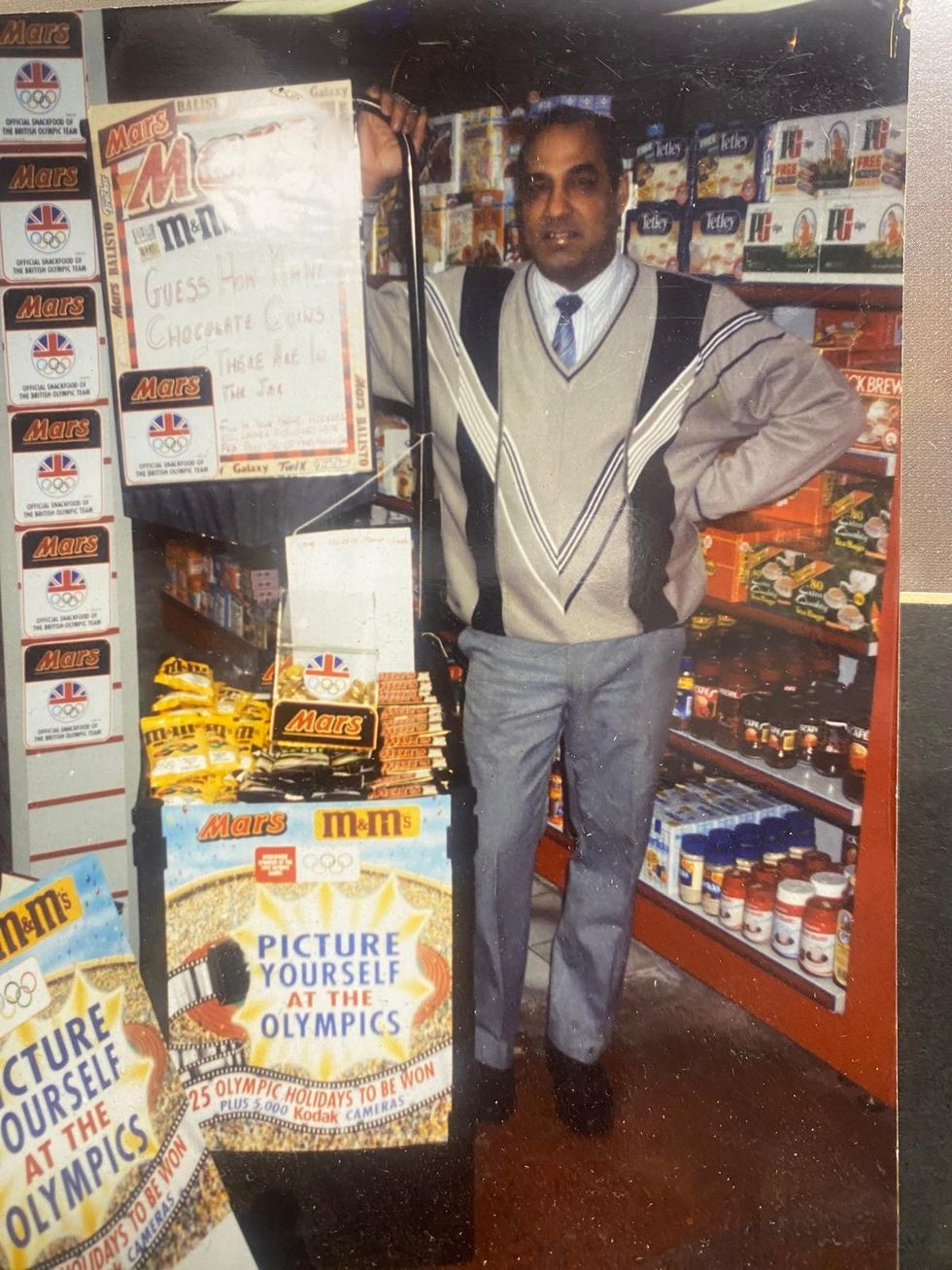

Julie said, “This store was bought by my father in law Harbhajan Singh in 1982 and was running as Duhra supermarket by him and extended family. When we got married, my husband’s uncles moved into their own store, and we stayed with the original one.

