Cost of living is still consumers’ number one concern, shows recent data, highlighting how shoppers are turning to scratch cooking to both save money and have a healthier diet.

According to new data released today byNielsenIQ (NIQ), total till sales grew at UK supermarkets (+5.3 per cent) in the last four weeks ending 27th January 2025, up from +3.6 per cent recorded in December.

With a better outlook on food inflation (+1.6 per cent) compared to last year (+6.4 per cent), there was good unit growth of +0.9 per cent at the Grocery Multiples. However, growth slowed after the new year.

January is typically a time of year for a healthy reset for consumers, and NIQ data shows 12 per cent of British households purchased meat-free substitutes in the last four weeks. Whilst this is a small drop from 14 per cent last year, shoppers have not cut back on healthy diets with double-digit growth in freshly prepared fruit (+16 per cent) and fresh veg accompaniments which grew by +9 per cent.

Meat, fish and poultry was the fastest growing super category (+9.1per cent) as shoppers sought to cook protein-rich meals as part of New Year diets. This was followed by pet care (+8.3 per cent) and dairy products (+6.8 per cent).

In addition, NIQ data shows that half of all UK households now say they cook from scratch every day or most days, with around 16 per cent doing so more due to the rising cost of living.

The impact of this shift in behaviour marks a spike in demand for easy hacks to speed up or elevate the dining experience, with a boost in sales for fresh gravy (+28 per cent), fresh dough and pastry (+18 per cent), fresh dips (+15 per cent) and fresh cream and custard (+14 per cent).

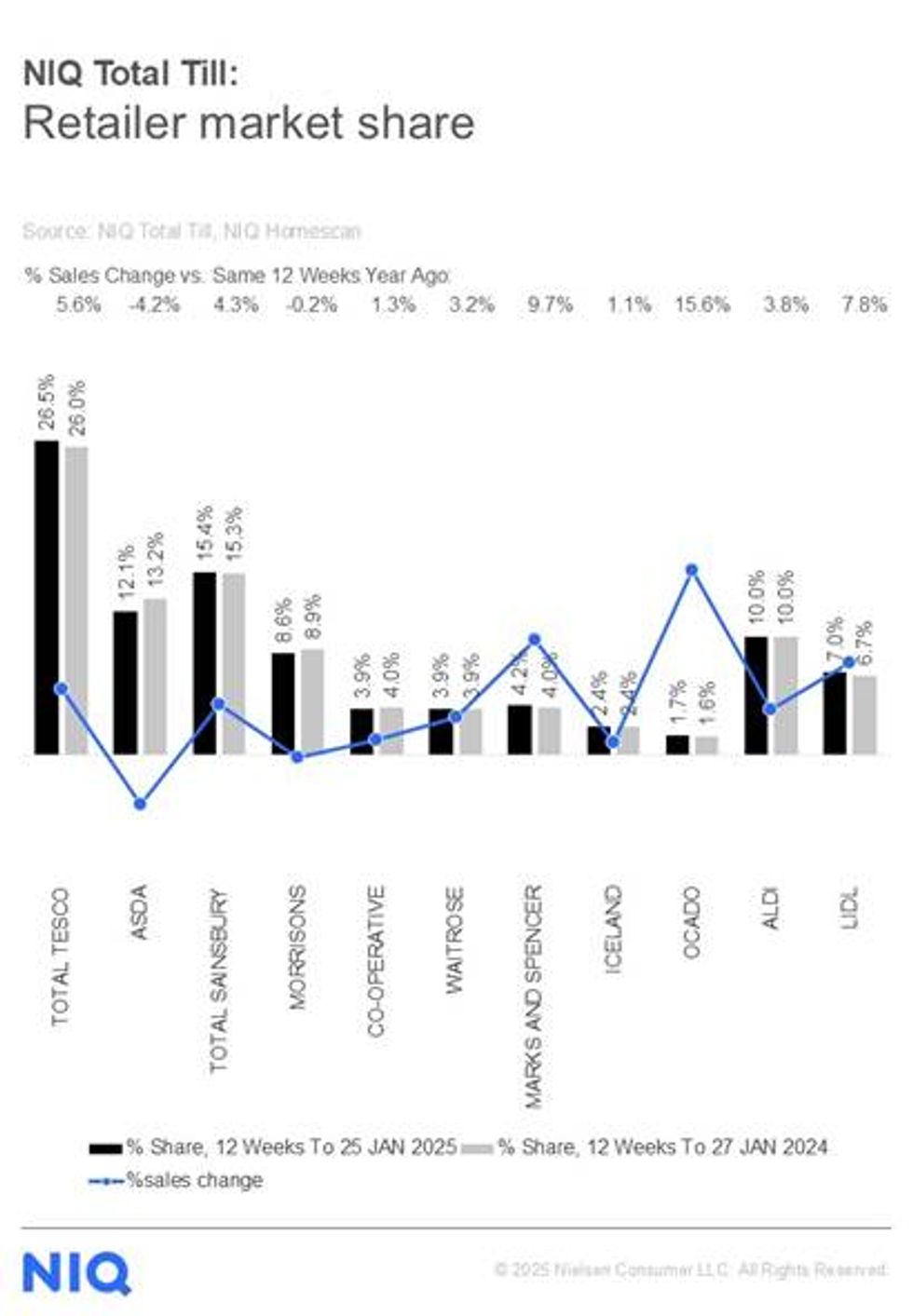

In terms of retailer performance, Ocado led with a sales growth of +15.6 per cent compared with the same period last year.

This was followed by Marks & Spencer (+9.7 per cent) helped by its bigger store formats motivating shoppers to add more items to their baskets as well as its dine-at-home deals. There was also continued growth at the discounters Lidl (+7.8 per cent) and Aldi (+3.8 per cent) with both retailers gaining new shoppers and more store visits.

Mike Watkins, Head of Retailer and Business Insight at NIQ said, “The lift to grocery sales in the last four weeks was helped by the timing of the New Year, with a proportion of sales coming from the new year festivities which was week ending 4th January (+10.0 per cent).

"However, after this, weekly growth in January was slightly lower. Whilst overall Total Till sales growth was higher than December, the underlying trend is closer to +3 per cent which is the average growth in the most recent three weeks.”

Watkins adds, “NIQ Homescan data shows that the cost of living is still firmly consumers’ number one concern at the start of 2025. Shoppers are looking to save money and eat healthier leading to a growing trend in scratch cooking, which is one of the key behaviours driving the strong unit growth (+2 per cent) and value growth (+6.8 per cent) in fresh food categories in the last four weeks.”