Christmas is the biggest occasion in the chocolate category for the independent channel, even beating Easter.

Self-treating begins early, and repeat purchases can increase sales and revenue for the well-prepared retailer. Later, gift boxes and last-minute impulse purchases can add to volumes of sales considerably.

All kinds of candy and confectionery are extremely popular in the festive season, as both gifts and during get-togethers in the increasingly popular sharing format.

The sweetest season

The festive confectionery market has demonstrated remarkable resilience despite economic challenges. In 2023, grocery sales during December reached a record £13.7 billion, driven by a seven per cent increase in value and a two per cent rise in items sold.

“This increase in expenditure is in part due to shoppers trading-up to premium ranges or luxury brands which was not to be expected in the face of the cost-of-living crisis,” observes Alison Robson, marketing manager for Baileys Chocolate. “This is evidence that consumers are still keen to indulge during the festive period, irrespective of their normal spending habits.”

Robson highlights that this trend extended to confectionery, which remained a consumer favourite even in the face of rising cost-of-living concerns.

“Shoppers wish to use the Christmas period as a chance to indulge and enjoy their favourite sweet treats,” she explains. Baileys Chocolates saw a 12 per cent sales growth during this period [Nielsen], driven by the brand’s reputation for quality and indulgence.

During Christmas 2023, the confectionery category performed exceptionally well, reaching a value of over £2.5bn [IRI Unify]. This represented a year-on-year growth of 12.8 per cent [Kantar Worldpanel] as chocolates and sweets remained popular for the festive period among friends and family.

Notably, 98 per cent of UK households purchased confectionery during the holiday season, spending an average of £68 per person, as per Kantar figures. Chocolate continues to lead confectionery sales during the holiday season, with a growing value of £1.9bn, an increase of 12.4 per cent since last year.

Additionally, sugar confectionery also plays a significant role, with sales exceeding £490 million during last Christmas and growing faster than chocolate at 15.5 per cent year-on-year.

“This demonstrates the significant opportunity available to retailers to boost sales by stocking up on the right confectionery products for the occasion,” notes Andy Mutton, managing director, Storck UK. “The Christmas spirit of sharing and gifting remains to be popular, especially within chocolate products such as boxed chocolates, limited editions and novelty chocolates, including advent calendars.”

Kathryn Hague, Head of marketing at the confectionery wholesaler Hancocks highlights that most of this growth was seen “in the late season, around mid to late December,” adding that the growth in the category was largely driven by chocolate cartons, sugar pouches, self-eat, boxed confectionery and novelty products.

“Retailers should use these statistics to their advantage and stock up on confectionery products ahead of the festive season,” she advises.

Premium chocolate has been a bright spot, with unit sales rising by 2.4 per cent over the past year, despite the overall chocolate category seeing a 2.3 per cent decline.

“Premium chocolate is where independents should dedicate more space to in order to win this Christmas,” Lydia Stubbins, group marketing director at Divine Chocolate, advises, recommending retailers to stock Divine, which the leading premium chocolate brand in terms of unit growth over the last 12 weeks – up 47 per cent year on year [NielsenIQ].

Laura O’Neill, senior brand manager at Mars Wrigley, also highlights the significance of Christmas for confectionery, explaining: “Seasonal and gifting is worth £1.8bn of total chocolate value sales. Christmas remains a key occasion … and chocolate plays an important role during many key seasonal rituals, from small festive gifts to the daily delights hidden in an advent calendar.”

Gifting and sharing

The tradition of gifting and sharing remains central to the festive season. Gifting blocks make up five per cent of total winter confectionery sales [Nielsen], so are a must-stock for retailers in the weeks leading up to Christmas Day.

“50 per cent of winter sales are made in December, so this last push before the big day is a great opportunity for retailers to drive sales through gifting and sharing formats, including selection boxes such as the Cadbury Medium Selection Box and Cadbury Buttons Selection Box,” notes Susan Nash, trade communications manager at Mondelēz International.

Cadbury offers a wide range of gifting blocks including the classic Cadbury Dairy Milk 360g bar, as well as this year’s 200th anniversary limited-edition tablet. 2024 also sees the return of the Cadbury Dairy Milk Winter Mint Crisp 360g block to shelves, helping retailers further tap into the sharing occasion with this popular flavour.

As a rise in shoppers’ confidence in spending has been recorded throughout the year and is believed to continue in the lead-up to Christmas, Mutton says the confectionery category is set to thrive with this boost in consumer confidence and an increase in shoppers looking for indulgent treats and gifting opportunities.

