In our country, a convenience store is more than just a place to buy groceries and daily supplies. A convenience store can be more like a lifeline, very much an integral and important part of a community dispensing a range of services.

Convenience stores have been offering a range of services since time immemorial. As the time changed, the services too evolved and took different shapes.

Services are a win-win solution that works for everyone. Not only it brings convenience closer to end-users, they also bring-in footfall, help in incremental sales, create a brand-image and eventually strengthen relationships with customers.

Moreover and above all, offering extra services is an easy and a sureshot way to survive the competition from ever-expanding multiples and discounters.

The coronavirus restrictions sparked a shift towards suburban living that has impacted the convenience market. This shift has also intensified consumer trends towards shopping and supporting locals, with most Britons now believing in supporting local suppliers and retailers.

Convenience stores have become centres of the community even more in isolated locations.

Chloe Hunsley from Association of Convenience Stores (ACS) strongly believes that offering services has a positive impact on communities.

“Local shops provide the communities that they serve with access to essential products and services, many of which may have otherwise disappeared from their local parade and it is because of this that they are highly rated amongst consumers.

“We know from our research that consumers rate convenience stores as the top local service that has a positive impact in their community, followed by pharmacies and post offices. Through offering the services that consumers need and want, local shops have a positive impact on their communities by meeting the day to day needs of their customers,” Hunsley said.

So beyond milk, bread and everyday essentials, what is it that stores across the country are offering?

At your service

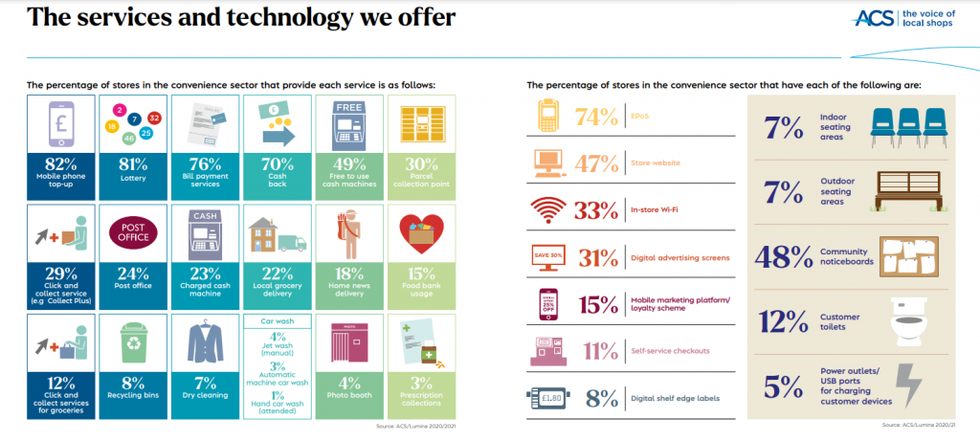

The ACS Local Shop Report 2021 statistics show that the most common service offered by stores is mobile top-ups (82 percent), followed by the lottery (81 percent), bill payment services (76 percent), free-to-use cash machines (49 percent) and post office (24 percent).

Services offered often depend on where a store is located and demands of its community. A store in London or Birmingham may not offer dry-cleaning or hairdressing services – which otherwise be advantageous in remote or rural stores.

In fact, it is these services that usually tend to elevate the status of a store in a community, especially in villages and remote areas.

Like, Ardingly News, a small convenience store in Ardingly-a small village in the Mid Sussex district of West Sussex, is much more than just a store, thanks to all the services provided by retailer Kamlesh Patel.

“It's a small store. But we have been offering mobile top-ups, bill payments and parcel collection services for many years now. People in this area are dependent on us because of these services and therefore we have managed in catering to them. They all are our loyal customers,” Patel told Asian Trader.

ATMs and cash-backs

Customers feel safer using an ATM in a trusted environment. Having an ATM inside a store attracts footfall, leading to better and greater chances of impulse purchase. This is one of the few services that customers regularly expect from a c-store and it ensures loyalty and regular customer flow.

Experts claim that an ATM in a convenience store increases basket spend by a considerable amount. In fact, as the use of cash dwindled alongside the rise of electronic payments, the number of ATMs and bank branches declined so for millions of people, their local shop is now the only place where access to cash is available.

Apart from ATMs, local stores are now stepping in to provide cash through the government's cash-back without purchase scheme, that provides a valuable new way to access cash on the High Street, allowing consumers to withdraw cash in convenience stores without the need to buy anything or pay a fee.

The system operates through a PayPoint network in local stores, and is backed by Link, which oversees the UK's cash machine network.

PayPoint’s Counter Cash service is currently running in more than 2,000 stores, providing vital access to cash services for communities across the UK.

People using the service can choose to withdraw any amount between 1p and £50, rather than just the notes dispensed by an ATM. They do not have to buy anything in the shop to receive the money, and are not charged a fee.

During the year-long trial, more than 24,800 transactions have been made, with an average withdrawal of £27.81.

Retailers receive a fee from the cardholder's bank each time the cashback service is used, and groups representing shopkeepers have given a guarded welcome to its expansion.

Lottery

The majority of convenience retailers (81 percent) offer lottery products. Overall, the lottery stand has been a very important part for both store-owners as well as shoppers. It not only bringsincome in the form of retailer commission offered on sales, but also introduces new customers to stores.

At best a store owner can get a token percentage of the lottery ticket purchases, though in reality, the entire benefit comes from boosting customer traffic and the resulting impulse purchases while they are in there.

