Once considered by many Brits as a symbol of foreign culture, wine today is an essential element of everyday life. This is not an exaggeration, particularly when most of us like to rewind with a glass of wine after a long day at work or while chilling with friends.

According to Mintel, a whopping 70 per cent of adults drink still, sparkling or fortified wine occasionally. Almost half (49 per cent) of consumers buy wine to drink with a meal at home for a non-special occasion. Also, 54 per cent of wine drinkers have drunk less wine in pubs/bars/restaurants in the last six months, indicating a move towards off-trade.

Wine also plays a significant role in the sales mix of convenience stores, contributing both to revenue, impulse purchase and customer footfall.

Volume sales for the UK wine market should pick up in 2025 due to improved household incomes. However, this will be tempered by the alcohol moderation trend.

Some of this fall can be attributed to an ageing population. The "boomers" are loyal consumers of wine, but as their numbers inevitably decline, they are not necessarily being replaced by Generation Y, millennials and – particularly – Gen Z drinkers.

The latter are most flexible consumers rather than category loyalists, often happy to hop drink styles. For this generation of UK drinkers, wine is just a part of a wider drinking occasion that also include craft beer, RTD cocktails, and artisanal coffee and low- and no-alcohol products. In other words, wine faces stiff competition.

Well Established

Nevertheless, wine continues to hold a special place in Brits’ hearts as well in convenience store aisles as it is still a key category to attract those consumers who are increasingly looking to top up shop during the week.

Canned wine, for example, that can be bought and drunk almost immediately has proved itself to be a success in the convenience channel in the last year. Local stores have also been good testing grounds for smaller sized bottles, pouches and boxed wine. Lower alcohol wine brands have also done well in the convenience channel as an increasing number of consumers look to cut back on their wine intake during the week.

As a well-established category, still wine remains a foundation of the beer, wine and spirits mix for any store, driving footfall, repeat traffic and overall customer loyalty. With £6.3 billion in sales in the past year, still wine has continued to perform strongly because of a combination of established consumer favourites and exciting innovation across several areas, from new formats to product formulation.

Dan Harwood, key account manager at Eisberg Wine, agrees that the wine and fizz category is experiencing steady growth, with a notable trend towards low and no-alcohol options. The low and no-alcohol segment has seen a significant increase in consumer demand, reflecting changing preferences for healthier lifestyles.

“With our new premium quality range and diverse offerings, Eisberg continues to resonate with consumers seeking alcohol-free alternatives in the wine category,” Harwood says.

Socialising in the home and garden is set to dominate drinks trends this summer, and local retailers can capitalise by offering their customers a selection of good quality, affordable bottled and bag in box wines for consumers to enjoy in the home.

With pizza parties, board games or console gaming nights, cheese and wine, film or sports viewings, cocktail nights and cook-offs, the opportunities for summer drinking at home are endless.

Jo Taylorson, head of marketing and product management at Kingsland Drinks, says, “We are expecting a bumper sporting season this summer, especially with the 2024 Summer Olympics and Paralympics in Paris, Euro 2024 in Germany, and the opportunities for stores are there to be tapped into for still and sparkling wines.

“As the cost-of-living crisis continues, it’s important for retailers to offer a range of wines to suit all budgets, and to cater for both low key occasions as well as more up-tempo gatherings – the ratio of value to quality is key for all occasions.”

Bestsellers

It is best to stock the mix of bestselling as well as some new, quirky, interesting and perhaps even local wines.

Top wine brands in the UK are Accolade Wines (Hardys), E&J Gallo (Barefoot), Caselle Family Brands (Yellow Tail), Concha y Toro (Casillero de Diablo, Isla Negra, Trivento), Australian Vintage (McGuigan), Pernod Ricard (Campo Viejo), Treasury Wine Estates (Blossom Hill, 19 Crimes).

Now in its second decade as the UK’s number one wine brand, Hardys is worth £316m, delivering £46m more in value to the category than its number two competitor. Within convenience, Hardys remains the strongest core brand accounting for £149.3m in sales last year.

Tom Smith, Marketing Director - Europe, at Accolade Wines, states that Hardys VR accounts for 35.5 per cent of the brand delivery, due to its good value proposition, positive price perception and familiarity.

