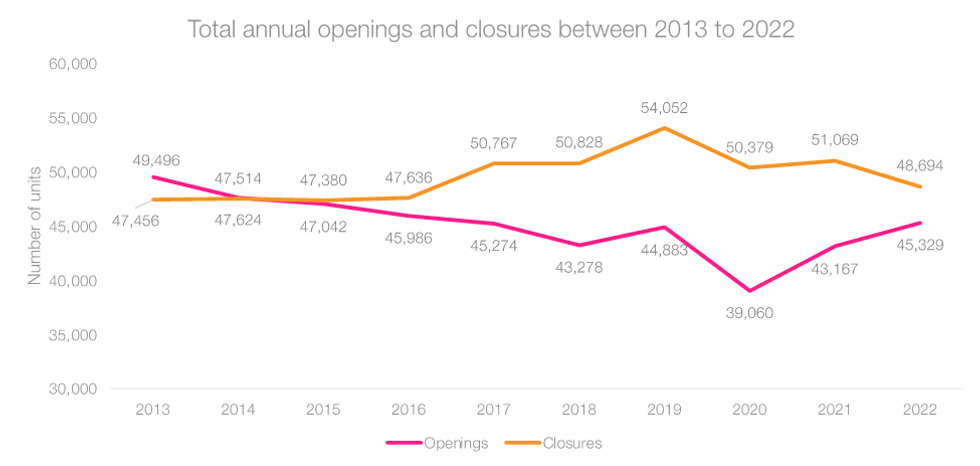

The gap between store openings and closures has narrowed to its smallest since 2016, a new report has found, as retail and leisure market witnessed signs of recovery amidst the persistent economic challenges.

According to the Retail and Leisure Trends Analysis 2022 by the Local Data Company (LDC), net change in units (openings minus closures) across Britain was -3,365 units over 2022, a 57 per cent year-on-year decrease from the 2021 figure of -7,902 units.

However, there was also a 5 per cent year-on-year decrease in store openings, as economic uncertainty, supply chain issues and rising inflation impacted new store plans.

The overall vacancy rate also experienced a notable boost, ending the year at 13.8 per cent. This represents a decline of 0.6 per cent on 2021, the greatest year-on-year decrease since LDC records began in 2013. Following a difficult few years since the onset of the pandemic, remaining retailers are largely more resilient than they have been in the recent past, the market research firm noted.

“As 2022 came to a close we were able to reflect on our first full year on the other side of a global pandemic. Happily as the year progressed, we were charting some of the most positive statistics we have seen since 2016, namely the largest decrease in vacancy rates in a given period and the fewest net closures,” Lucy Stainton, commercial director at the LDC, said.

“That’s not to say 2022 hasn’t been marred by some phenomenally tough economic headwinds which squeezed both businesses and consumers with unhelpful circularity.”

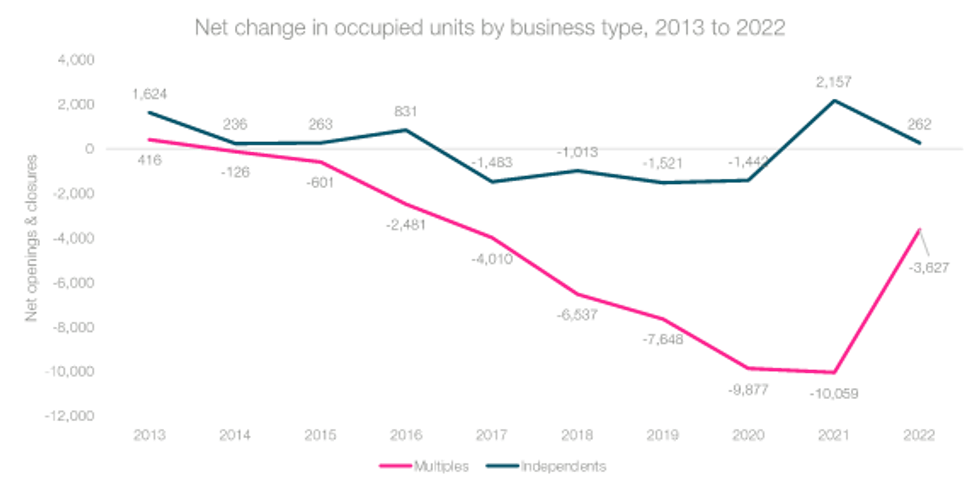

Following a large net increase of 2,157 units across 2021, the independent store sector did not perform as well over 2022, with a net increase of only 262. Independents have been particularly impacted by the energy crisis and the removal of some government support schemes.

Having been affected by a raft of CVAs and administrations in the previous few years, multiples fared much better in 2022, with net decline in units rising from -10,059 in 2021 to -3,627. This represents the best performance for the multiples sector since 2016.

“In particular, whilst overall market performance did improve, independent businesses have started to feel the pinch from the impact of the cost of living crisis and this is reflected in the slowdown in openings and increase in closures,” Stainton commented.

“Soaring energy costs, combined with lower levels of disposable income for consumers, have led to some independent businesses falling into trouble and closing their doors for good. Government packages designed to support small businesses recovery post-covid also came to an end, causing additional pressure.

“However, it’s important to acknowledge that openings are still strong – both across the independents and chains. This shows that despite a tough economic backdrop, local entrepreneurs are still active, and the larger chain retail and leisure operators have the infrastructure and agility to navigate these tests.”