2023 was a rollercoaster year. With the lingering effects of the COVID-19 pandemic, fluctuating economic instability, increasing political unrest, spiked crime and rampant shoplifting being the flavour of the year, retail as an industry overall has been in a state of permacrisis.

The markets in 2023 suffered uncertainty and worry but small and independent retailers are standing tall and confident as ever, looking ahead to next year filled with determination and optimism.

According to the annual survey of independent retail and hospitality business owners, on behalf of American Express and Small Business Saturday, growth expectations is high for next year.

Among the challenges in running their business, retailers pointed out rising costs of goods and services (31 per cent) and energy costs (30 per cent) as top ones. However, almost half of small business owners (48 per cent) said they are “excited” and 45 per cent feel “confident” about the next six months, showing that these challenges are nowhere near dampening their spirit.

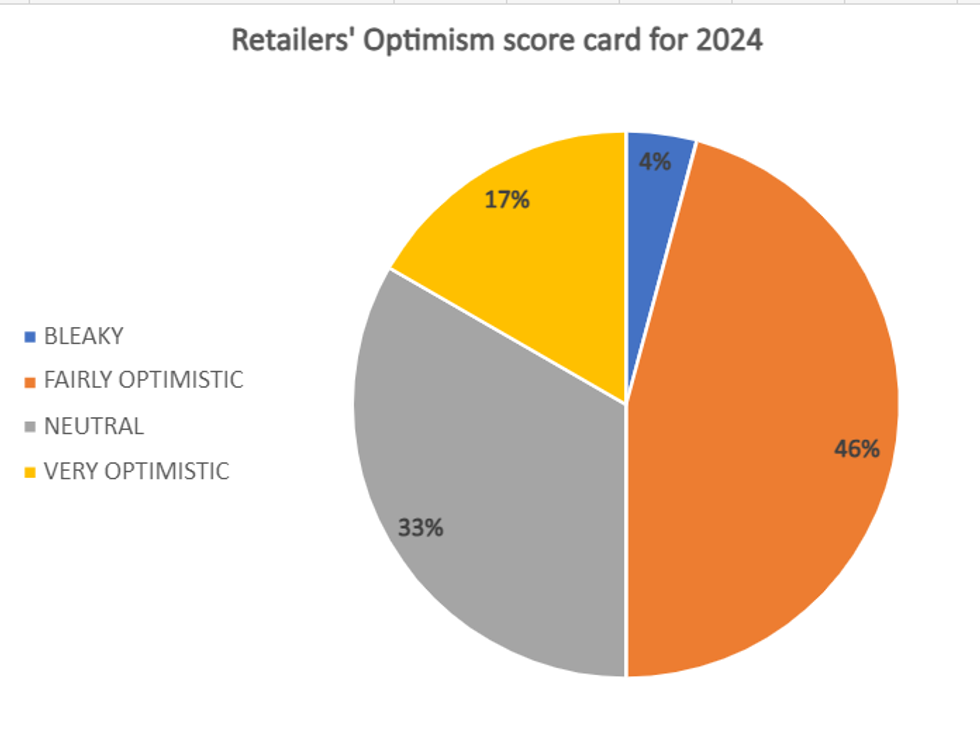

Similar feedback was observed in our very own exclusive Asian Trader survey that suggested that most indie retailers are in upbeat mood albeit the challenges of crime and energy cost. A good majority (62.5 per cent) of convenience store owners admitted feeling “very optimistic” and “fairly optimistic” for 2024while one third said they feel neutral about the coming year.