White wine continue to lead the category, accounting for four out of the top five varietals. This is also reflected inHardys performance- Hardys Sauvignon Blanc, Hardys Crest Chardonnay and Hardys Stamp Chardonnay/Semillon.

With sales of £103m, another brand in dynamic growth across convenience and genuinely resonating with younger wine drinkers is Jam Shed from Accolade Wines. The Jam Shed portfolio now includes Shiraz, Malbec, Chardonnay, Rosé, Red Blend, Tempranillo and Jam Shed Fruits- Rhubarb & Strawberry Smash & Black Forest Mess. With growth of 13.6 per cent in the last year, Jam Shed has become the tenth largest UK wine brand in just a few short years.

Campaneo wine brand - hailing from the lesser-known Campo de Borja region in Spain -has built real momentum and a cult following of consumers and wine critics. The range scooped several awards in the recent People’s Choice Wine Awards – the Sauvignon Blanc was awarded bronze and the Verdejo received silver in the Easy Weekday White Wine category, while Garnacha won gold in the Easy Weekday Red Wine category.

White wines are the order of the day when it comes to summer drinking andaward-winning Campaneo Sauvignon Blanc and Verdejo varieties are real crowd pleasers as they are light bodied, versatile and great with food such as paella, fish tacos, seafood dishes, as well as BBQ food and pizza.

Both are available in 75cl bottles, with the Sauvignon Blanc available in a convenient 2.25L Bag in Box (BiB) format too.

Taylorson tells Asian Trader, “Consumers are switching on to wines in this format, so we must embrace what they offer; recyclability, affordability, and longer lasting wine. New consumers to the bag-in-box category realise the benefits in terms of convenience, freshness and quality, it’s a great format to have in the house for party evening and beyond. Bag in box wines stay fresh for up to six weeks so can cover a whole weekend, or multiple gatherings.”

Developed specifically for the value end of the market, Campaneo wines have the look, feel and taste of a premium wine brand, but at an affordable price point- SRPs start at £6 for the 75cl bottle and from £18 for the 2.25l bag in box.

Best-selling products over summer tend to be traditionally popular wines such as The Hidden Sea Chardonnay or Rosé, as well as those that have good recognition for the brand or the varietal for an easy decision at fixture. Andrew Peace Chardonnay and Shiraz is one of those.

“Prosecco continues to prove incredibly popular among British consumers and we see real potential for affordable, quality sparkling wines over summer, especially during events such as Wimbledon where we usually see an uptick in impulse purchases. Our Corte Molino Prosecco DOC makes a great celebratory wine for summer gatherings, and really looks the part with its striking blue label,” adds Taylorson.

No and Low

Low and Alcohol-Free wine is one of the growing trends globally at the moment. Wine makes up just 3 per cent of the global alcohol-free category: skewed towards sparkling (2 per cent) rather than still (1 per cent), according to figures from market analysts IWSR. But the category is growing as the alcohol-free sparkling wine market was up 7 per cent in 2023 (compared to 2022), and still wine up 6 per cent.

Brands like Noughty and Zeno are best sellers in the UK, and Moderato, one of the leading French brands, has developed a new premium range of wines using new aroma capture technology.

It's important to know that this is not about people going sober, but there is a global reduction in the amount of alcohol consumers are drinking, and so their alcohol-free purchase is an additional purchase next to their alcohol shop. So retailers need to have a good range of both.

Convenience is a key place for product discovery so customers will expect you to have a carefully curated and dedicated range. Astore’s alcohol-free range should complement the alcohol stock - look for a few brands of still and sparkling wine like Zeno, moderato and Noughty or a wine alterative like Blurred Vines aor a sparkling tea.

Smith from Accolade Wines states that the no and low still wine sector remains smaller than other no-low alcohol variants. However, although it is comparatively small, it has a clear role to play as a growth driver in still wine, especially with people looking for new options that support moderation trends.

Smith says, “The principal barriers in wine for no and low are around quality perception. Negative taste perceptions are still a key barrier; according to 24 per cent of adults, equivalent taste is the leading enticement for non-alcoholic drinks.”

What’s new

Smith from Accolade Wines feels that improving the taste of no-low drinks, refining the quality credentials, appealing in new occasions, and broadening awareness and availability may be mechanisms to drive growth.