“Sharing boxes, sweets, and chocolates are considered affordable treats that bring comfort and joy to festive occasions, with seasonal sales set to grow,” he predicts, noting that Storck UK’s portfolio of “popular and loved brands” is well situated in the chocolate and confectionery category for the holiday season, offering shoppers something for all occasions.

“Retailers can maximise their sales by stocking up on Storck UK’s core and seasonal range, with Werther’s Original, Riesen, Bendicks, Toffifee and merci performing well last Christmas,” he adds.

Storck is returning Werther’s Original Golden Mix Christmas gift box this holiday season, featuring an assortment of classic treats, including butter candies, toffees, creamy filling, and chocolate fudge.

“Caramel lovers can indulge and share this unique selection with loved ones, while the eye-catching festive packaging attracts seasonal shoppers,” Muttons says.

Worth £36 million, Werther’s Original holds the number one place in the traditional sugar category in the UK [IRI], maintaining a consistently high brand penetration of 15.4 per cent [Kantar].

This year, the brand has invested in a multi-million-pound media campaign. This includes a TV advertisement that will air in the lead-up to Christmas, ensuring that awareness is high when people make seasonal purchases.

O’Neill comments that, while consumers remain conscious of their spending, they continue to seek out well-known and loved brands and products. “The appeal of these is expected to stay relatively strong due to their ability to provide moments of indulgence and connection during the festive period,” she adds.

Celebrations and Maltesers Assorted Truffles are among Mars Wrigley’s top performers, offering indulgent options for both giving and personal enjoyment.

Celebrations, for example, has performed well over the last few years, seeing 16 per cent MAT value sales growth vs YA and delivering 7.2 per cent value sales between October and December 2023 versus 2022 [NielsenIQ].

“This clearly demonstrates the brand’s position as a firm favourite with consumers. In terms of individual products, Celebrations Tub is the number one gifting SKU in the total UK gifting category and the number one full year Twistwrap brand,” O’Neill adds.

For its festive NPD, Mars Wrigley has combined innovation with tradition. The launch of M&M'S Crispy Santa Shapes encapsulates the fun of the season while catering to the growing self-eat category.

“With the self-eat category growing by two per cent year on year, and 36 per cent of Christmas sales coming from small shapes [NielsenIQ], the new release is the ideal permissible treat, meeting multiple consumer needs while bringing the brand’s signature fun to the festive season,” O’Neill explains.

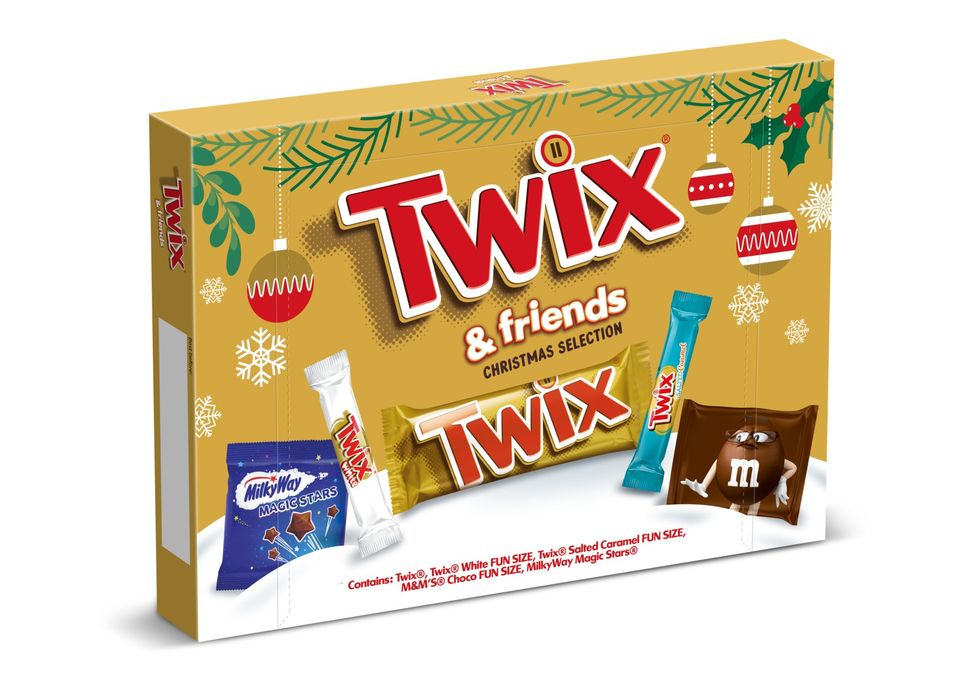

Harnessing the popularity of Twix which is outperforming the category and has a 25 per cent category penetration (1.7 per cent ppts vs YA), NPD from the confectionery giant also comes in the form of the Twix & Friends Medium Selection Box.

