As more and more shoppers now seek value while buying essentials, loyalty and reward platforms are emerging as great tools for independent convenience retailers not only to boost sales and footfall but also to beat multiples in their own game, Asian Trader has learnt.

In the light of the cost-of-living crisis and otherwise too, Brits are increasingly becoming cost-savvy. They are on the constant lookout for discounts and schemes to cut down their monthly expenses and are not shying away from signing up to loyalty schemes, a fact which supermarket giants have been milking for years.

Retail analysts at Mintel spill the beans: a staggering four out of five shoppers are card-carrying members of at least one loyalty scheme. Tesco's Clubcard reigns supreme, dishing out instant rewards that give them a leg up. But Sainsbury's isn't far behind, tempting shoppers with exclusive, time-limited offers tailored to their favorite purchases.

Also, their numbers are constantly rising; the number of Tesco Clubcard members rose above 20 million while Sainsbury’s added 3 million new Nectar card customers last year. Both the supermarkets are in the lead when it comes to offering the biggest range of on-the-shelf discounts, though other supermarkets are now racing to bolster their own loyalty schemes.

While offering loyalty and reward schemes were once limited to supermarkets only, times have now changed. There are a slew of loyalty schemes which small local stores and corner shops can make use of to offer the same privilege to their customer base.

Several industry reports tend to point out that Brits want better prices. A recent research from shelf edge automation Pricer, almost nine in ten shoppers now actively seek out more deals and discounts when shopping for groceries.

Reward schemes can help independent retailers to compete with the bigger supermarket chains by offering at-par discounts to shoppers who in turn tend to return to the store for better value as well as for availing rewards. Plus, a better understanding of customers can only help stores to position products better suited to their buying habits and requirements, thus helping them increase shoppers’ basket size.

A leading name here for independent stores is Jisp, whose loyalty platform utilises Augmented reality (AR) voucher technology to bring discounts on branded products. By offering a combination of savings, rewards, and community-building opportunities, platforms like Jisp are transforming the whole trading scenario.

Alex Rimmer, head of marketing & communications at Jisp, explains how Jisp stands apart from its peers.

“Jisp's AR solution, Scan & Save, reads product barcodes and presents exclusive promotions, which customers can then save and redeem with their mobile phones. It helps retailers grow in-store sales and, due to vouchers only being redeemable in the stores they were unlocked in, build loyalty.”

Rimmer added that the Scan & Save app not only offers a loyalty and reward scheme for independent retailers like 6p back on every Scan & Save product purchased, it also offers money-off vouchers and rewards to shoppers that can only be used in a specific local store, thus ensuring shoppers’ loyalty to local businesses.

“It is free to retailers, drives increased sales, basket size, spend, frequency and shares brand investment with the retailer, something no other platform offers. With the value of the discount funded through the app and promoting brands, the retailer receives full RRP on the product while also receiving a margin enhancing 6p for every tap and redemption of a product in store.”

For customers too, Rimmer stated that Scan &Save is one of the easiest and most rewarding ways they can save and earn money while shopping locally.

“Customers download the Jisp Scan & Save app, which is completely free of charge. Once they’ve registered an account they can search for their nearest participating retailer and see what special promotions are available in store. They can then either tap and save the vouchers in their virtual app wallet or visit the store and scan promoted product in store to unlock vouchers. These are then redeemed at the till and the saving taken off the value of their goods," Rimmer told Asian Trader.

Rimmer added that the big difference between Jisp and its competitors is that the loyalty scheme cost retailers and shoppers “absolutely nothing” but pass on rewards through a brand revenue share model. They connect customers' mobiles with physical shopping environments and products, driving more customers to stores, increasing sales, footfall and repeat visits.

Another emerging leader in the convenience store loyalty world is MyDD Points that offers a multi wallet program wherein points earned at a particular store can only be redeemed at the same store.

Founded in 2018, MyDDPoints aims to help communities thrive and remain vibrant by strengthening the bond between local independent stores and their customers.

Konesh Kandiah, CEO of MyDDPoints, said, “Local corner shops implementing a loyalty program is not just about increasing sales; it's about building a community and establishing a shop as a vital part of the local economy.

“MyDDpoints help maintain a competitive edge by enhancing customer satisfaction and loyalty, which are crucial for long-term success in a community-centric business environment. They also provide valuable information on customer preferences and buying habits, which can guide inventory management and promotional activities to accomplish short-term goals," Kandiah told Asian Trader.