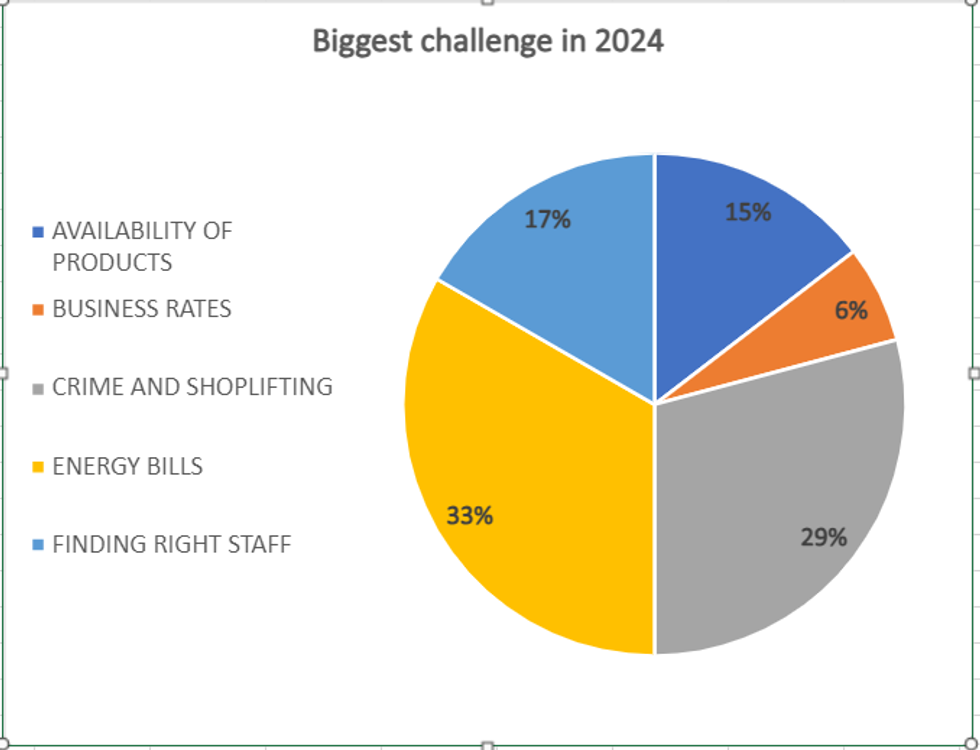

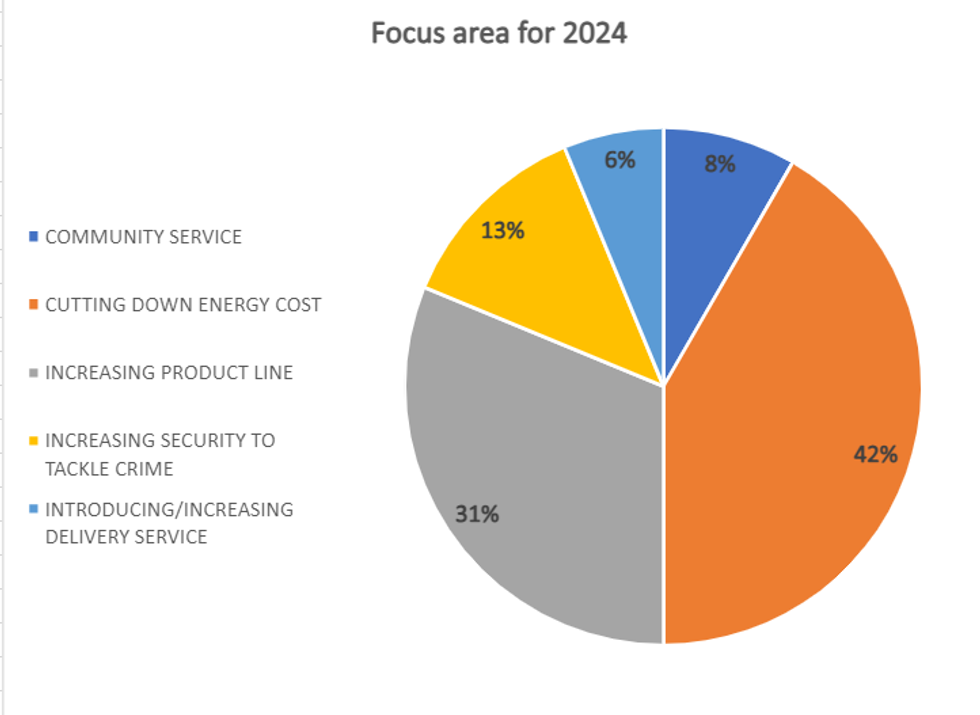

Rising energy bills seem to be on everyone’s mind at the moment. While tackling energy bills was rated as the top perceived challenge for 2024 (closely followed by “crime and shoplifting”), about 41 per cent of those surveyed told Asian Trader that “cutting down energy cost” will be their top focus area in 2024.

