Nicotine alternatives used in vapes being launched in the US and abroad, such as 6-methyl nicotine, may be more potent and addictive than nicotine itself, though the scientific data remains incomplete, according to the US Food and Drug Administration (FDA) and independent researchers.

The synthetic substances - which have a chemical structure similar to that of nicotine - are not subject to US tobacco and vaping regulations that are designed to control traditional nicotine, a highly addictive drug.

That means manufacturers can sell vapes containing synthetic nicotine analogues such as 6-methyl nicotine in the US without seeking authorisation from the FDA - a process that can be costly, time-consuming and is often unsuccessful.

Big tobacco firms like Altria Group and British American Tobacco have already lost substantial US sales to an influx of disposable vapes containing traditional nicotine that are being illegally sold without FDA authorisation.

Altria, the maker of Marlboro cigarettes in the US, highlighted the emerging use of 6-methyl nicotine in vapes and other smoking alternatives in a May 9 letter to the FDA, according to a copy of the correspondence posted on its website.

It urged the agency to evaluate the compounds and establish what authority it had over them, warning they posed a "new threat" to regulation of the sector.

"The introduction and growth of chemicals intended to imitate the effects of nicotine, if left unchecked, could present unknown risks to US consumers and undermine FDA’s authority," the letter said.

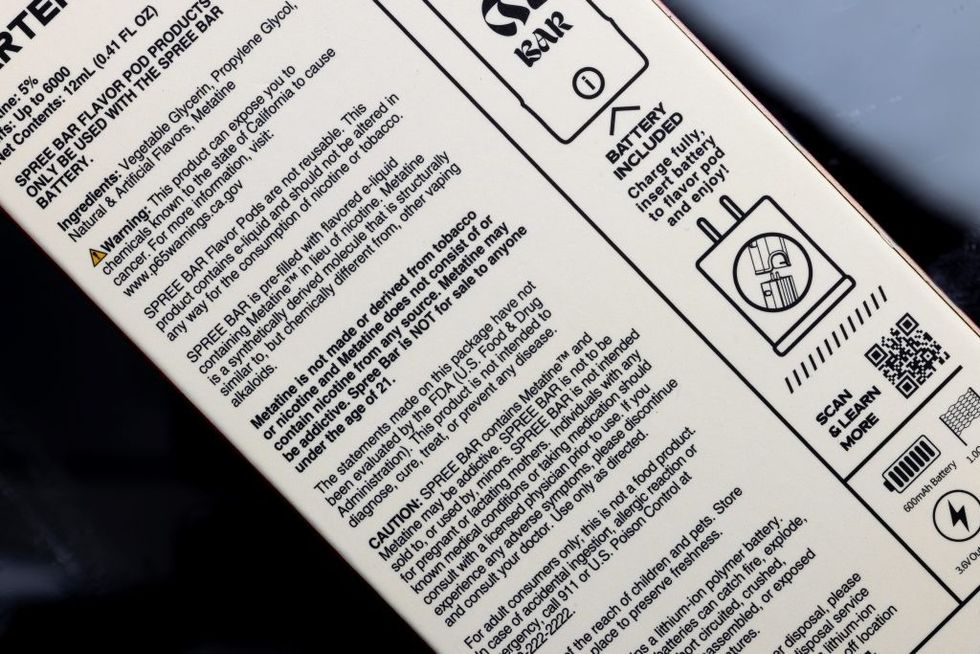

It cited Spree Bar, a vape launched in October by Charlie's Holdings Inc that uses 6-methyl nicotine.

The FDA does not comment on its correspondence with individual firms.

In response to Reuters' questions about 6-methyl nicotine and other nicotine alternatives, the FDA said in a statement: "Although more research is needed, some emerging data show these nicotine analogs may be more potent than nicotine – which is already highly addictive, can alter adolescent brain development and have long-term effects on youth's attention, learning and memory."

Traditional nicotine found in many vapes and pouches is extracted from tobacco leaves. 6-methyl nicotine, in contrast, is made entirely in the lab using chemicals.