“At the time, it was just a convenience store with basic groceries. In 1991, we undertook a massive refit and a year later, bought a shop next door and sublet it.”

By 2005, when the store completely came into the hands of Julie and Joey, they got an alcohol license, giving the store a new lease of life. Around the same time, the store also came under Premier symbol group, (a decision which Julie likes to call today as a “game changer”), giving way to Premier Jules Convenience.

Around 2013, the store faced another setback when a Tesco Express opened half a mile away, stealing its footfall. This is when the couple came up with another master plan to salvage the situation by expanding the store and widening its range.

She said, “Around this time, the shop that was next door that we had sublet was merged with our store. Very soon, we got the National Lottery in which boosted our footfall.

“We also had a very broken road outside the store which had potholes and that needed upgrading. In 2012, we upgraded our outsides which gave us 15-car parking spaces, which once again helped with the footfall and elevated the store at par or at even better standards as compared to other stores in wider neighborhood.”

The following years saw rapid growth of Premier Jules Convenience both in sales and stature. Being an epitome of family-run British corner shop, the store did not have any paid employees and was run completely by Julie and her family for a long time.

“My children worked with us. It was just five of us who have been running the store for 15 years. It was only last year we started employing staff,” she said.

Today, the store employs four people, though Julie and Joey remain as hands-on as ever.

Being close to the community, Premier Jules Convenience is well-tuned with its customer base, their needs and preferences.

She said, “We as a family have been serving the community for three generations. We keep everything from everyday newspapers, greeting cards, pet food, soft drinks, confectionery, snacks, household cleaning items, usual grocery items and much more.

“We are in close touch with shoppers and try to bring in everything that our customers ask for. Like, we get lots of young customers who are on Tik Tok more than we are and they wanted dried sweets and American sweets. We listened to them, procured what they asked for and now those lines are now selling really well.

Having a Premier brand on the storefront helped the business a lot.

Julie explained, “Since the stock is Premier branded, we haven't got to do a lot of work behind the scenes. We have leaflets that go out once a month; we've got promotions happening in store. So Bookers has been very good providing us with the service. Their Retail Development Managers are also very prompt on visits.

“We just started using Booker delivery and that has been a really huge help and saves a lot of our time,” she said.

"We are also in charge of parcels and that also brings us lots of footfall,” she added.

For her next addition, Julie is planning to start offering hot foods in the food to go section.

Beyond business

Apart from her thoughtful approach and risk-taking skills, Julie has managed to master another skill and that is having good and fruitful relations with leading suppliers, something which has perks of its own.

Over the years, Julie has built strong relationships with leading suppliers and even sits at roundtables with Mondelez, Suntory, JTI, and Coca-Cola, something which not only keeps her abreast of trends but has also made Premier Jules Convenience a perfect launching pad.

Advising the fellow retailers to “talk to suppliers; they don’t bite”, Julie revealed how suppliers’ approach towards convenience channel has changed massively after Covid-19.

She stated, “I always had a good relationship with them, but since Covid-19, I feel that suppliers appreciate what the independent retailers did for the local communities and saw our reach too. I feel they've got more respect for us as well and they are eager to work with us.”

Over the years, the couple has evolved and elevated their humble neighbourhood convenience store into a one-stop community pillar and society hub of Telford.

During Covid-19, Julie and her family “hands on” helped the community and extended its active support to the local council as well.

“We took special care for the elderly. We used to go round every day to make sure no one is left underserved. Our store was always open despite the fear and panic of the disease,” she said.

No wonder that Julie was the first winner of Raj Aggarwal trophy as well as Spirit of the Community Award winner at the 2021 Asian Trader Awards.