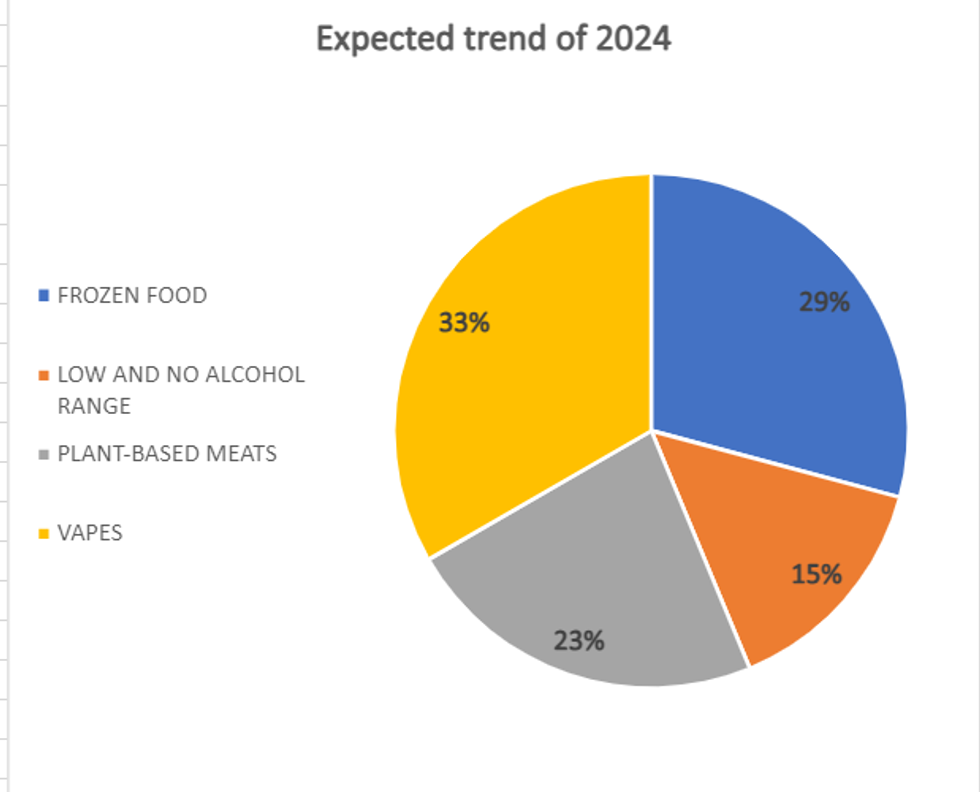

One third of those surveyed feel vapes will be the highlight of 2024 in driving their sales, closely followed by frozen food.

