Nearly half of people working for UK retailers are at risk of quitting (51 per cent) or going into work with a health problem (44 per cent) in the weeks following Christmas, according to a new index tracking employee well-being trends across the retail industry over the last year.

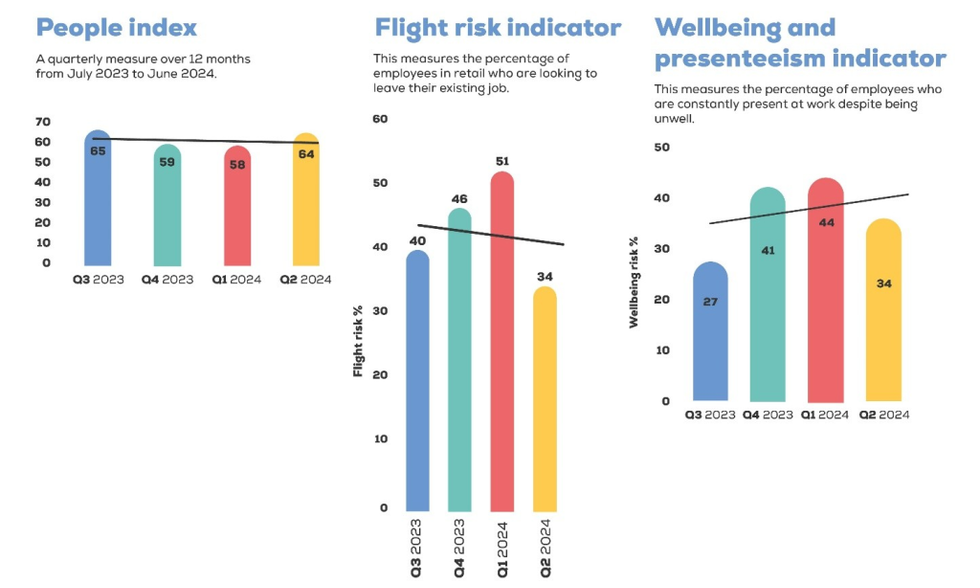

The Retail People Index, which surveyed more than 2,000 UK retail employees and is the first to be published by retail industry charity the Retail Trust and global consulting firm AlixPartners, also showed a 7 per cent drop in overall well-being (from 65 per cent to 58 per cent) across the retail workforce between the start of autumn 2023 and the end of last winter, showing the impact of the busy Christmas period on employees’ mental health.

Calls to the Retail Trust’s well-being helpline also rose by more than a third (36 per cent) in January this year.

The research found that the risk of employees leaving their jobs or working while unwell is lower in the summer months. 27 per cent of all UK retail employees were at risk of working while unwell and 40 per cent were at risk of quitting in the summer of 2023 and just third (34 per cent) were at risk of working while unwell or quitting by the start of this summer.

Younger retail employees most impacted

But the Retail People Index discovered a greater mental health toll on young retail employees between the ages of 19 and 34 years than on that of older colleagues.

Young employees were found to be 10 per cent more likely to leave their retail jobs than the workforce as a whole at the start of this year (61 per cent versus 51 per cent). Meanwhile, half (52 per cent) of 19–24 year olds and 43 per cent of 25-34 year olds were still at risk of coming into work while sick between April and June this year, compared to a third of retail workers overall.

The index was created by measuring more than 4,500 responses to the Retail Trust’s online happiness assessment, delivered with employee engagement platform WorkL, between June 2023 and June 2024.

More than 2,000 staff were asked about their mental and physical health and how valued and fulfilled they feel at work to create an overall well-being score. Questions around pay, recognition, relationships with managers, work-related anxiety and workplace safety were among those used to separately help calculate the likelihood of them leaving their jobs or working while unwell.

‘Getting used to a new job, meeting new people, working out how to exist in an office, my living situation – it was overwhelming.’

“I’ve always been able to adapt to new situations, moving schools, starting college, going to university. However, this was so different,” admitted Phillip James, a 22-year-old student who sought help from the Retail Trust after beginning a marketing placement with The Perfume Shop.

“If I had been dealing with just one thing, it would have been ok, but putting it all together – getting used to a new job, meeting new people, working out how to exist in an office, my living situation – it was overwhelming. I started to dissociate. I’d go home after work and there would be nothing.

