A gang of burglars armed with axes and baseball bats targeted a convenience store in Pewsey on the night of Tuesday (2), taking away £8000 worth of cigarettes and tobacco while causing £3000 worth of damage.

In an exclusive conversation with Asian Trader, retailer Susan Connolly revealed how the gang struck in the middle of the night and managed to get away with thousands of pounds of loot.

"I received a phone call from the alarm company saying that one of my stores alarm was going off. I started heading towards the store when my daughter, who lives above the store, also called me up to say the store has been broken into.

"When we got there, we realized that culprits got through the front door and nicked the majority of the cigarettes and tobacco products," she said.

Police soon arrived at the store and told Connolly that a gang is active in the area and a similar incident had happened in another store in the vicinity.

"Police said that the gang had a collision with a police car. But the police still didn't manage to catch them."

Such "smash and grab" incidents have been happening in the locality a lot, Connolly said.

"We absolutely feel it's the same gang going around. The police have been really good is now gone to the organized crime unit. They also think it's the same gang, who is crossing the border into Wiltshire and Hampshire."

The cigarette's gantry was destroyed completely which was soon taken care by Imperial Tobacco representatives, the retailer said.

"They've completely destroyed the cigarette gantry, which is about £3000 worth of damage. But Imperial Tobacco came out yesterday. They made it safe straightaway. And they're working with us to put a new drawer system in so it will be more secure."

Connolly seemed to be satisfied with "proactive" police action and is confident that culprits will be caught soon.

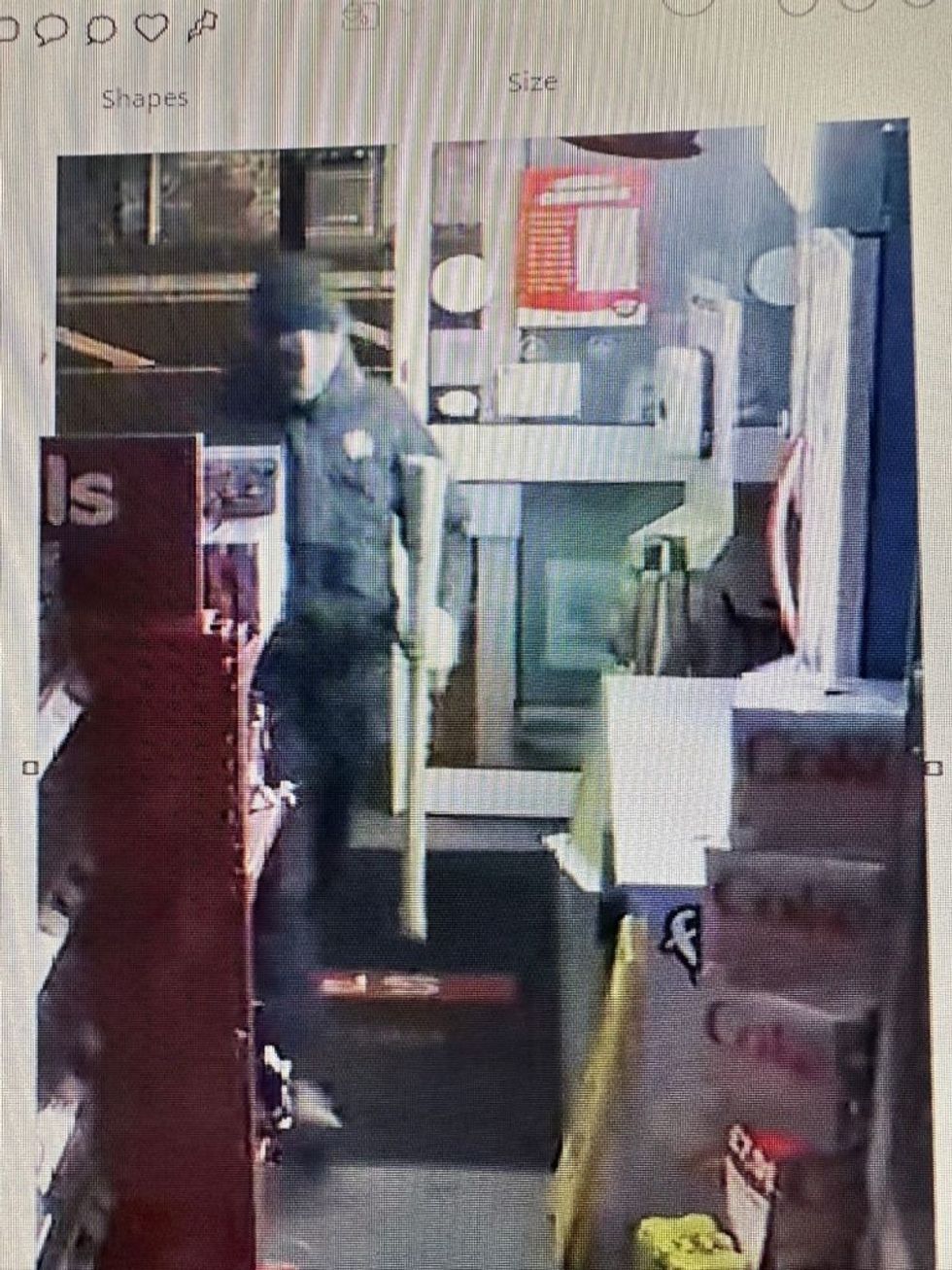

"I think it's part of the bigger operation that they're doing. But I'm quite confident they (police) are going to catch them. We have CCTV images of each of the men involved though they had face masks on. Criminals like that always wear the same clothes. They did have axes with them and supersize baseball bat- I've never seen a baseball bat that big. It must have been a metre and a half.

The man with the baseball bat stood outside to guard while his accomplices robbed the store. I dread to think what would have happened if somebody would have turned up because they definitely appeared sort of ferocious."

"It seems like the worst thing in the world. We're absolutely determined not to let them go free," she told Asian Trader.

Connolly later took to social media to warn other retailers on what they can do.

"We cannot stop this from happening but we can make it harder for the criminals. The first tip I have for retailers is mop your floor last thing every night if you don’t already. Due to this we were able to get trainers prints from the criminals. It doesn’t seem a lot but it the case of prosecution it goes a long way.

"If you have a cigarette gantry make sure it is locked properly. Ours was which seemed to surprise them. Due to this it delayed them causing them to panic. Still unfortunately missing the police but it wasn’t by much.

"Make sure your alarms are working as they should. Do a test once a month. We do this and our alarm system worked as it should. It rang me and I was able to head to the store immediately. CCTV cameras are vital. Look at installing them if you do not have them. Make sure all cameras are clear of cobwebs, spiders and rain marks etc.

"Do you own press release when incidents happens. Get hold of your local radio, news and newspaper. It also reinforces the cry for help with retail crime both with the police and government.

"Lastly but probably most importantly if this does happen to you regardless of time of day please let them do their thing. Products can be replaced but people can’t. Call the police," she wrote.