Asian Trader talks to Jonny Briscoe, MD of Perfetti Van Melle, about life, candy and everything

Jonny Briscoe joined sweets, mints and gum maestros Perfetti Van Melle as its UK Managing Director from Mondelēz International back in early 2021, in the depths of lockdown. He was certainly taking on a challenge, as the pandemic had pole-axed sales of the mints and gum products that people usually pick up impulsively on their way somewhere – to work or play. Exactly what makes the category so perfect for convenience was proving to be its Achilles’ heel at that point, when everybody was staying put at home.

“It’s no secret the last year has been a challenge to the categories in which we play, and I am looking forward to leading the UK business back to the consistent high levels of growth seen prior to 2020,” Jonny said at the time.

Well, it is now three years on, and big things have been happening under his leadership.

“Since I've been here, we've gone from roughly £80 million RSV to £125 million-ish, to great growth and scale, but with a relatively streamlined range,” he says, on a visit to Asian Trader Towers from PVM’s idyllic Thames-side headquarters in Old Windsor – or maybe not quite so idyllic …

“It's lovely and we're right on the river, which 95 per cent of the time is amazing,” he says. “Less so when it's flooding. And we flooded in January, so we had to shut the office and redo a lot of stuff. But most of time it's beautiful. It floods about every 10 years, so we were unlucky.”

It sounds as if that is the only bad luck that Perfetti Van Melle UK – an arm of the family-owned Dutch-Italian confectionery company – has had since Jonny took over. In fact, they recently won something at our own GG2 Diversity awards, a sign that not only sales and profitability have improved.

“The award was for driving awareness of diversity. When I joined Perfetti I discovered it's a lovely family organisation, but I think it was still relatively in its infancy in terms of thinking about diversity as an agenda item. Emma, who is our former HR manager – she's gone on to a different role of at Perfetti now – did a great job over the last two to three years really driving Diversity Awareness in our UK arm, but also the European, so now we have things like a Diversity Charter, which focuses on how to drive gender diversity from a shortlisted interview point of view.”

Jonny has had quite a career already, transferring out of Mondelēz, where he was MD Northern Europe and overseeing chilled brands such as Philadelphia and Dairylea.

“I started my career in sales at Procter and Gamble and worked there for nine years across various different parts of their business, in the account management function, and then went into internal strategy,” he says.

“I left there to go to Mondelēz. I'm from Edgbaston and I grew up a mile down the road from Cadbury, so when Mondelēz called saying, ‘Are you interested?’ it was pretty hard to turn down. I suppose that's how I got into confectionery.”

He stayed with for Mondelēz for five years, the first three working on confectionery (“confect”) before coming over to full-time sweets at PVM “because I wanted to do something different”. It wasn’t a clean getaway, as PVM bought Mondelēz’s gum business last October – but that’s the crazy world of candy!