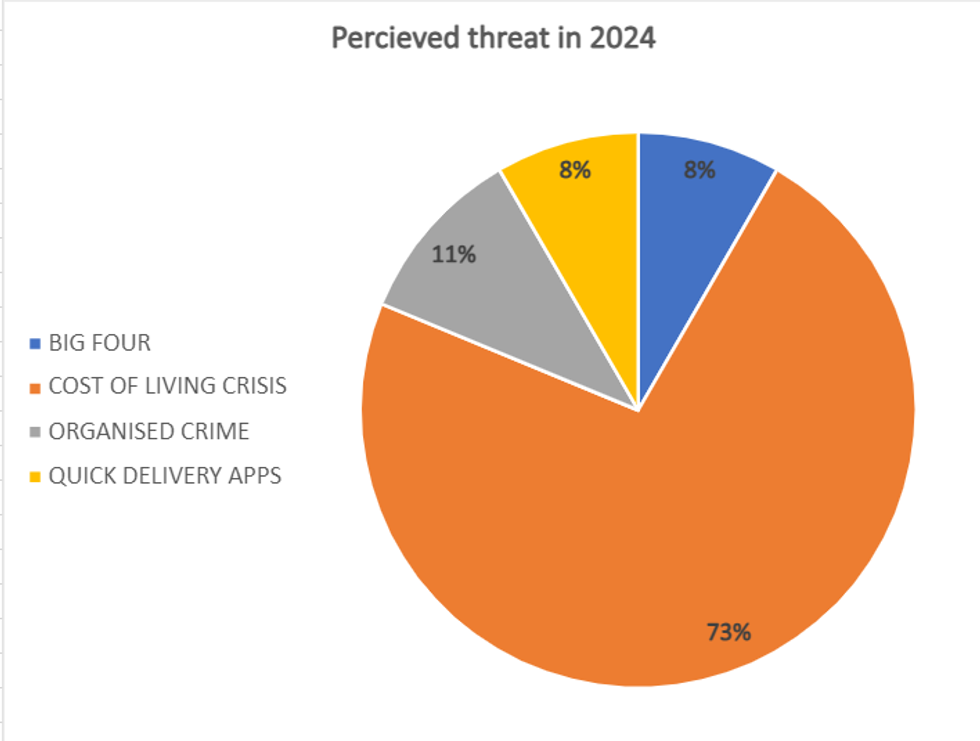

An overwhelming 72.9 per cent majority of retailers said they see “cost of living crisis” as the biggest threat to their business in 2024.

Munching on

With more and more Brits continuing to stay at home first due to pandemic, later due to inflation and now due to sheer habit, the snacks category will continue to grow.

Protein-led snacking, plant-based options, guilt-free pleasures and color-coded packaging are some of the expected trends to emerge in the year ahead.

Susan Nash, Trade Communications Manager at Mondelēz International, says, “The snacking occasion is only set to grow more and more over the year ahead, with shoppers increasingly looking for excitement and innovation from retailers’ ranges and their favourite brands. While challenging economic circumstances look set to continue, we are continuing to adapt and find new ways to provide the treats that shoppers know and love.”

Health is absolutely a key trend; we are already seeing consumers looking for more health and wellbeing options across the broader snacking category and we anticipate this trend to continue in 2024.

In fact, Mondelez’s data shows that healthier biscuits are the biggest value driver in the category and are growing at 20 per cent, proving just how important this part of the market is.

[the_ad_placement id="featured-ads-1"]

“We also know consumer demand for healthier options is more prominent in the mornings, when they seek out more functional benefits and attributes, and look for treats to keep them going. belVita is growing ahead of the category in both volume and value sales and in penetration, frequency and repeat purchase levels,” says Nash.

Though shoppers continue to feel the pinch of pennies, treats remain a ‘must’. Moments of indulgence continue to be important, particularly for younger adult consumers so retailers should stock lines accordingly.

Consumers turn to OREO as an ‘everyday’ treat they can enjoy at any time, whether for a special occasion or simply “just because”. The brand is growing at 18.9 per cent and continues to progress with several exciting launches, promotions and engaging partnerships.

This year, Mondelēz International is offering a luxurious treat by re-vamping the Cadbury Chunk Collection. This involves expansions into new pack sizes to tap into the sharing occasion and drive value, as well as including the addition of a new Caramilk chunk within the collection.

Mondelēz International is also rolling out a new Cadbury Buttons Selection Box this year. The contents of the box are sure to appeal to all tastes, as it includes four different flavoured treat bags- Cadbury Dairy Milk Buttons, Cadbury Dairy Milk Orange Buttons, Cadbury Dairy Milk Salted Caramel Nibbles and Caramilk Buttons.

Retailers can further tap into the sharing category with Cadbury Dairy Milk Winter Orange Crisp 360g, which is now available across the market for the first time this year, ideal for sharing with friends or family on cold winter evenings.

Something Chill

Soft drinks are and will continue to remain a massive sale base of convenience stores.

By identifying category changes over the last 10 years and understanding how the pandemic has opened new avenues, new data and analysis from SBF GB&I shows that not only are soft drinks more important to retailers than ever before, but that there is also an opportunity to unlock an extra £1.2 billion in soft drink sales.

Matt Gouldsmith, Channel Director- Wholesale at Suntory Beverage stated that the energy drinks segment is hugely important to convenience retailers – and becoming more so year-on-year.

“We know from our conversations with retailers that the core ranges from big brands (such as Lucozade Energy) that lead the segment, and the interest that new launches and flavours create, really help get shoppers excited,” he says.

From the start of January, Lucozade Energy will be moving its 380ml single SKUs to 500ml bottles only, including Lucozade Energy Orange and Original, the Lucozade Energy Apple, Cherry and Caribbean Crush flavours and Lucozade Zero Pink Lemonade. The move will also see the introduction of a price-marked variant, RRP £1.509, available for the first time in 500ml format, offering a bigger bottle10 and better value for Lucozade Energy drinkers.