The assortment of favourite chocolate goodies is presented in festive cardboard packaging, making it perfect for gifting, and the launch is being supported by a £8m+ media plan.

Maltesers Assorted Truffles are also back by popular demand this year following its success in 2023 which saw the total range grow by 11 per cent.

Mondelēz is also bringing something unique to shoppers’ advent countdown with the launch of the Cadbury Dairy Milk Creamy Advent Calendar, featuring 24 Cadbury Dairy Milk chocolates with a soft creme filling.

“It’s a great option for those looking to trade-up this year and make the countdown ritual even more special,” Nash says.

In addition, the Cadbury Puds range is expanding this year with the launch of new Cadbury Mini Puds, bringing this festive favourite into a bitesize bag format for the first time. The 73g bags feature Puds’ iconic festive design and are set to appeal to shoppers looking for a stocking filler gift or even as a treat to enjoy themselves.

Emerging trends

Two key trends dominate the festive confectionery market: flavour innovation and nostalgia. Mint chocolate, for example, is gaining traction.

“The mint chocolate market size is projected to reach multimillion dollars by 2031 and we see this trend work its way to the UK with key players enjoying growth in mint chocolate flavours,” Robson says.

Baileys responded to this popular flavour trend with their Mint Chocolate Truffles, made with a milk chocolate shell and a mint-chocolate truffle centre with a hint of delicious Baileys Original Irish Cream.

Robson says household-name brands such as Baileys Chocolate can benefit from this trusted status because consumers are more likely to try a new flavour or product from a brand they can rely on the quality of.

Nostalgia also remains a powerful driver. “Our Christmas range taps into the current trend of nostalgia perfectly,” says Stubbins, referencing Divine’s classic Chocolate Coins, Giant Milk Chocolate Coin, and Mint Thins.

Mondelēz taps into the Christmas nostalgia with the return of its beloved Cadbury Dairy Milk Coins, which were a huge success - ending the season as the number-one NPD across the whole market with over 1.4 million packs sold [NielsenIQ].

“Bringing a touch of nostalgia and magic to the season, Cadbury Dairy Milk Coins are a great stocking filler, set to delight shoppers again this year and drive incremental sales for retailers,” Nash says.

At Hancocks also, their best-selling confectionery line from last year was the “nostalgic favourite” Bonds Milk Chocolate Coins 60g bag, which works great as a stocking filler or small gift, according to Hague.

Their other top selling lines included Bonds Candy Canes, Bonds Mixed Case Candy Cups, Bonds Festive Mix Candy Cup and Kingsway Fizzy Christmas Trees. The 2024 range of the wholesaler builds on this with new and improved options such as Candy Realms Christmas lollies and Bonds Snowflakes Candy Cup.

The large range of seasonal sweets also includes Kingsway’s Jelly Elves, Fruity Reindeers, Fizzy Christmas Trees, Snowman & Snowflake Mallows and Candy Cane Gummies.

“Boxed formats are also popular at Christmas for gifting and Bonds of London stocks a selection of sweet shop favourite treats in attractive boxes including Rum Truffles and Turkish Delights,” Hague says. “Bonds Pun Boxes are another fun and quirky gifting option that come in a variety of fun designs and names including You’re Eggstra Special and the award winning You’re One in a Melon.”

Meanwhile Hancocks’ sister company and confectionery distributor World of Sweets has brought new launches from premium confectioner Anthon Berg for Christmas 2024.

New to this offering is a collaboration with the leading cream liqueur brand Baileys, with the Anthon Berg Baileys Marzipan Treats. Each marzipan round is covered in Anthon Berg milk chocolate, with a swirl of dark chocolate as decoration and the taste of Baileys cream liqueur.

Norwich-based chocolatier Gnaw has taken the festive chocolate market by storm with its revamped brand identity, not only bringing a welcome dash of vitality and exuberance to the UK’s bustling chocolate and gifting fixtures but to trumpet the business’s new adult-orientated appreciation of nostalgic comfort food, ambitious flavour marriages and compelling mouthfeel and textures.

“Over the last 12 months the team and I have been immersing ourselves within the latest food trends, not simply within chocolate but throughout all the key lifestyle food and drink movements,” Mike Navarro, Gnaw’s managing director, explains.

“We have always known that we made incredible chocolate but needed to reaffirm our commitment to unearth bold, unapologetic flavours that tap into happy childhood memories, comfort food yearnings and happy nostalgic moments.’