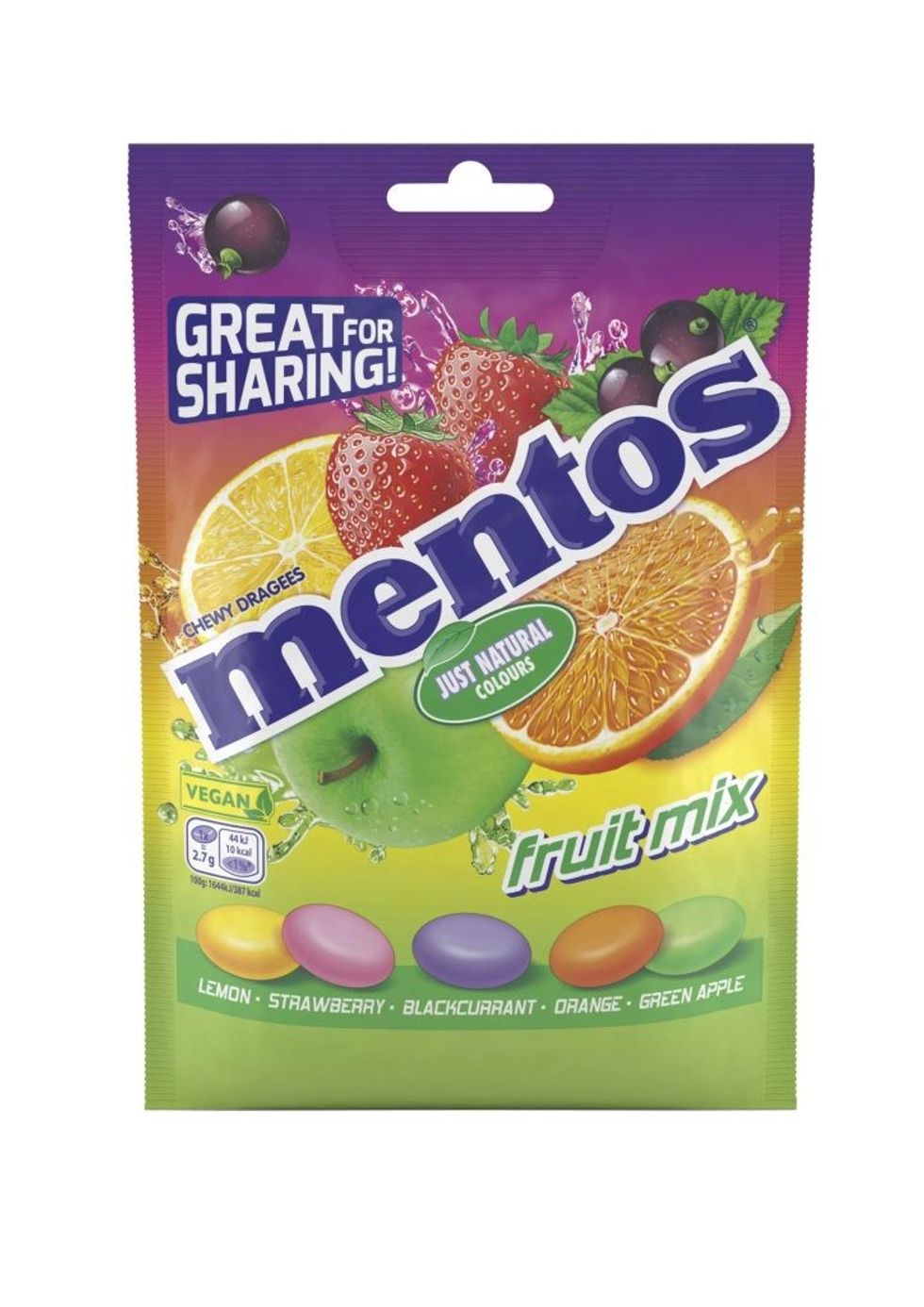

I note that PVM is an international company with very many brands across the globe, but that it restrains itself to just four in the UK: Mento’s, Fruit-tella, Smints and Chupa Chups. The thinking and strategy about choosing and placing different products in different markets sounds fascinating, as if a sweet tooth has a sort of cultural specificity. Is that true?

“That's a good question. We do have other global brands and good examples are Airheads, which is a great brand for us in the USA. And then we have Alpenliebe over in Asia, which is a bit like a milk version of Werther's Original, is the easiest way to describe it. Werther's is full of butter, Alpenliebe is full of milk, but similar type of dynamic.

“And then we have a lot of other types of brands. We have other gum brands in Italy, Vivident in Turkey. And then obviously we have a lot of these in the portfolio we have just bought [from Mondelēz] seven months ago and have brought them under the gum portfolio, which has Trident, Hollywood's and Stimorol in there.”

Sweet stories

Exactly what is the philosophy behind the British version of PVM?

“Our focus is around trying to drive the right portfolio for the market,” Jonny explains, “and all of our decisions are insight-based, from both consumer insights but also category-led insights. But in the UK, you know, Fruit-tella has been here, although not directly through PVM, for a very long time. And Fruit-tella Strawberry Stick has been here for 50-plus years.

“It would have been distributed back in the day by Van Melle [as it then was], so wouldn't have been direct distribution. But it's been the heritage of kids and the adults in the UK for a very long time.”

“Chupa Chups came direct to the UK a little earlier than either Van Melle or Perfetti and has been here for a long time. Smint when it launched, launched in Spain and the UK first, and then Mentos is one of our biggest global powerhouse brands. And the reason we launched Mentos in the UK – so I'm told, but I don't know the truth of this – is because the Trebor soft-mint factory flooded, and they couldn't sell them anymore.”

More flooding. It is almost as if the best things happen by chance.

“Mondelēz went to Van Melle to ask them to make Trebor back in the ’90s, which they did, but also, because of the success of Trebor, they decided to launch Mentos on the back of it, and that's where Mentos came in, I think the late ’90s, early 2000s.”

Apart from streamlining with specific brands, PVM stands out because of its product strategy. Confectionery is almost hyper-active where NPD is concerned, with many new bars and packets and brands appearing and disappearing all the time. PVM, against this trend, has chosen to stick with its four champions and develop products within them – such as Mentos Gum and Smint Defensive – with NPD remaining recognisably part of the existing and well-loved logos.

