September marks the 60th anniversary of World Food wholesaler Wanis

1964 was a year for the history books: Muhammad Ali became the Heavyweight Boxing Champion of the World, America was in the throes of “Beatlemania” … and Wanis opened its first shop in London’s old East End.

Mr and Mrs Wadhwani – or “Wani” as they affectionally became known – were the parents of Kapil and Sanjay, the current Directors. It was then that they took the first steps in the family business that, after six decades of long working hours, stress and sacrifice, has become one of Europe’s leading World Foods distributors, employing over 200 people and creating thousands of jobs and business opportunities worldwide.

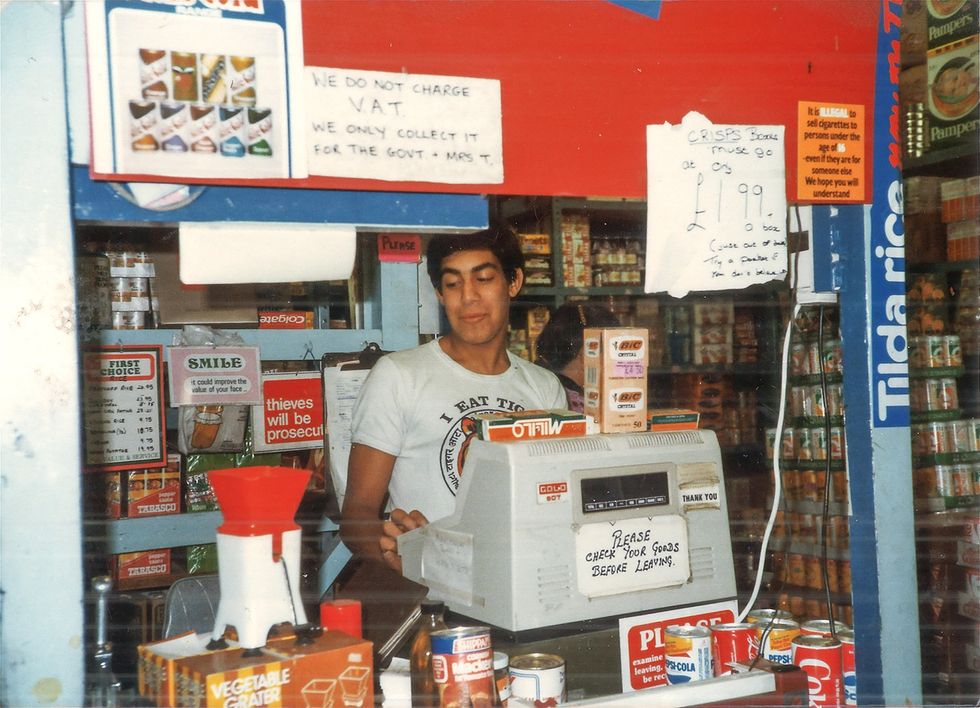

Proudly taking its name from founder Tulsidas Wadhwani (aka Mr Wani), Wanis began when he started to import small quantities of exotic foods from Africa and the Caribbean to sell to London’s newly-arrived migrant community in his retail store in Holloway.

It wasn’t long before the enterprise outgrew the original site, and Mr Wanis relocated to Commercial Street in the early 1970s, close to the site of the original Spitalfields Market, which at the time sold an unparalleled range of exotic fruits and vegetables, drawing in customers from across the UK. Mr Wani’s wife and his two sons then joined the firm, making it a real family business.

By the early 1980s, the business had grown further and acquired a storage warehouse which became the UK’s one-stop shop for specialist ethnic food before relocating again in the 1990s to even larger premises in East London. Wanis began delivering goods to its customers in the UK and in 1994, also identifying a huge opportunity to export British and global brands around the world – and the export side of the business was launched.

Today, Wanis is one of the largest specialist food and drink wholesalers in Europe with an annual turnover exceeding £140,000,000, servicing all UK trade sectors in addition to 35 overseas markets across Europe, West Africa, The Caribbean and the USA.

With sites in East London and Milton Keynes, Wanis commissioned a new £20million state-of-the-art distribution centre in Rainham in 2021 as part of their long-term growth plans. Constructed on a brownfield site in Essex, it was completed in April 2022, significantly increasing the capacity of the distribution and delivery function of the business. The Rainham site features dedicated facilities which position the company to further grow the export side of the business including unique stock locations, bulk container handling, picking and racking.

