Over a third of Britons always opt for the same type of products in grocery stores, says a recent report highlighting consumer shopping habits, finding that the tradition of the weekly shop still reigns, as the majority (74 percent) of Brits still do one big shop per week.

According to new research from Nectar, price is revealed as the most important factor in choosing what to take to the checkout, followed by quality and expiration dates. A quarter (26 percent) said they enjoy discovering new products while over a third (38 percent) confessed to being creatures of habit and always opting for the same types of foods.

The research adds that two thirds (59 percent) plan their shopping ahead by making a list. It also revealed that over two thirds (66 percent) believe that writing a list means that they get their shopping done in less time.

One fifth (20 percent) admitting to frequently spending more than they had budgeted for and a third (28 percent) saying they spend too long wandering down aisles hoping their purchases will make up the number of meals they plan to cook.

It also emerged that nearly half (42 percent) of shoppers actively seek out bargains to save money on their groceries, although a quarter (28 percent) of Brits admitted that they wish they were savvier when purchasing food.

Of those who wrote their lists on paper, half admitted to often forgetting to bring it with them or check it, while a third are also guilty of forgetting items that they intended to buy. To help avoid that, Nectar and Sainsbury’s are encouraging customers to use the digital shopping list function on the SmartShop app, which also allows shoppers to tick off items as they browse.

The research also explored the shopping habits Brits wish they could break, which included forgetting to get products that they intended to buy (33 percent), not planning meals ahead of time (23 percent), forgetting to bring their reusable bags with them (26 percent) and not utilising loyalty scheme promotions such as My Nectar Prices (12 percent).

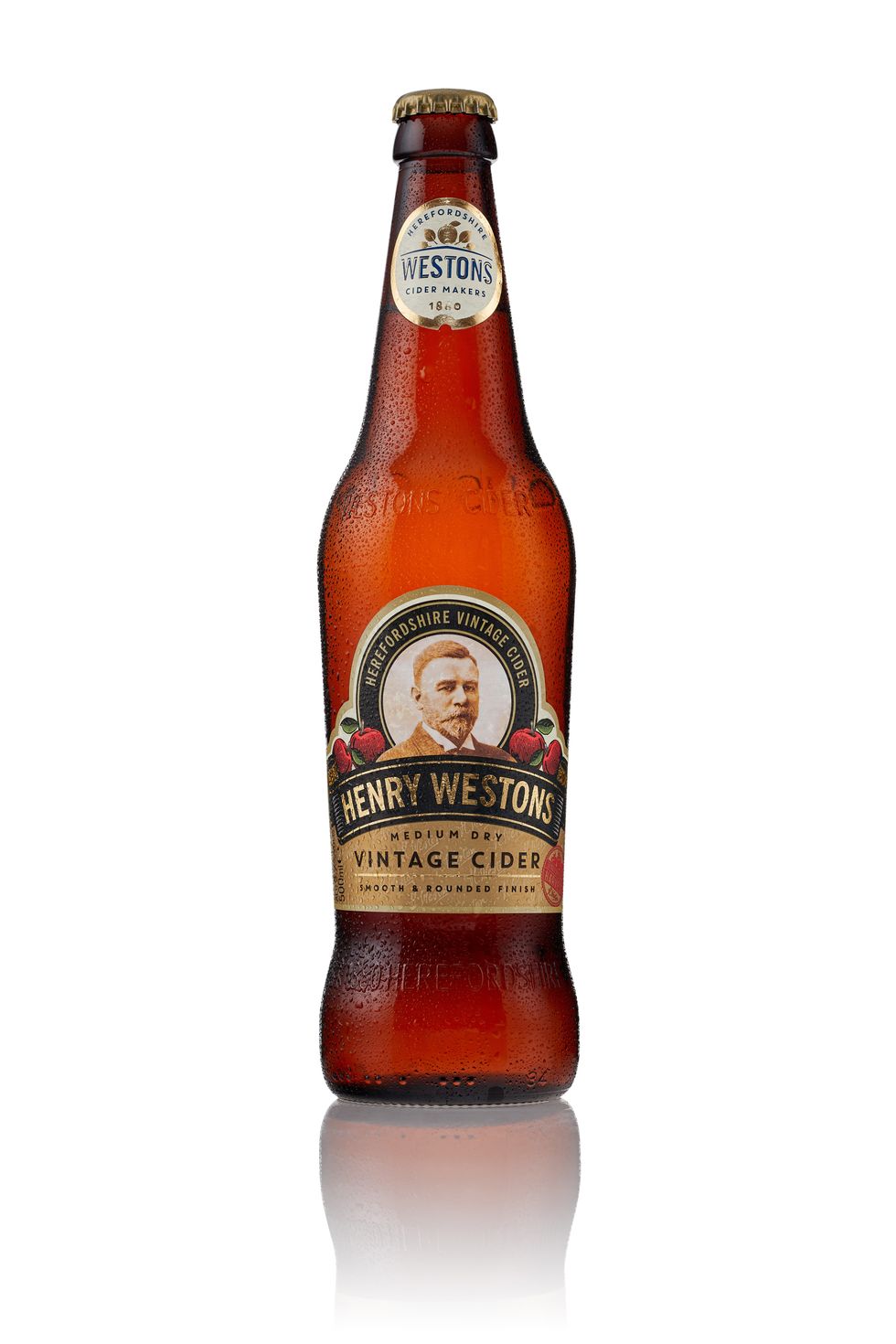

Apple cider remains the core of the category

Apple cider remains the core of the category Top ten cider SKUs in the convenience channelWestons Cider Report

Top ten cider SKUs in the convenience channelWestons Cider Report