“Slowly it crept into work. It was like I was on autopilot. I’d be in situations and think, I should be happy, I should be enjoying this right now, and I’m not, and that’s tough.”

‘The industry’s reputation as a great place for young people to begin or build a career could be under threat.’

Chris Brook-Carter, chief executive of the Retail Trust, said: “Retailers need to put in place the right well-being support in the run up to this winter when the mental health pressures on retail staff could again be at their highest. This is particularly important for younger workers who tell us they feel less happy and safe at work and lack the tools to manage their stress and anxiety themselves.

“Retail has a fantastic track record of moving people from the shop floor to the boardroom so we are concerned the industry’s reputation as a great place for young people to begin or build a career could be under threat unless they are given more support.

“There is a fundamental link between the hope, health and happiness of a business’s workforce and its economic resilience. And, thanks to the support of our data partner WorkL, we hope the new Retail People Index will spur on more businesses from across the retail sector to address the causes of poor well-being within their organisations. In doing so, they will also help to ensure a more sustainable and successful industry as a whole.”

Laura Bond, Director at AlixPartners, said: “It continues to be an uncomfortable time to be a retailer. Persistently high levels of disruption – such as rising input costs and broader geopolitical uncertainty – affect not only business performance, but also the confidence of the people that work within them.

“At times like this, it is people and culture that can act as your shock absorber to these external forces, and this can have a material long-term impact on a company’s ability to be successful.

“So much effort goes into attracting and developing retail talent, but retention is perhaps the softer side that businesses do not always do so well. However, building a strong culture is the secret sauce to an engaged workforce that will perpetuate a sense of belonging and purpose, driving business performance in the process.”

Separate research by the Retail Trust found 80 per cent of retail workers were experiencing declining well-being last year, with a fifth (19 per cent) struggling to meet their monthly outgoings due to rising costs and nearly half (47 per cent) feeling unsafe at work amidst a wave of assaults and retail crime.

66 per cent of shop workers also told the Retail Trust they were feeling stressed or anxious about going into work following a rise in assaults and 42 per cent were considering quitting their jobs or leaving retail as a result.

The average cost to replace a departing employee earning £25,000 a year or more is £30,614, according to Oxford Economics and Unum while research by Deloitte has found poor mental health costs UK employers more than £50 billion a year. A study by CIPD has found UK employers are now absent for an average of 7.8 days, compared to 5.8 days before the pandemic.

The Retail Trust runs a well-being helpline and provides counselling and financial aid for retail workers and works with more than 200 retail employers to improve the mental health of their staff. It launched a new generative AI powered dashboard earlier this year to help retailer better track staff well-being trends and improve the effectiveness of support.

Case study:

“Leaving Brighton, where I had been studying, for High Wycombe to start my 12-month placement at The Perfume Shop was a bit of a shock,” admitted Phillip James, a 22-year-old marketing management student.

“I’ve always been able to adapt to new situations, moving schools, starting college, going to university. However, this was so different. If I had been dealing with just one thing, it would have been ok, but putting it all together – getting used to a new job, meeting new people, working out how to exist in an office, my living situation – it was overwhelming.

“I started to dissociate. I’d go home after work and there would be nothing. I would just sit and dwell. Slowly it crept into work. It was like I was on autopilot. I was getting on with things, but I think there’s a difference between feeling neutral in a positive way, as opposed to having no feelings. I’d be in situations and think, I should be happy, I should be enjoying this right now, and I’m not, and that’s tough.

“Around that time, I saw a poster in the bathrooms at work that said something along the lines of, it’s important to feel good and happy at work but if you’re feeling bad, here’s an email, reach out and so I did. We had a bit of back and forth and then I met up with a member of the HR team at The Perfume Shop. I asked about my options, and she suggested I contact the Retail Trust, and guided me in the right direction.

“I signed up on the Retail Trust website, called the helpline number and had an initial chat. After the call they set me up with some counselling sessions.

“I still experience moments of dissociation, but now I’m more patient with myself. Rather than panicking, I’m much more relaxed and I’m way more comfortable in the situation I’m in. That’s not just down to the counselling, growing into the role has helped too. But the counselling has helped to prevent things overflowing to the point where it becomes unmanageable.”