“Lots of people tell me that they wish we would bring Airheads or Stimorol to the UK. But the reality is, consumers and shoppers need to understand the brand, understand what it does, make sure it's differentiated versus what's out there today, and then buy it.”

It appears to be a successful strategy.

“As I said, we've grown from about £80 million in retail sales in the category to about £125 million in three years,” says Jonny. “We've had significant growth and the goal is to continue, so we should have £135-£140 million-plus this year, and then beyond. I say this to my team sometimes, and they look at me like I'm mad, but I think we should be a £250 million manufacturer in the UK. As we scale, we have the opportunity to do more, but we'll only do that with the right insight.”

Jonny says they are continually reassessing the portfolio to understand what's needed.

“Would we bring another brand over in the foreseeable future or not? It's possible, we never say never – but we would look at what can we bring over that is under Mentos Gum,” he says, for an example. “We have a really good Mentos Gum brand here that's growing significantly, growing ahead of the category over the long term, and we're still building versus a very strong, dominant player – Wrigley.”

With that sort of performance you don’t need to start up untried new things – instead you can move ahead from within. I remark that PVM has just revamped Fruit-tella, brought out Mentos Discovery, and Smint ‘Defensive’ …

“I think the core is still a power mint, as we call it, which is an instant ability to be refreshed,” he says. “It's all about giving you that confidence every day and most of our business remains there. The dispenser still exists but it's more about the core tin now which you can get in 50-piece 36-piece, Peppermint and a load of other flavours. That's where it's really at.”

There’s an “organic” logic that guides development, it seems.

“As a company, we're also looking at other spaces around wellbeing, whether that is calming, whether that is more functional, vitamins and health needs,” he answers. “That's where Smint Defensive came from – that insight, which was around, ‘How do we play in an area that gives people refreshment but also added benefit?’ Which is, I suppose, a non-medicated solution to having a cold, which people seem to have permanently these days.”

It's also sugar free, and he points out that in the UK, that cough-sweet area is typically dominated by brands that contain sugar, “and which are exempt from the HFSS legislation, by the way, which is interesting”.

Because they're medicinal?

“Not because they're medicinal but because they lobbied, which in itself is fine. But for me, it's all around how do you provide really great tasting products with additional benefits? And with Smint Defensive – I mean, I'm biassed, I admit – but it's a phenomenal product.”

I am still thinking how crafty the lobbying was by the lozenge companies.

“Our challenge is that Smint Defensive plays outside the category norms. It's not a mint, it's a health sweet. Therefore, we have to have different areas of the store, so where we distribute in places that are appropriate, like Boots, Smint Defensive sells really well. It sells incredibly well at WH Smith Travel in the airports. But apart from that ... It shouldn’t be a niche thing, but it's got added things in there that are really helpful.”

So the idea is that the core range brings it into key areas, such as the counters of c-stores, and over time normalises Smint Defensive as part of the core brand?

“Once we believe in something we tend to do it for the long term. We don't need to be a huge brand overnight. We're willing to be here and grow a brand sustainably with the right investment over time, so I think the Smint Defensive proposition is here to stay. And there are lots of other innovations globally, as you mentioned before, that we can look and play into that space. But not yet.”

Insight and innovation

Jonny thinks that the category is getting better – because not so long ago it was a bit staid and boring, which seems counter-intuitive given all the apparent colour and activity.

“You had Cadbury, which is great product,” he points out. “You had Mars. And then with sweets, you had Maynard Bassetts and Haribo, and that was sort of it.

“It just wasn't that exciting as a category. Then, a lot of these niche brands and startups started to come in and you had Divine chocolate, you had Tony’s Chocolonely. I think Mondelēz on biscuits did a good job with belVita and Oreo as brands they owned. And that really kickstarted the need for innovation because what big manufacturers saw was, you can't just keep punting the same stuff and hope for the best.

“Mondelēz is more skewed toward chocolate and biscuits than candy. I think the innovation in the category has got better, that is my overall assessment, driven by smaller startups – a bit like beer. Before the craft beer craze came in, it was quite a boring category. And chocolate was the same.

He believes this been the single biggest change in confectionery: a huge investment into innovation “Which, for me, is what makes the job exciting, but also for consumers and shoppers.”

The mints and gum category was – as we noted – knocked sideways by lockdown, and then came the economic woes we are still living with, and of course HFSS legislation, although it affects the convenience channel relatively obliquely, at least so far, because stores below 2000 square feet are excluded from the legislation, and still-pending extra rules have now been delayed. But is has – like the sugar tax did with soft drinks – affected product development and category outlook.