The move to 500ml single bottles from 380ml PMP and existing 380ml standard pack flavours across the range enhances the options for shoppers wanting to choose the right drink for their different consumption occasions by offering them their favourite drink, in a larger on-the-go format. Lucozade Energy 380ml bottles will still be available in multipacks.

While 250ml and 330ml cans offer a great entry option for those looking for an on-the-go drink,900ml bottles deliver a great “drink later” option. Standard non-PMP single 380ml packs of Orange and Original flavours will still be available across Northern Ireland.

Lucozade Alert Zero Sugar Mango Peachade is available in 500ml cans, including a £1 price-marked variant. Lucozade Alert Zero Sugar joins the existing Lucozade Alert range of Cherry Blast, Original and Tropical Burst flavours.

It is imperative to understand your clientele and stock and promote products accordingly.

And that’s why retailers should check out SBF GB&I’s unique initiative Simply Soft Drinks, a dedicated website, which features a wealth of insight to give retailers the best and most up-to-date snapshot of the soft drinks category. It’s a reliable place to see if there’s anything they should bear in mind for the next few weeks or months, from health and wellbeing to sales spikes around sport or seasonal events.

Moving on, energy drinks are a bit of a hit and within the category, energy flavours grew massively in 2023. We expect this momentum to roll into 2024 as well.

Red Bull is a driving force behind flavours in the market, with the Edition range now bought by 2.6 million shoppers and growing +£19.9m year on year. Furthermore, 85 per cent of shoppers agree that they “want to try new and unusual flavours in energy drinks” which has contributed to the success of Red Bull flavours this year, according to a Red Bull spokesperson.

Although shoppers are feeling the effects of inflation within the wider grocery market, this hasn’t stopped them from getting out and about within the convenience channel.

“We saw shoppers making more trips out-of-home to buy soft drinks this year, with trip frequency +7 per cent and as a result Soft Drinks remains in strong growth within Independents and Symbols stores, adding an additional +£213 million versus last year,” says the Red Bull spokesperson, adding that sports and energy has been a key part of this, accounting for 68 per cent of all growth and adding +£144m to the category.

[the_ad_placement id="featured-ads-2"]

As inflation rises, consumers have had to consider their spending across all areas. However, as a category, energy drinks have been less impacted by cutbacks with brands largely leading the way.

The major growth opportunity for retailers in 2024 is through capturing and engaging shoppers that are entering the energy category by having the right range in store.

The original Red Bull Energy Drink 250ml continues to sell more units than any other single-serve soft drink and so making sure this is well-stocked and available at all times is essential. In addition, providing a range of sizes to cater to different occasions is key.

Getting the full range of Red Bull is key to driving sales across the Soft Drink fixture. Red Bull Energy Drink is an on shelf essential with 250ml, 355ml and 473ml all falling into the top 20 most valuable FMCG SKUs.

Alongside this, Red Bull Sugar Free taps into the growing consumer health trend and was bought by 2.3 million shoppers this year.

Retailers should also stock Red Bull’s new ranges like The Summer Edition with the taste of Juneberry and Red Bull Winter Edition Spiced Pear.The launch of Red Bull Winter Edition Spiced Pear is being supported with a range of tailored POS to raise awareness in store across all key touch points.

Cheers to 2024

Shoppers seek premium treats in the Off Trade, even when finances are challenged.

To maintain their brand loyalty, shoppers look for alternative more cost-effective formats. Larger pack sizes and formats can lure shoppers looking for value.

Craft beer has been a growing category leading up to and throughout 2023, outperforming the total beer market. And there are no signs of this slowing down as consumers prioritise quality drinks over quantity.

Stuart Harrison, Head of Grocery, BrewDog PLC, states that craft beer saw another strong summer as shoppers continued to premiumise in the off trade.

“BrewDog outperformed the category seeing +7.2 per cent value growth and +4.8 per cent volume growth. Looking further at the key styles to watch in 2024, Stout saw one of the strongest uplifts this summer, thanks in part to the launch of BrewDog Black Heart, which has driven excitement into the category to appeal to new drinkers.

