The Food Foundation’s annual State of the Nation’s Food Industry report, published today, has found that:

- Just 5 companies (Haribo, Mars, Mondelez, PepsiCo, Kellog’s) are responsible for over 80 per cent of TV ads for snacks and confectionary aired before the watershed, despite all of them claiming not to advertise to children

- Almost a third (30 per cent) of major UK restaurant chains serve main meals where over half of the options are concerningly high in salt

- Almost one in five supermarket multibuy offers are on meat and dairy products, with half of these offers on processed meat (10.6 per cent of all offers) despite the known health risks of consuming too much processed meat

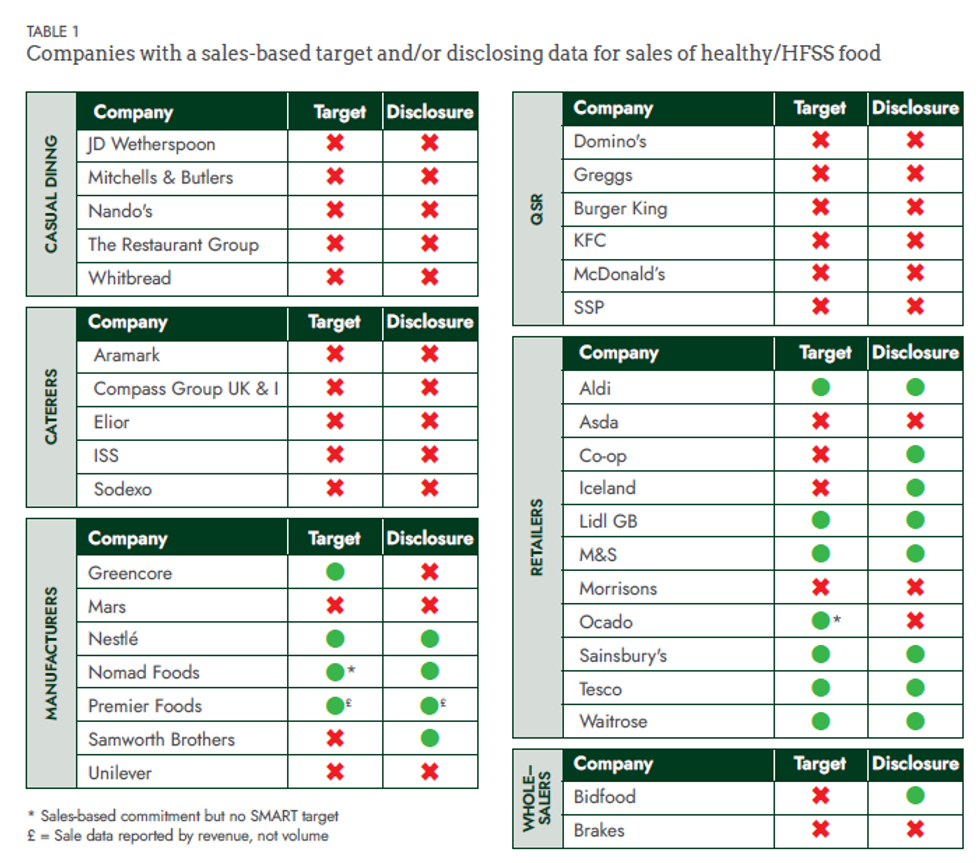

- Only one in four major UK food businesses has a healthy sales target and discloses data on the healthiness of their sales

- Restaurant chains and fast-food outlets are the least transparent sector by some way, having made no progress since last year in disclosing healthy sales data or setting targets to improve the healthiness of menus

- Global food giants Mondelez, Mars and Coca-Cola still have no clear explicit board-level accountability for nutrition

- Food industry representatives and their trade associations met with Defra ministers a total of 1,377 times between 2020 and 2023. This is over 40 times more meetings than those held between food NGOs and Defra ministers

The report, published annually by The Food Foundation, analyses data across an array of sources to build up a revealing picture of the UK’s food system. The findings show that currently the food environment, from the food being advertised to us, to the food that dominates menus when we eat out, to the price promotions being offered to us in supermarkets, is relentlessly pushing consumers to make unhealthy choices.