“Well, the category is still growing at double digit rates, so ultimately, it doesn't seem to have had its desired effect,” Jonny says, implying HFSS was designed to deter sweet-munching, adding pointedly that the new rules are not “consumer-driven”.

“Volumes are challenged, but personally I'm not sure it's fully driven by HFSS. What we have seen is, if you walk into front of store today, you won't see sweets or chocolate. Unfortunately, in my view, what you see instead is mountains of alcohol. And you know, Christmas, you couldn't buy our gum in some shops, that's on checkout, because it was hidden by the Baileys. And for me, that isn’t particularly consumer-driven [either].”

Chupa Chups stands remain welcome on c-store counter-tops throughout the land, and gum and mints are not particularly driven by POS promotions:

“A lot of ours was growing through convenience channels, where the shoppers were buying on impulse, which tends to not be as much about display,” he says. “In terms of the performance of PVM, we're growing ahead of the category with double-digit growth. We were not particularly feature-led anyway, as a brand and a category and manufacturer, and we didn't have a lot of our products on gondola-end, so we haven't been heavily impacted as a manufacturer [by HFSS rules]. In fact, we've grown.”

He agrees that the rules – allegedly all about health, but effectively a sort of tax on commercial enterprise, have indeed stimulated new thinking and strategy.

“What it has forced us to do, which I think is positive, is think differently about our portfolio. So for instance, these new Fruit First jellies from Fruit-tella wouldn't have happened without the legislation. We've launched a really great product, but it is a bit better for you and that's a good thing, I suppose, from the legislation.

PVM has also been forced to think of different ways to bring products to life in the aisle, “which means we're spending more money on things like cardboard,” he sighs.

Voyage of Discovery

PVM recently launched a new product from the Mentos stable called Discovery, which manages to place 14 different fruit flavours in a single tube. The difference from other “selection rolls” is that the production line machinery was able to be tweaked so that each of the fourteen flavours was guaranteed to be in each roll, and in the same order. It’s a piece of genius, as not only do you find yourself wanting to taste each one – knowing what is coming up next – but it makes you wary of missing out on one – as I “discovered” when my wife tried a sample packet (“Get your own!”).

What was the thinking behind Mentos discovery, because it appears to be looking at hooking customers at both ends of the age range?

“All of our skus are almost point-of-market-entry – for the new people coming in,” Jonny explains. “We have some skus that are skewed to older consumers, Mentos mints and chews tend to be the more older generation. But Mentos core candy tends to be younger millennials. Fruit-tella is all about parents to kids to about 4-12 and Chups Chips for the teenagers and in between the two.”

Looking at the figures, it is certainly working – double digit growth after all – but who is PVM taking market share from?

“So of course we're winning market share versus some people, but we're not specifically targeting other manufacturers,” he muses. “We're trying to drive the overall category and ensure that penetration still stays high in the category. I think sweets is just over 90 per cent penetration, but it is declining slowly. Every time you lose one at the top end, you have to bring one at the bottom end – and our brands do a good job of that.”

The category is certainly changing, and Jonny reveals that Halloween 2023 was one of the first years ever that saw sugar confectionery as a category steal from chocolates.

“Now, there's lots of reasons for that. HFSS may have had an impact, but typically, chocolate is ahead of sugar on pricing. You've seen a bag of chocolate go from £1 to £1.25 to £1.35. I think I saw some chocolate today £1.65 for a bag. Typically, sugar is cheaper.”

Stealing market share from chocolate, then – and with a cocoa record price predicted for this summer.

“We see ourselves as part of confectionery but also part of total snacking. If you think about it, confectionery is probably £5-6 billion and snacking is +£40 billion, which means we are part of a broader scene, and it's not that we want to steal share, although clearly it has an impact.

Add to that, that chocolates already had its premium boost, with Green and Black’s and Tony’s Chocolonely and so on. I suggest that chocolate (candy’s real rival) surely can't go a lot higher on c-store shelves.

“Well, never say never,” he laughs,” but I wouldn't have though so – certainly for mass consumption there'll be a ceiling at some point.”

And frankly that favours sugar. PVM has just had the new Fruit-tella Fruit First packs, alongside the “Out in Space” and “By the Sea” (and so on) jellies series. Smints are going technical with Defensive, and Mentos is discovering new fans: cost-of-living crisis or not, it’s a deliciously chewy future outlook for PVM.