In MyDDPoints, customers either scan a QR code at the point of sale or provide their mobile number to ensure points are added to their account. Points can be redeemed for discounts, products, or vouchers within the app, which can be used during future purchases.

“More importantly, shoppers get to know about the deals on offer based on their regions,” Kandiah told Asian Trader.

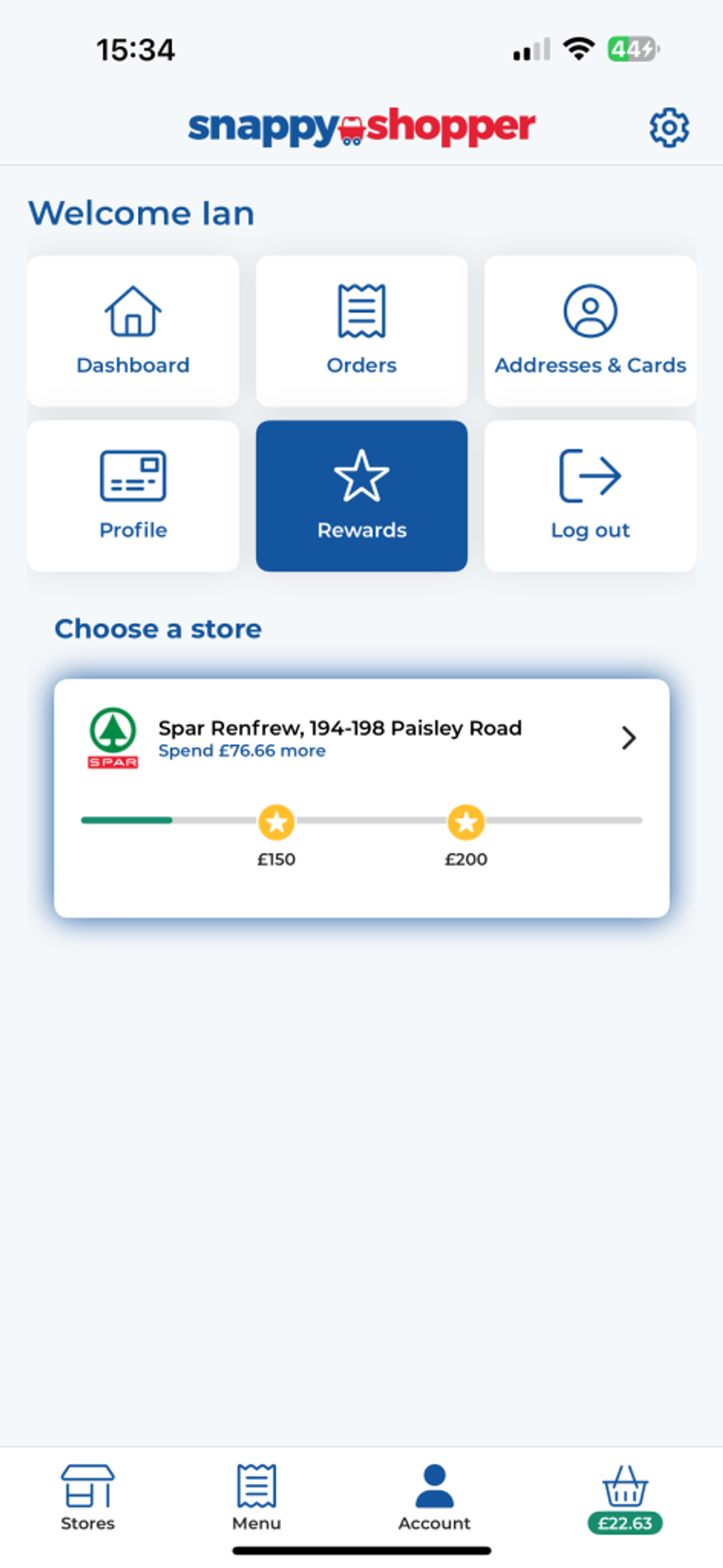

The newest kid on the block here is Snappy Rewards, a new loyalty scheme launched by Snappy Shopper.

Andrew Baker, Head of Product Growth at Snappy Shopper, states that the company took the plunge into loyalty schemes as an answer to calls from retailers.