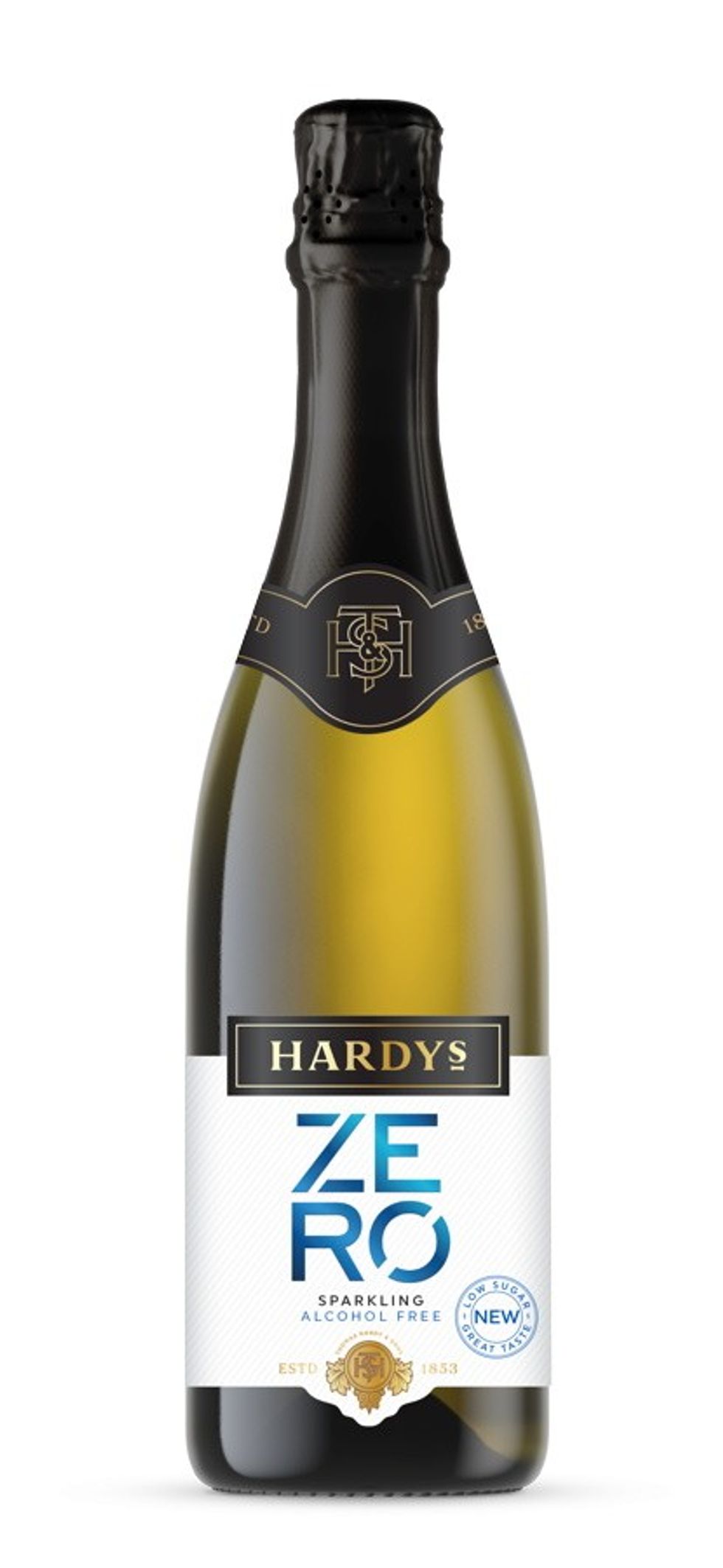

To address this, Hardys has launched Hardys Zero, the zero-alcohol brand that uses cutting-edge de-alcoholising technology, which removes the alcohol but retains the brand’s well-loved taste credentials.

Smith says, “Making use of first-to-market access to world leading de-alcoholising technology, Zero Tech X, Accolade Wines has truly delivered the next generation of taste for Hardys. As a result of a gentler alcohol removal process, Hardys Zero retains more of the familiar aroma, body, and flavour of full-strength wine with fewer additives versus conventional de-alcoholising technology.”