The report also shows there is a clear lack of accountability, with food industry giants failing to set targets or report on their company’s health credentials and global food giants Mondelez, Mars and Coca-Cola having no clear explicit board-level accountability for nutrition.

The new Government has committed to raise the healthiest generation of children ever, to halve the gap in healthy life expectancy and to strengthen the economy. There is increasing public awareness that this cannot be done without addressing diets and the availability and affordability of healthy food. Currently obesity and overweight are estimated to contribute to around 40,000 deaths every year and cost the UK economy an estimated £98bn annually. Last month a report from the House of Lords Committee on Food, Diet and Obesity forcefully called for the government to fix the “broken” food system and turn the tide on the public health emergency.

The Food Foundation’s annual report includes data from its Plating Up Progress benchmark which monitors 36 major UK food businesses, covering retailers, the Out of Home sector, wholesalers and manufacturers. The benchmarks looks at which of these businesses are disclosing transparent data on sales, marketing and sourcing and setting targets to support the sales of more healthy and sustainable food.

The Food Foundation found that while the majority of major food businesses have now set targets for and are reporting on reducing Scope 3 emissions, only 1 in 4 major UK food businesses has a healthy sales target and discloses data on the healthiness of their sales. This is likely being driven by the increasing number of corporate reporting directives requiring businesses to publicly disclose data on their environmental impact in comparison to the lack of regulation and absence of reporting directives on the healthiness of portfolios.

While there has been more target setting and disclosure on climate than health, there is still an intention-action gap on environment goals, with over half of businesses assessed either not reporting on progress or seeing emissions rise.

The Food Foundation is calling on the government to introduce mandatory reporting by all large food businesses on both the healthiness and sustainability of their sales. This is crucial for identifying what food is being sold (and ultimately consumed) and pointing to areas for improvement. Setting targets is equally important, serving as a North Star for driving meaningful change within companies. A great deal of progress had been made in aligning on the health metrics for food businesses to report on via the Food Data Transparency Partnership (FDTP) during the last term of government, but this has come to a complete standstill since the election. Labour ought to use the existing mechanisms for health reporting and move swiftly to place it on a mandatory footing.

“This year’s State of the Nation’s Food Industry report demonstrates the huge impact food businesses have in shaping the food we eat – and how the current system is setting us up to fail,” Rebecca Tobi, Senior Business and Investor Engagement Manager, The Food Foundation. “It’s not right that the most affordable, appealing and convenient options are often the unhealthiest ones.

“We urgently need the government to introduce regulation to raise standards and create a level playing field that enables progressive businesses to go further, faster. If we are to have any chance of ensuring the next generation are the healthiest ever - as Labour have pledged - then we simply can’t continue to ignore the major role large food companies are playing in shaping UK diets. We need regulation to ensure proper safeguards are in place to make sure businesses act responsibly, supporting people and planet as well as profit.”

Baroness Walmsley, Chair of the House of Lords Food Diet and Obesity Committee said, “When people are swimming against a tide of availability and advertising of unhealthy food, it is not helpful to tell them to swim harder. This report shows just how far the industry needs to move to support everyone to eat well, and the calls to action repeat many of those in the Lords committee’s report (Recipe for Health; a Plan to fix our broken food system). The government should act now to develop a long term strategy to fix our food system, underpinned by a new legislative framework. Without it, businesses have insufficient incentive to act in the public interest and will continue to cause harm with their relentless promotion of junk food.”

James Toop, Chief Executive of Bite Back added: “All through 2024, we’ve been running the Fuel Us, Don’t Fool Us campaign, and what we keep hearing from the young activists who drive Bite Back is how Big Food is putting profit over their health. Companies are secretive or even misleading about what’s in the junk food they’re marketing, while young people are hit with 15 billion ads online every year. Our research this year shows that the majority of Big Food’s UK sales come from unhealthy products, which has real consequences — one in three Year Six children are at future risk of food related illness. If the new government wants to be on the right side of history and truly create the “healthiest generation of children ever,” they need to tackle this issue head-on and act on the recommendations in the State of the Nation’s Food Industry report.”