“Craft Lager also achieved impressive growth over the summer. The brands driving this are BrewDog Lost Lager, Camden Hells and NPD from Brooklyn Pils,” Harrison tells Asian Trader.

It becomes tricky to stock each and every new launch in the alcohol section. To solve that, try introducing a ‘product of the week’ display to showcase the new launch for a limited time and get feedback from customers before committing to making it permanent to your range. The top five NPD beer brands to consider, according to Harrison, are Peroni Capri, Cruz Campo, BrewDog Black Heart, Carlsberg Classic and Guinness Nitrosurge.

“When retailers are reviewing their beer range, we recommend they start with our core range and top three products- Punk IPA, Lost Lager and Hazy Jane, which continue to see a lot of love from shoppers,” says Harrison.

Overall, there is a rise in “drink less, drink better” attitude among consumers. This is especially the case when it comes to wine and spirits, implying that they want to enjoy excellent drinks, but it’s not necessarily about it being cheap.

Sharing insights on key areas to watch out for in 2024, Jo Taylorson, head of marketing and product management at Kingsland Drinks, states that value and quality reign supreme for UK consumers as they are watching their each spend amid cash crunches.

“We know from previous economic downturns that some consumer groups will trade down within their existing shop, looking for lower priced items, yet others will shop around and buy their wines and spirits when they are on promotional offers or look online for discounts.

“We’re expecting a bumper summer season for alcohol sales, thanks to major sporting events such as the Paris Summer Olympics, Euro 2024 in Germany, and other national and international football, rugby, tennis and cycling tournaments. Viewing parties in the home and garden are set to dominate the sporting season, with alcohol a key component of a successful screening,” says Taylorson, urging retailers to keep the right mix of value and well-priced premium products.

Campaneo - hailing from Spain and backing lesser-known regions such as Campo de Borja - has built real momentum and a cult following of consumers and wine critics. In 2023, the range was expanded with the addition of a new Sauvignon Blanc variety and a new, convenient 2.25L Bag in Box (BiB) format.

Campaneo wines have the look, feel and taste of a premium wine brand, but at an affordable price point.

Tempranillo and Sauvignon Blanc are available in Bag in Box format, while Tempranillo, Sauvignon Blanc and Garnacha are all available to convenience and independent retailers in 75cl bottles.

Canned RTDs have been met with an explosion of popularity in 2023 and this is set to grow even further in the year ahead.

“Earlier this year we expanded the range to include three new flavours- Mix Up Coffee Rum & Cola, Pink Gin & Diet Lemonade, and Apple Rum, Lime & Ginger Ale, which have been flying off the shelves and are positioned to win in the current context,” Taylorson tells Asian Trader, informing that the range is 100 percent developed, created, canned and packed by Kingsland Drinks Group onsite in Irlam by an award-winning flavour team in a Lab Trust-certified NPD Lab.

The wine aisle is bustling with activities with new wine reforms and duty changes as well as changing customers’ habits.

Bag-in-box (BiB) wines have become increasingly popular over the last couple of years, predominantly due to changes in lifestyles, budgets and circumstances. They are lightweight, helps prevent wastage and the wine can stay fresh for up to six weeks.

Taylorson says, “At Kingsland Drinks, we have taken some of our most popular wines into the bag in box format and several of our customers have diversified into the format too to tap into the opportunity.”

Andrew Peace expanded its UK portfolio of Australian wines and introduced a range of new lower ABV SKUs. Andrew Peace is a trusted name to tap into the trend for lower ABV wines to moderate alcohol consumption, while addressing recent duty changes the wider industry is navigating.

[the_ad_placement id="featured-ads-3"]

The entire range now benefits from two new design propositions – Andrew Peace Black Label and Andrew Peace White Label. The latter includes the brand’s existing, popular 75cl Signature Shiraz and Chardonnay and new 1.5l BiB format.

Health continues to be on the minds, so does low and no alcohol range.

In the past, non-alcoholic drinks were an option only for a few, like designated drivers, but this is no longer the case and looking to 2024, we expect these drinks to become even more mainstream.

Sustainability will continue to be a key focus in 2024 as brands and consumers become more environmentally conscious and will be on the lookout for brands that highlight their efforts to reduce their carbon footprint, use eco-friendly packaging, or support conservation initiatives.