The business is now led by Mr Wadhwani’s two sons – Kapil (Business Development Director) and Sanjay (Managing Director) They are supported on the board by George Phillips (Commercial Director), Adam Reader (Finance Director) and Alam Ameer (Operations Director)

Wanis is Europe’s leading World Food and Drink Wholesalers. Foods of the world have been a star performer in grocery over the past decade with consistent double-digit year-on-year growth. With increasing diversity among our population, allied to Brits continuing to embrace an ever-wider range of cuisines, this doesn’t look to be slowing down anytime soon. With the widest range of World Food brands and products available in the UK, they have seen significant growth in volume based on the trend seen from some 10,000 products stocked by Wanis across all categories and cuisines. World Foods is such a broad category, from Caribbean hero-products like Jerk Seasoning to West African staples such as Fufu Flour and South Asian basmati rice, as well as drinks, snacks and so much more that it is impossible to cover the entire category!

Among their 200-strong team across all the Wanis sites, they number 28 nationalities and ethnicities with 25 languages spoken, making them a truly inclusive employer. The business serves many communities across the UK and further afield, and it is through having members of these communities in the Wanis family that they feel they are really able to connect with the range of people who are ultimately their customers.

Wanis believes community starts with their team and strongly believe in the ethos that the staff are all part of the “Wanis family”. They value everyone equally, and this is illustrated by the results of their annual employee satisfaction survey.

They know each other’s children and spouses and regularly celebrate together at various events, one of the most popular being the summer BBQ where staff are encouraged to bring their families to a day of games, fun, music and food.

They are proud to be a valued part of the local community, both as an employer and in their work with local stakeholders such as Counsellors, MPs and Mayors to support their initiatives.

Their new warehouse in Rainham has resulted in more sales space in their Leyton Cash and Carry, including a large range of frozen products.

Charity

To celebrate their 60th year Wanis is donating £60,000 of grants to charities and community groups. They are also hosting a party for their suppliers, customers, and partners to say thank you to those who have helped the company to grow over the years.

One of the charities Wanis supports in Waltham Forest embodies the firm’s philosophy in its cross-community, inter-faith approach to tackling poverty, cultural deprivation and isolation in the borough: PL84U provides hot meals, companionship, food and clothes to the elderly, homeless and those in need with both financial and ancillary support. They give the charity – recently praised for its “remarkable work” by Her Majesty the late Queen – a monthly budget that can be spent in the cash-and-carry warehouse on items to distribute from its food bank. Recently the company proactively increased the monthly budget as they are acutely aware of the cost-of-living crisis and the increased demand for PL84U’s services. Wanis also helps PL84U to promote itself via their marketing and public relations team to increase the charity’s profile and boost funding and donations.

In addition, Wanis supports several other food banks across London and the U.K, including Peckham Pantry, Brixton Soup Kitchen, Made in Hackney and the Birmingham Care Group.

Their portfolio of brands includes many traditional Asian, Caribbean and African food products, and whilst these are becoming increasingly popular with customers from all backgrounds, they recognise that many of their customers are of black and south Asian heritage. As such, Wanis wants to help serve and engage these communities. This is what led the team to work with the NHS at the height of the pandemic to encourage people of black and south Asian heritage to donate much-needed blood at a time when donations were worrying low. They also worked on a campaign to encourage conversations around the often-taboo subject of organ donation where there are sometimes cultural or religious barriers to this life-giving gift.

They put stickers on 100,000 bags of rice to encourage donations and also utilised their marketing and Public Relations expertise to recruit celebrities and influencers to create and post content across social media channels.

Last year when Pakistan was struck by devasting flooding, Wanis provided 150 water pumps to rural villages.