New offerings from Gnaw include New York Cheesecake bar, Raspberry Mojito, Seville Orange, Popcorn & Peanut, Espresso Martini, Honeycomb & Caramel, Peppermint and Sticky Toffee Pudding, all crafted using ethically sourced Colombian cacao and sustainable packaging.

“Initial feedback from both loyalist and pending retailers has been nothing short of incredible, so we simply can’t wait to see how consumers respond in the run up to the festive season and beyond,” Navarro adds.

Health-conscious choices are influencing consumer decisions too. “We’re hearing a lot of consumers now talking about how they are looking for ‘healthier’ chocolate and treats. As dark chocolate has a lower sugar content than milk or white chocolate it fits with this demand,” Stubbins observes.

Divine has seen the strongest unit growth year-on-year from their dark chocolate range – outpacing white and milk chocolate - and according to Morder Intelligence trends for higher-cocoa indulgence are gathering speed, with dark chocolate expected to be the fastest growing sub-segment of the premium chocolate market through 2030.

“This means that this year, Divine has ensured we have festive must haves, like our Chocolate Coins and Advent Calendars available in both milk and 70 per cent dark chocolate. Our dark chocolate versions of these are vegan too – opening them up to a new segment of consumers,” Stubbins explains.

Time to shine

For independent retailers, the festive season is an opportunity to stand out by offering unique products and exceptional service. Robson highlights the advantage independents have in responding to trends and stocking seasonal novelties.

“A shopper mission that stands out during the festive season is the consumer desire for new and exclusive festive varieties of their favourite confectioneries and brands. We typically see NPD driving sales spikes for brands as consumers are keen to try limited edition or seasonal products,” she says.

“Novelty” products, including advent calendars and selection packs, make up 30 per cent of Christmas sweet sales, and Robson notes stocking unique products can set independents’ offering apart from those of the multiples and engage customers to return to find more unique offerings in this category and others.

Baileys Chocolate Assorted Truffles exemplify the appeal of novelty formats and innovative flavours, featuring festive flavours such as Strawberries and Cream, Salted Caramel, and Birthday Cake. “The assorted flavours and gift box branding denotes festive indulgence whilst still being a recognisable household brand that shoppers purchase year-round,” Robson says.

Stubbins highlights the convenience factor, especially for last-minute shoppers. “There will be points throughout the festive season when consumers will want to avoid the multiples,” she explains. “No one wants to be standing in a massive queue in their local superstore on Christmas Eve morning, having forgotten something small, like a stocking filler or Christmas gift for a neighbour. This is where independents can win!”

She advises retailers to ensure they have stocked up on some gifting and stocking filler options for these specific shopper missions and that they’re well placed in store to catch the shoppers’ eye. “Divine’s stocking fillers like Milk and Dark Chocolate Coins, our Joyful bar and Mint Thins play nicely into this,” she adds.

Stubbins also notes that the products that work best in convenience are versatile and can fit into different consumer occasions and shopper missions.

“Products like Divine’s Mint Thins or Joyful Bar – a limited-edition block chocolate bar that sold out for Christmas 2023, and is packed with Christmas flavours like sweet caramel, crunchy hazelnut pieces and tangy candied orange. These can work as a mid-afternoon treat, a gift for a friend or as a post dinner pudding – meaning there are suited to a range of occasions,” she says.

Matton says their Toffifee, a delightful hazelnut floating in caramel covered with creamy nougat and chocolate, makes for the “perfect stocking filler or gift to share” with loved ones. And Riesen, which has seen double-digit growth in both value (+45.3 per cent) and volume (+21.9 per cent) in convenience [Circana], is ideal for any festive occasion, with signature treat featuring dark Gavoa cocoa chocolate on the outside and a rich chocolate caramel filling.

Toffifee is also supported by a national TV campaign, positioning itself as a brand for sharing occasions.

With over 30 lines, Rose Marketing UK offers retailers an extensive and sought-after choice of Christmas confectionery. With sure-fire appeal to everyone, The Snowman and the Snowdog range is “guaranteed to bring smiles to recipients faces,” says Steven Watt, chief executive.ew for 2024 is a Harry Potter Stamper with Jellybeans featuring all the fan-favourite characters. Presented in a branded counter display box of 24 x 8g they will retail at a purse-friendly £1.39 making them ideal stocking fillers or Christmas Eve box treats.

Other affordable treats include bags of Chocolate Sprouts 100g RSP £2.39 and SLUSH PUPPiE Candy Canes RSP £1.49.