Australian wine brand, The Hidden Sea, as an example, has a compelling but simple story. For all bottle consumers buy, The Hidden Sea removes 10 plastic bottles from the world’s oceans and rivers.

Another name to consider here Pod Pea Vodka is the first vodka made from peas and is built with sustainability at its heart.

In 2024, we are confident vodka will continue to grow, as gin consumers shift categories while that rum will still be the darling at home. Equally, tequila’s stronghold in the on-trade will start to very much take hold at home.

Taylorson says, “Our insights team expects to see Asian flavours such as yuzu, citrus notes such as pink grapefruit, and florals such as blossom, rose, and hibiscus to come to the fore in 2024, coupled with a surge in new drinks launches containing well-known classic ingredients such as coffee, ginger, cherry and mint and smoky flavours in aromatic cocktails, ciders and spirits.”

There are huge opportunities for convenience retailers to drive sales of alcoholic drinks in 2024. Shoppers will be looking for drinks that offer more of an experience and appeal to their senses so consider stocking colourful cocktails, eye-catching packaging, popular and emerging flavour.

Key trends for 2024 include even more socialising in the home and garden, as cash strapped shoppers look to let loose at home, quality beverages including higher ABV drinks, flavour exploration, convenience, value and ease, and versatile packaging formats.

The shift to DIY drinking means local stores and smaller format retailers become even more important than ever for getting products into consumers’ hands, especially for impromptu occasions, impulse purchases and big nights in. Grab and go Ready to Drink (RTDs) have proved their worth.

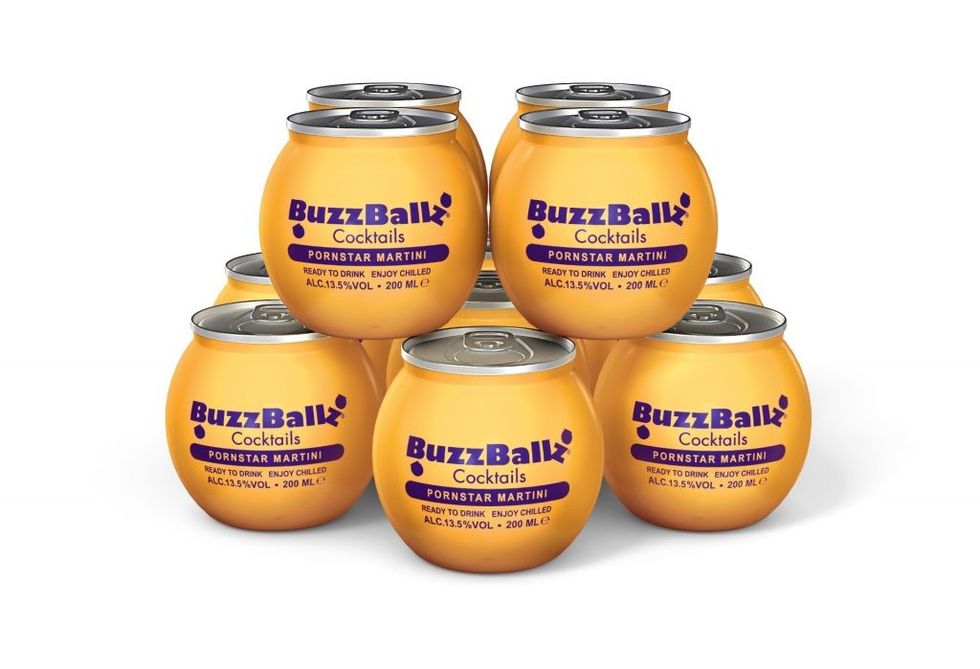

David Relph, country manager UK and Ireland at BuzzBallz Cocktails, feels that shoppers will be seeking out good value for money and drinks that enhance the occasion and bring an element of fun excitement to the weekend.

“Sofa socialising - whether among the household or with invited friends and family - is set to deepen as a trend in 2024 as it presents a way to spend time together without the higher prices of hospitality venues.

“This style of casual socialising calls for easy-to-prepare drinks, paired with bowls of sharing snacks and informal foods such as chips and dips, nachos, loaded fries, tacos and home delivery takeaways,” Relph said, suggesting retailers to be prepared to help shoppers match their drinks to their food.