Available in three classic choices - Shiraz, Chardonnay and Sparkling - Hardys Zero is perfect for everyday social occasions where consumers still want the taste, they love but in a zero-alcohol option.

New launches keep this category exciting. So stores should make the best use of this to keep their alcohol section buzzing.

This February, Echo Falls, the UK’s leading flavoured wine brand, launched a fresh, fruity flavour – Watermelon and Kiwi Fruit Fusion. With a 9 per cent ABV, the new launch will appeal to a young consumer demographic as it taps into a demand for RTD cocktails and sweet ciders in a bid to lure existing consumers of these popular products towards fruit wines.

There are many interesting things in the pipeline at Eisberg too.

Harwood hints to expect a fresh-looking new label on newly rebranded “Signature” range, set to roll out within the coming months - coupled with a ‘Get the Signature l0.0k’ campaign. Retailers can expect a boost in demand for Eisberg Mulled in the run-up to Christmas, with demand set to soar based on the reviews of the product last year.

Eisberg Wine has rebranded its original collection as the “Eisberg Signature” line, showcasing new labels for its original core collection. Eisberg Signature will be introduced alongside the new premium “Eisberg Selection” line, marking the start of a new chapter for the brand.

The soon-to-be-renamed Signature range, comprising Sparkling Blanc, Sparkling Rosé, Sauvignon Blanc, Chardonnay, Rosé, Merlot, and Cabernet Sauvignon, offers a diverse selection of wines for every palate at a very affordable price point. The rebranding underscores Eisberg’s overarching vision to cater to every customer for every social setting.

On the other hand, popular wine brand Mud House has partnered with premium travel brand Coolstays to launch a new on-pack promotion, supporting the wider ‘Taste a World of Adventure’ campaign, designed to drive brand engagement.

Live from May 1 for five months in all major grocers and retail nation-wide, 15 lucky Mud House shoppers will win an extraordinary getaway, with an additional £1000 spending money to help them make the most of their trip, whilst one hundred shoppers will have the opportunity to win a premium, Mud House backpack, made from recycled materials.

All they have to do is scan the QR code on-pack or on supporting POS and digital channels, or head to the dedicated micro site and complete the entry form.

The activation will be supported by striking, in-store POS, influencer activity and bolstered by Coolstays own social media content and website communications to ensure maximum visibility and engagement.

“We’re so excited to be joining forces with Coolstays for our latest on-pack promotion. Combining the adventurous spirit of Mud House with the epic catalogue of adventurous and interesting places that Coolstays has to offer, gives our loyal consumers an opportunity to embark on a cohesive and authentic brand journey,” Anne Uva, Mud House brand manager at Accolade Wines, said at the time of the announcement.

Tipsy tips

Wine sales generally stay strong year-round, but for maximum customer loyalty, stocking core signpost brands will boost shopper trust and ensure that customers keep returning to your store when they need a bottle for tonight. Crucially, the majority of sales in convenience come from the core mid-range price point between £6 - £8 and should be at the heart of every retailer’s range in-store.

The obvious challenge through 2024 will be the on-going consumer concern about the rising cost of living. As a result of broader economic turbulence, shoppers will be watching every penny but as spending decreases on bigger ticket purchases, smaller scale indulgences are likely to increase, as shoppers aim to treat themselves without breaking the bank.

Smith tells Asian Trader, “At Accolade, we’re committed to offering a portfolio of market-leading, quality brands which offer affordable quality to consumers and compelling category development opportunities to our retail partners.”

If there was ever a time for retailers to give more space and turn their attention to boxed wine, it’s now as they offer great quality credentials but also more value for money to shoppers, whilst helping to reduce glass costs and environmental considerations.

Boxed wine is a lightweight and compact format, meaning fuel consumption and emissions per product are lower, too. It also uses fewer materials and up to 80 per cent less water in the manufacturing process, while the packaging is made mostly of cardboard with a small amount of plastic.

Smith says, “At Accolade Wines, we are focused on transforming consumer perceptions around the quality of bag-in-box wines and introducing new shoppers to the category. Accolade Wines introduced Jam Shed, Hardys and Mud House in bag-in-box formats, which offers consumers great value for money, and taps into sharing occasions.”