The 2024 collection also features a new Candy Castle Crew’s Christmas range including Fizzy Gingerbread Man, Fizzy Christmas Trees and Fizzy Holly Jolly Mix bags. These fun and festive treats, some of which are suitable for vegan diets, come in a range of fruity flavours and conveniently packed in 90g bags.

“Ideal for impulse purchases and with a suggested retail price of just £1, they offer excellent value for money and are sure to be a popular choice for consumers this Christmas,” Watt says.

To add colour to a festive display, he urges retailers to stock the Rose Tutti Frutti Rainbow Candy Canes Bucket packed with 80 candy canes. Priced at just RSP of £0.40 per unit they are an affordable and cheerful stocking filler. Additionally, the Christmas Jelly & Rock Pops, priced at a competitive RSP £1.00 per pack, are cleverly designed to feature festive favourite characters like Santa, Penguin and Reindeer.

Rose also has products that can be stocked for both Christmas and into the New Year. Hot Chocolate Stirrers 30g RSP £1.49 and deliciously creamy Hot Chocolate Bombs that amplify the flavour of a favourite chocolate drink are ideal stock lines for Winter. Available singly 24g RSP £1.00 or as a 72g trio pack RSP £3.00.

Winning strategies

Effective merchandising is critical to capturing consumer attention during the festive rush. Robson stresses the importance of early preparation and strategic stocking.

“Festive celebrations and preparations for the festive season are starting earlier each year,” says Robson. “This is due to a number of factors including a consumer desire to be more prepared and spread the cost over a longer period, as well as brands wanting to maximise profits and edge out their competitors. Retailers can capitalise on this by making seasonal goods available earlier and take advantage of consumers’ demand for these limited-edition goods.”

She advises retailers to stock premium and boxed chocolates early, as these are popular for gifting. Smaller items, such as stocking fillers, are best introduced closer to Christmas to drive impulse purchases.

Stubbins recommends to tap into consumer-led trends or ways of thinking, as well as stocking day-to-day classics.

“On-trend products are a great way to increase profit margins, they often come at a slightly more premium price, but consumers are usually willing to pay more for these. Stocking on-trend products can also help make you a destination retailer, that customers are willing to travel to,” she adds.

Gemma Allanson, national field sales manager at World of Sweets, stresses the importance of impactful displays.

“In the run up to big seasonal sales periods it's vital to have a clear and purposeful POS with all confectionery products. Increasing the selection of products throughout the store and showcasing a varied and fully-stocked Christmas display looks much more attractive and can encourage repeat customers,” she says, adding: “Make the most of special offers and promotions by having large and clear displays to help make customers aware of what’s available.”

Offering a range of price points and pack sizes is crucial in addressing consumer budgets. Mars Wrigley has prioritised value, with O’Neill noting, “By offering a variety of pack sizes, from sharing to multipacks and single-serve options, we cater to different consumer needs and financial situations.”

As shoppers look to get into the festive spirit of sharing and gifting during the holiday season, Muttons advises retailers to expand their product offerings beyond the usual confectionery items.

“In addition to stocking seasonal varieties, they should also look to increase their sharing and selection box range which performed well in the confectionery market last Christmas,” he says.

He also emphasises the importance of maintaining stock levels, particularly in the final three weeks before Christmas.

“As Christmas approaches shoppers will seek boxed chocolates, indicating that retailers should be prepared for increased demand in the final three weeks leading up to the big day and ensuring stock availability,” he says.

Rose Marketing has a new eye-catching Christmas-specific Countertop Stand. This free-standing display showcases a tempting selection of 54 pocket-money priced sweets, including 20 Christmas Dippers – a delicious combination of hard candy and sherbet dip in three refreshing flavours, alongside 12 festive Christmas Tree Lollipops and 24 Santa Liquid Pops.

With a modest RRP of just £1.25, Watt says these products are sure to drive incremental sales and increase overall basket size.

He recommends displaying Christmas lines within regular confectionery fixtures and creating additional seasonal displays as well.

“This makes selection easier and boosts impulse purchases. Gondola ends are another way to increase visibility and drive sales,” he adds.

Festive chocolate and confectionery are much more than indulgent treats—they are symbols of joy, tradition, and connection. With strategic planning, retailers can maximise the potential of this lucrative season.

By offering a mix of nostalgic favourites, innovative products, and well-planned displays, retailers can ensure a sweet and successful Christmas for themselves and their customers. As Watt concludes, “Christmas delivers the biggest sales uplift for confectionery … Sharing boxes, sweets and chocolates can evoke memories and bring comfort to festive occasions. They are often seen as more affordable indulgences, so it is imperative to stock a wide range of sweet treats to boost that all-important bottom line.”