“Our retailers and our customers have been asking us for this (reward scheme). We listened and so we delivered, we’re excited to see this live and being used by both sides of our marketplace.”

For Snappy Rewards, Snappy Shopper has built a feature that enables retailers to reward their loyal customers based on what they spend at their store each month.

Baker explained to Asian Trader, “Using an intuitive interface, retailers can easily set any number of reward tiers for the month, offering free products, free delivery or money and percentages off future orders (for example spend £75 in the month for a free bottle of Coca-Cola). Reporting is built in so retailers can see rewards created, redeemed and the impact on sales.”

Snappy Rewards is into its third month of rollout, with around 15 per cent of its retailers opted-in and are using Snappy Rewards at their stores. Early indications are extremely encouraging with uplift sseen in customer spending, orders and sales, Baker added.

Looking good

While loyalty was more of a supermarket thing, shoppers are now warming up to the idea of availing rewards at their local stores too.

Jisp experienced a record year in 2023 finishing the year with sales for its retailers up 327 per cent on the previous year. This trend has continued into 2024 earning retailers almost £1.5m in the first quarter of 2024, up 104 per cent on the same period last year. The number of stores trading with Jisp in 2023 was up 62 per cent on the previous year, and it has continued to add stores to its partnership in 2024 with top independent retailers such as Kash Retail, Sudi Stores and Pak Supermarkets joining-in.

Retailer Harmeet Singh, who runs Nisa Local in Convent Road, states, calls Jisp a “game-changer”, saying the discounts it provides not only attract more customers but have significantly boosted his store’s turnover.

Retailer Satty Nijjer, who runs Crest Store, says, “We run very competitive in-store promotions and many of these are also available on Jisp, meaning the customers get a ‘double-discount’.”

Elsewhere, Best Food Megamart in Wembley, Premier Express in Liverpool and Sambai Express in South Harrow are few names that vouch for MyDDPoints, saying it has increased their footfall as well as expanded the existing customer base.

Kandiah told Asian Trader how the response of MyDDPoints has been “positive with increasing uptake by both consumers and retailers”, adding that “it stimulates customer retention, enhances customer lifetime value, and increases sales basket value”.

For instance, retailer Girish Jeeva managed to increase his Glasgow-based Premier store’s footfall by 25 per cent and sign up over 1000 customers actively using the loyalty card within just three months after the recent introduction of MyDDPoints.

Snappy Rewards is also seeing a warm welcome.

Baker from Snappy Shopper said, “We’re into our third month of our rollout, with around 15 per cent of our already retailers opted-in and using Snappy Rewards at their stores. Early indications are extremely encouraging with uplifts in customer spend, orders and sales.”

It’s been just three months for Nick Kooner, owner of Keystore More at Prestwick, but figures speak for themselves.

Kooner said, “Average customer spend, average order per customer has increased and the stores’ gross merchandise value has also increased double figures.”

Win-win

After seeing a good response in convenience retailing, Jisp recently expanded into the world of wholesale as well, offering a similar scheme to wholesalers enabling them to reward their retailers.

Confex Savings Club powered by Jisp is a wholesale specific loyalty platform giving wholesalers the ability to reward retailers for purchasing through their business, generating their loyalty, thereby increasing earning potential for the wholesaler and offering cost savings and rewards to retailers. It is an industry first and completely unique to the wholesale sector.

Confex Savings Club Powered by Jisp operates in much the same way but the promotions, savings and rewards go to the retailer. This further enhances their margin on in-store sales of products through Scan & Save.

While lower prices for shoppers and more customers for retailers sound like good news for everyone, regulators are not so sure. Amid a wider drive to weed out any profiteering in the grocery market, this month the Competition & Markets Authority (CMA) has begun a review of how grocers are using loyalty card prices.

The investigation is looking particularly at whether customers at supermarket giants felt forced to sign up to loyalty cards and whether the system risked excluding any groups.

Whatever the outcome of the investigation, it is evident that to stand out in the sea of competitors, independent convenience stores must bring something new to the table that customers can’t find elsewhere.

There is a clear opportunity for retailers to complement their personal touch with new-age digital tools to further enhance their consumers’ in-store experience. Easy-to-manage digital schemes can bring long-term loyalty, particularly when times are hard, and people are more conscious of where they choose to shop.