Despite multiple features and attractions, Premier Jules Convenience’s most unique selling point, which is also its strength, is its deep-rooted connection with the community.

“It’s a place where everybody knows everybody. My staff and I know almost two-thirds of our shopper base by first name. We use our store window to make community announcements and keep the community buzzing with various activities,” Julie said.

Currently, Premier Jules Convenience hosts Breakfast Club for the elderly where they are given free tea, coffee and a breakfast bite. The store also hosts a sponsored Santa’s grotto, an idea that came to Julie during the peak of cost-of-living crisis when she saw several parents struggling to afford Christmas gifts for their children.

She said, "Our Christmas event has only got bigger each year. We started with 80 children, last year we had 120 and this year, we are going to giveaway gifts to about 150 local children along with an Amazon voucher each.”

Adding the suppliers have been very generous and enthusiastic about such events, Julie said that this year, the store will provide gifts through the help from a bunch of leading suppliers like Bookers, CCEP and Mondelez along with JTI.

Revealing more about the store’s involvement in people’s lives, she added, “If someone needs character references, we write them one. If they need some work experience, we provide it. If they need a Stop Gap 3-weeks voluntary work they want to do for the Duke of Edinburgh board, we facilitate that. We now work closely with the local college where we provide internship and training to youngsters on retail which help them in their qualifications.”

It is fair to say that Premier Jules Convenience has been supporting the local community in ways that go beyond retailing.

Women power

Apart from being a leading retailer, an active community member, a local councilor, a mother and now a grandmother, Julie is also a marathon runner with several local and national races under her belt.

Reflecting how in 2012, she picked up a pair of trainers for the first time and never put them back, she said, “I picked up running with a running group that used to assemble in front of my store in the morning and start from here. One day, I decided to join them. Initially it was tough but I eventually built my stamina.”

She has run the London Marathon multiple times apart from numerous other races to raise money for charity and local hospice. In 2022, she was chosen to carry the Queens Commonwealth Games baton.

This year, she has already raised £4000 for Teenage Cancer Trust through her races. She did a half marathon in May and most recently, ran 26km MBNA Metric Chester Marathon earlier this month, through which she raised over £1000 for the Severn Hospice.

In an otherwise comparatively male-dominated sector, Julie is one of the leading women retailers who have not only earned their respect but also and managed to pave the path for others as well.

Julie said, “Back in 1990, when I joined my husband in business, we were the only couple that went to cash and carry. I was very young too. Most of the checkout and filler staff was men. That time, I indeed felt I was not much invited though I cannot say I was ever discriminated against.”

Reflecting on the evolution of role of women in retail as well as in wholesale, Julie recalled how award ceremonies 15 years ago were massively dominated by male.

Julie recalled, "When I joined the Federal News Federation and went to my first conference, I was shocked at how it had mostly male retailers. However, I did not feel discouraged and vowed to myself to keep learning.”

Scenarios, thankfully, have changed massively over the years, she said, as the sector now boasts of the likes of “Susan Nash, Amy from Coca-Cola and Sarah Johnson from ACS”.

Julie said, “I do try and go to as many conferences and seminars. Events, like last year’s Women in Wholesale conference that was packed with female, perk me up a lot. It gives me a lot of inspiration to see women like me excelling in this sector.”

Under her multifaceted and multi-talented personality, Julie is still a passionate retailer at heart, something which gets reflected in the store as well.

She said, "Even to this day I enjoy going to the cash and carry. I enjoy putting the stock car; I enjoy displaying product. I love to find out what I need to from any supplier and work with them.”

To continue to keep it ahead of the curve, Julie is planning to give Premier Jules Convenience another major refit through major investment and get it up to the next level. In her words, she has “another good 10 years” before she retires.

Julie is also determined to keep serving the community in whatever way she can.

"As a retailer, if I can support my community, I will. May be that’s my purpose in life, maybe that's why I'm here,” she concluded.