Selling tickets comes with the responsibility of checking the age of shoppers – something retailers are well aware of, as revealed in a recent survey. Camelot revealed that 90 percent of National Lottery retailers visited correctly asked for ID as proof of age on their first ‘Operation 18’ mystery shopping visit – rising to 95 percent for second visits.

Current National Lottery operator Camelot works with 44,000 retailers across the UK, with independent outlets making up the majority. They earn around 5 percent commission for each draw-based game sold and 6 percent on each scratchcard, as well as 1 percent on certain prizes paid out in-store.

Post office

In a nationally representative poll of 2,000 people by Public First recently, 92 per cent said a post office was essential to have in an ideal town, and more people said a post office is essential to have on a high street in rural areas than a supermarket.

ACS revealed Post Office being voted by the public as one of the most valuable services in c-stores. And the reason is very much clear as having a Post Office in a local store means people can gain access to key services such as banking, passport and DVLA applications, travel services and home shopping returns (to name just a few), outside of traditional Post Office trading hours - everything that epitomises convenience.

Like the National Lottery, Post Office helps retailers to drive convenience shopping and give customers more reasons to visit their stores.In fact, c-stores in many ways are the saviour of the Post Office network, so the benefits run both ways. With stores’ longer hours and wide range of products create a sustainable and often interdependent environment for post office services while such stores significantly increase their sales due to extra footfall.

The relationship between c-store and post office works so well that they easily become a lifeline of a community- any disruption of which is met with hue and cry.

Home Delivery

Delivering groceries and other products to customers’ doorsteps is a service that is very swiftly becoming vital – a trend spurred by the pandemic.

Greg Deacon from Jisp home delivery agrees that the market has been heavily influenced by the pandemic.

“Shopper behaviour, routines and consumption altered due to the absolute nature of being locked down or not really wanting to leave home for a quite considerable amount of time- the ‘new normal’. This generated the rise of home delivery via own or third party services,” Deacon told Asian Trader.

Delivery service is a great way to increase shoppers’ dependability on the local store. Plus an underrated way to increase radius.

Asian Trader award-winning retailer Lewis Prager, who runs best-one Preens store in Wakefield, hit a jackpot when he introduced home delivery services as he was able to get new customers who were not his usual walk-in ones.

“What I did notice was, they weren't my customers we were delivering to,” Prager told Asian Trader. “People who order online for home delivery were completely new customers. It's a way to tap into a three-five mile radius of your store. So I would advise everyone to do it.”

ACS too acknowledges the rise of delivery services.

“Home delivery is a service that retailers are exploring to grow sales and profit. This comes with costs as well but could be profitable in the right location with the right product offer,” pointed out Hunsley.

Bill Payments, Parcel and others

Bill payment service provider PayPoint claims that about half of users end up purchasing additional items while they are on their bill payment or mobile-top excursion.

Hosting bill payment and mobile top-ups eventually become a great way to boost footfall.

Service providers enable retailers to facilitate the payment of pay-as-you-go gas or electricity,water bills, council tax and much more. Service provider Payzone also provides travel cards as well as pre-purchase-and-collect train, tram and bus tickets.

Another very valuable service that a retailer can offer through such service providers is parcel collections.

With click & collect parcel delivery services in-store, customers can shop online and send their parcels directly to the store and return them.

Collect+ is a network of locations made up of thousands of newsagents and convenience stores. Since the majority of Collect+ stores are open seven days a week, early ’til late, collecting, returning and sending parcels becomes easy and convenient.

Bill payment, mobile top-ups and parcel services offered by local stores experienced a boom recently, as people under lockdown turned to them for essential day-to-day purchases, or as a means to avoid crowds in busier shopping destinations.

Data from PayPoint show how highly communities have come to value these businesses, with 61 percent saying their local store had become more important to them during Covid-19 while almost one in three people said that they regularly used their local convenience store for parcel collection and returns.

As the UK continues to return to normal there will be further increased reliance on pick-up/drop-off parcel services. This is likely to be particularly true of convenience store locations around transport hubs such as train stations and bus stops.

Other community services

A new kind of store fixture is popping up in prime positions in hundreds of stores across the country, which has potential to give a much-valued service to the community as well as the environment.

As plastic waste becomes an ever more pressing issue, many stores, including many new co-operative convenience store locations, are hosting soft plastics recycling bins where people can drop cling film, biscuit wrappers and carrier bags for recycling.

In the recent initiative by Southern Co-op, regional co-operative has initially chosen 29 stores to trial the bins and, if successful, it is hoped they could be rolled out to even more of its convenience stores across the south of England.

Another very underrated yet very valuable service a c-store can offer is community notice boards which are more useful than ever before. The notice board can become a vital community hub, a place where everyone can post important information, requests for help, and offers of support.

Hosting and investing in a community notice board sends a very strong message that the retailer is invested in the community and cares about their health, safety, and wellbeing.

Owing to the fact that convenience stores cater to significant services as well as purchasing requirements of Britons, convenience stores continues to have the highest visit frequency among grocery channels, with two visits per week, compared with supermarkets with 1.8 visits and online grocery with 1.5 visits, according to Lumina Intelligence's UK Convenience Market report.

More than just a store, today’s convenience stores are sophisticated retail outlets providing 20 to 30 different services.

In fact, some independent convenience stores, especially if they are in rural locations, offer shoppers so much more than just food and drink- they are real lifelines for their local communities, providing them with essential services under one roof- something which they otherwise would not be able to access elsewhere.

Davie’s Mobile Grocery Shop

Davie’s Mobile Grocery Shop Inside the Davie’s Mobile Grocery Shop

Inside the Davie’s Mobile Grocery Shop