He vouches on dual siting RTDs- both in the fridges and on the drinks fixture along with signpost snacks such as sharing bags of tortilla chips, nuts and crisps, to encourage additional sales and inspire at the moment of purchase.

The RTD category is still dominated by fundamentally similar products, vodka or gin based, low ABV and 250ml slimline cans. This is beginning to change.

“In 2024, we’re going to see a real appetite for bar strength, bar quality RTDs, and for spirit and flavour exploration. Consumers want to enjoy their much-loved and go-to cocktails in the home - this is where Margaritas and Espresso Martinis will take the spotlight, having earned their place in bars and restaurants and making their way into the home.

“Our Tequila Rita and Expresso Martini fit right into this trend and the colours and shape of the ballz really make an impact on shelf, enhance the drinking experience and offer and no-mess solution,” Relph told Asian Trader.

Another trend to make note of here is the rise in demand for single-serve options.

[the_ad_placement id="featured-ads-4"]

Single-serve canned alcoholic drinks and RTDs offer a casual, accessible and affordable, fun drink, and the size means consumers can explore different flavours and try new products without breaking the bank, perfectly ideal for today’s on-the-go culture.

When it comes to planning 2024 deals and promotions, Relph advises store owners and managers to stock well on BuzzBallz Cocktails bundle deals as these help drive weight of purchase with ‘2 fors’ or ‘3 fors’.

“Bundle promotions linking with other categories are also starting to prove popular linking with snacks for instance. BuzzBallz Cocktails work especially well when linking with American products. Tex Mex food and snacks are particularly well suited, so consider a bundle with tortilla chips, salsa or dips for the full taste experience, or with popular American candies or fiery snacks,” says Relph.

For added convenience and shelf appeal, BuzzBallz Cocktails also comes in range of 12 packs with shelf-ready packaging (SRP).

There is a new limited edition 1.75 litre large format to help drinks retailers capitalise on the take-home opportunities in the coming year. BuzzBallz Biggies range features three flavours - Strawberry ‘Rita, Tequila ‘Rita and Choc Tease (all are 13.5 per cent ABV).

Seven single-serve SKUs- Pornstar Martini (limited edition), Choc Tease, Tequila ‘Rita, Strawberry ‘Rita, Lotta Colada, Chili Mango and Espresso Martini- are available to retailers via exclusive distributor, Hammonds of Knutsford.

All 200ml balls are 13.5 per cent ABV with an RRP of £3.99 each. Three limited edition Biggies are available in Strawberry ‘Rita, Tequila ‘Rita and Choc Tease flavours. All are 13.5 per cent abv and priced at £28 RRP.

Onward and upward

Shoppers’ priorities will change as the economic climate continues to stay fragile.

Over the course of 2023, loyalty card promotions have become a crucial and successful driver of customer retention. A key focus of 2024, therefore, will be to build stronger loyalty schemes and foster a customer base which will not stray.

For some retailers this means encouraging additional customers to sign up. Some may even need to establish a new loyalty scheme from scratch.

Scrutiny of processed food and drink is intensifying. Fueled by discussions about highly, overly or ultra processed food (UPF), feelings about processing will inspire consumers to look more closely at ingredients, nutrition and production methods.

A report by Mintel states that ‘ultra processing’ is the latest evolution of terms such as ‘junk food’ or ‘clean label’. Starting in 2024, more consumers will become aware of different levels of processing from media reports, regulations and voluntary on-pack labels with ratings.

Therefore, retailers should look out for brands that offer minimal processed food and drink that focus on the positive aspects of food-processing techniques.

Cost of living will continue to be a concern for all grocery categories as we move into 2024. Many individuals are now seeking more premium treats through retail channels. It is crucial that these indulgences remain affordable and do not result in post-consumption guilt.

The cost-of-living crisis is still at the forefront of consumers’ minds. However, rather than waiting for a resolution, consumers are learning to adjust. They will actively be looking to reduce spending on food and drink. As consumers adopt recessionary spending habits, brand loyalty is expected to dwindle as they become more willing to explore more options.

Come 2024 and local retailers need to be agile and stay ahead of the game, to offer more in choices, value and flexibility at affordable prices at a time when every penny and purchase counts. So be ready to offer more.