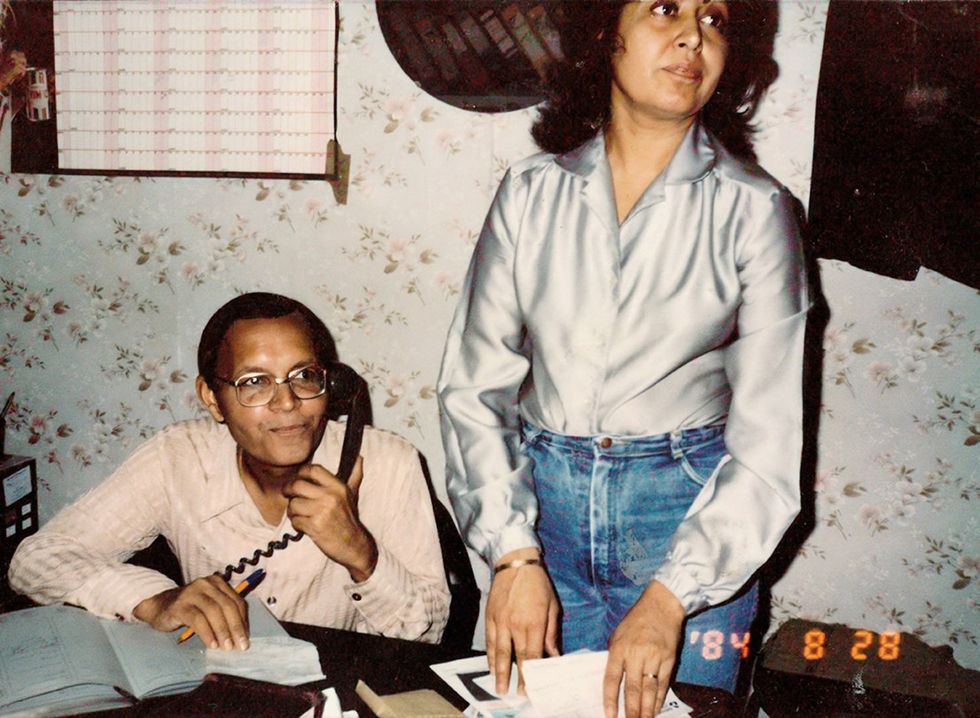

Mrs Wadhwani and Sanjay reflect on key milestones in the Wanis journey:

“My mum and my Dad, they were the guys who started this. Mum was always very strict and dad was very soft. They imported fresh fruit and vegetables and the location close to Spitalfields Market was ideal because we benefited from passing custom but because we weren’t officially part of the market we didn’t have to pay their levy, which gave Mum and Dad a price advantage.” – Sanjay

“Sometimes shipments were delayed so the produce would go off, or the wrong shipment came in at the wrong time. I realised that importing fresh produce from abroad was a very precarious business to be in, so I told my husband we needed to change and that’s when we started trading in tinned stuff. ” – Mrs Wadhwani

“In the 1970’s there were lots of industrial action and strikes which resulted in power cuts. This was a disaster for my parents because our fresh stock would spoil when the fridges and freezers would go off. All their money was tied up in stock so they’d lose all their money. In those days they got money and put it into stock, got money and put it into more stock…that’s what you did. So, everything was destroyed and that happened to them three times!” – Sanjay

“By the 1980s we were selling products mainly from the Caribbean. I noticed that East London had more and more people from West Africa, so I asked my husband to start importing foods from that part of the world, business picked up and our customer base increased, it was really successful” – Mrs Wadhwani

“In 1991 Spitalfields Market moved to East London, so we had to move too, we found a large warehouse on Waterden Road, which is now the Olympic Park. It was owned by the Brook Bond Company; they accepted our low-ball offer with the proviso that we had to complete within 7 days. We didn’t have time to organise finance with the bank so we went to a loan shark with a crazy rate of interest. We borrowed the money from him, bought the building and sorted out the mortgage with the bank afterwards so that we didn’t lose the deal. The building was too big for us, we couldn’t afford the overheads like the rates and mortgage, so we did it in stages. We took one part of the building and rented out the back part. As we grew, we took back more and more of the space. That’s what we did, we kept knocking the walls down!” – Sanjay

“My brother Kapil and I still enjoy coming to work every day, so we have no plans to retire to the golf course just yet. Having said that as we continue to grow its natural that we have brought in key individuals to be responsible for the running of the business and strategy. Kapil always says that our people are our USP.” – Sanjay

“We made a name for ourselves, people would say 'the stuff you can’t get anywhere else, you’ll get at Wanis'.”