As the cost-of-living crisis continues to bite, consumers are choosing to make more of the Big Night In and at-home occasions, as well as saving money through making lower alcohol choices.

Gen Z is increasingly recognised for their reduced alcohol consumption, although this doesn't imply complete abstinence. Roughly one-third of individuals aged 18-24 abstain from alcohol altogether, but among those who do partake, it's typically for leisure, unwinding, or commemorating special moments.

Additionally, about a quarter of Gen Z consumers opt for low- and no-alcohol beverages due to their lower calorie content or additional functional advantages like pre-biotics and vitamins. In the wine and fizz category, key trends include a shift towards moderation, increased demand for alcohol-free options, and a trend towards premiumisation within the alcohol-free segment.

Harwood from Eisberg Wine tells Asian Trader, “Retailers should anticipate continued growth in these areas over the next year as consumers prioritise healthier lifestyles and seek high-quality alternatives. Providing a diverse selection of alcohol-free wines, such as both Eisberg Signature and Eisberg Selection, can help retailers capitalise on these trends and meet the evolving preferences of their customers.”

“At Eisberg, we provide a range of options for our retailers. Due to the various backgrounds of alcohol-free customers, we offer both a standard range for everyday use with Signature and a more premium range for customers seeking higher quality alternatives in Selection. Our category advice emphasises the importance of offering recognised brands like Eisberg, which provide consumers with quality assurance and trust, ultimately driving sales and customer loyalty.”

Taylorson from Kingsland Drinks expects consumers to shop more cautiously with value wines becoming more important to the category.

“Campaneo’s brand proposition - centred around its outstanding reviews, affordable price points, and exceptional quality liquid – helps cement its place on drinks fixtures as an option, which savvy sippers will love and we are expecting the wines to be a firm favourite over the summer season,” he says.

Taylorson further adds that overall, there is a “drink less, drink better” attitude among consumers, that is they are drinking less or opting into lower ABV options.

“Yes, they want to enjoy excellent wines, but it’s not necessarily about it being cheap - they want good quality, tasty products and drinking experiences at an affordable price,” adds Taylorson.

Say Cheers

The rising cost of living has prompted consumers to cut back on wine buying in both the on- and off-trade channels in the UK wine market. Reduced household incomes further favoured the lower-priced off-trade and this, coupled with trading down within the off-trade, drove down average prices and therefore, value sales.

Interestingly, the UK is now a wine producing nation, with an increasingly well-regarded array of sparkling wines. English sparkling wines today sit side by side with some of the most famous and glamorous Champagne brands on wine lists.

The current 4,300 hectares of vines will grow to 7,600 hectares by 2032 and the record 22 million bottles produced in 2023 will be up to at least 29 million bottles by the time 2032 comes along. In fact, wine production is claimed to be “the fastest growing agricultural sector in the UK”.

Additionally, around a third of the total English wine production now goes towards still wine so it can only be good news to see more quality English still wine coming into the market. It opens up the sector to everyday drinking and the mass market.

Given the importance of meal accompaniment occasions in supporting wine purchases, retailers should proactively drive the visibility of their food pairing suggestions drive impulse purchases.

While older wine drinkers value brands, reliability and value for money, younger drinkers often prize authenticity. Organic, biodynamic, sustainable and ethical products tend to strike a chord with the younger lot.

Wine can drive impulse buys, particularly when positioned strategically near other complementary products like snacks, cheeses, or other alcoholic beverages. Regular promotions on wine, such as discounts or multi-buy offers, can attract price-sensitive customers and increase basket sizes.

Stocking locally produced wines can appeal to community pride and support local businesses. This strategy not only enhances the store’s image but also meets the increasing consumer demand for locally sourced products.

Hosting wine tastings or other related events can increase customer engagement and loyalty, turning casual buyers into regular patrons.

The good news here is that there has also been strong growth in the wine section in local convenience stores which in turn are increasingly working with major wine brands to offer them a strong route to the market. By working with local stores, brands are using convenient locations to push a more premium price point. Convenience, thus, is proving to be a good channel to help drive and trial new products and packaging innovations.

Offering a wide selection of wines, including local and international varieties, can differentiate a convenience store from competitors, thus creating a niche and may be even emerging as a destination store for passionate wine connoisseurs. Cheers to that!