The FDA said it was considering the use of such synthetic compounds from an "agency-wide perspective" and would use all of its resources to protect youth from products that may harm their health. As well as tobacco products, the FDA also regulates drugs, foods, cosmetics and more to ensure safety and efficacy.

"The FDA is a data-driven agency, and we're in the process of reviewing the available data to inform potential actions in this space," it said in response to Reuters' questions.

Three academic researchers told the news agency that current studies of 6-methyl nicotine are too limited to draw definite conclusions on the health impact or to what degree it is addictive.

Imad Damaj, a professor in the Department of Pharmacology and Toxicology at Virginia Commonwealth University, said his research showed 6-methyl nicotine may be more potent than nicotine, but more extensive tests were needed to say what impact it has on humans.

The limitations of existing research included that some papers were industry funded, while others focused on the short-term impact on animals or cells and were insufficient to understand 6-methyl nicotine's effects on human bodies, the researchers said.

Charlie's Holdings calls the 6-methyl nicotine solution used in Spree Bar Metatine. SPREE BAR's website says Metatine "may have a toxicity profile similar to nicotine".

Charlie's Holdings co-founder Ryan Stump acknowledged that more research is needed on 6-methyl nicotine, adding that the company dilutes it in its products.

Spree Bar promises users 6,000 puffs from each device and offers fruity flavours including "blue razz ice" and "creamy melon", according to its website.

The FDA has yet to approve any flavoured vape using traditional nicotine for sale in the US, saying companies have not been able to show that the health benefits they offer to smokers outweigh the known risks to young people, who may be more attracted by the flavours.

Stump told Reuters that the company only targets adults, adding that flavours played an important role in its mission to help smokers quit cigarettes. He said Charlie's Holdings respects and abides by laws in every market where it operates.

Stump said that Charlie's Holdings is working on new varieties of Spree Bar and new products using 6-methyl nicotine. It will launch Spree Bar internationally this year. He declined to say where.

The company buys the 6-methyl nicotine solution used in Spree Bar from another US firm, Novel Compounds, according to Novel Compounds' founder Samuel Benaim.

Novel Compounds imports 6-methyl nicotine from overseas and alters it to make it easier for manufacturers like Charlie's Holdings to use in their products. It sells this solution under the trade name imotine.

Tests commissioned by Novel Compounds have found 6-methyl nicotine to be no more harmful than nicotine, Benaim said. But he also said that more research was needed into the chemical.

Benaim added that Novel Compounds had received legal advice that its product is not classified as a tobacco product or drug in the US. The company is committed to legal compliance, he said.

More potent than nicotine?

Sven Jordt, a professor at Duke University, who has authored papers on products like Spree Bar, said 6-methyl nicotine could be more addictive and toxic than its traditional cousin.

"Do we want to have such a chemical as a recreational product, available to anyone?," he asked. "That's really questionable."

Neither Jordt nor Damaj - the professor at Virginia Commonwealth University - have received funding from tobacco or vape makers.

As well as the US, Novel Compounds also sells its 6-methyl nicotine solution around the world, including in the UK, Indonesia, India and Japan.

Another company, Aroma King, sells 6-methyl nicotine in the UK in pouches, which users insert under the lip to get a buzz. The pouches are sold in cans emblazoned with graphics of gorillas in suits and sunglasses.

It said in a February blog post that its 6-methyl nicotine products were "less toxic", "less harmful", and "less addictive" than regular nicotine products.

In a statement to Reuters, Aroma King cited existing research, its own toxicology and other tests and its supplier, which classifies 6-methyl nicotine as less toxic under the European Union's Classification, Labelling and Packaging of Substances and Mixtures (CLP) Regulation.

Aroma King said 6-methyl nicotine was self-classified by its supplier. It declined to say who supplies it with the chemical.

Four Chinese companies hold patents in China related to the production of 6-methyl nicotine, including Zinwi Biotech, a company that makes the liquid used in vapes.

Zinwi Biotech confirmed it is researching 6-methyl nicotine but did not answer further questions, including on whether it has sold any 6-methyl nicotine so far. Reuters was unable to find contact details for the other firms.

(Reuters)